Charted📊: Mexico, Navigating New Economic Horizons

In today's segment of the Globe On A Scope Series, we're honing in on Mexico as part of our exploration of single-country equities ETFs around the world, focusing specifically on the Americas.

In the first and second installments of our Globe On A Scope series, we explored prominent U.S.-listed single-country ETFs in the Americas, delving into the economies of Argentina, Brazil, Chile, and Peru.

This article shifts focus further north to Mexico, Latin America's second-largest economy, spotlighting its role as a major beneficiary in the global supply chain reorganization.

Mexico: An Introduction

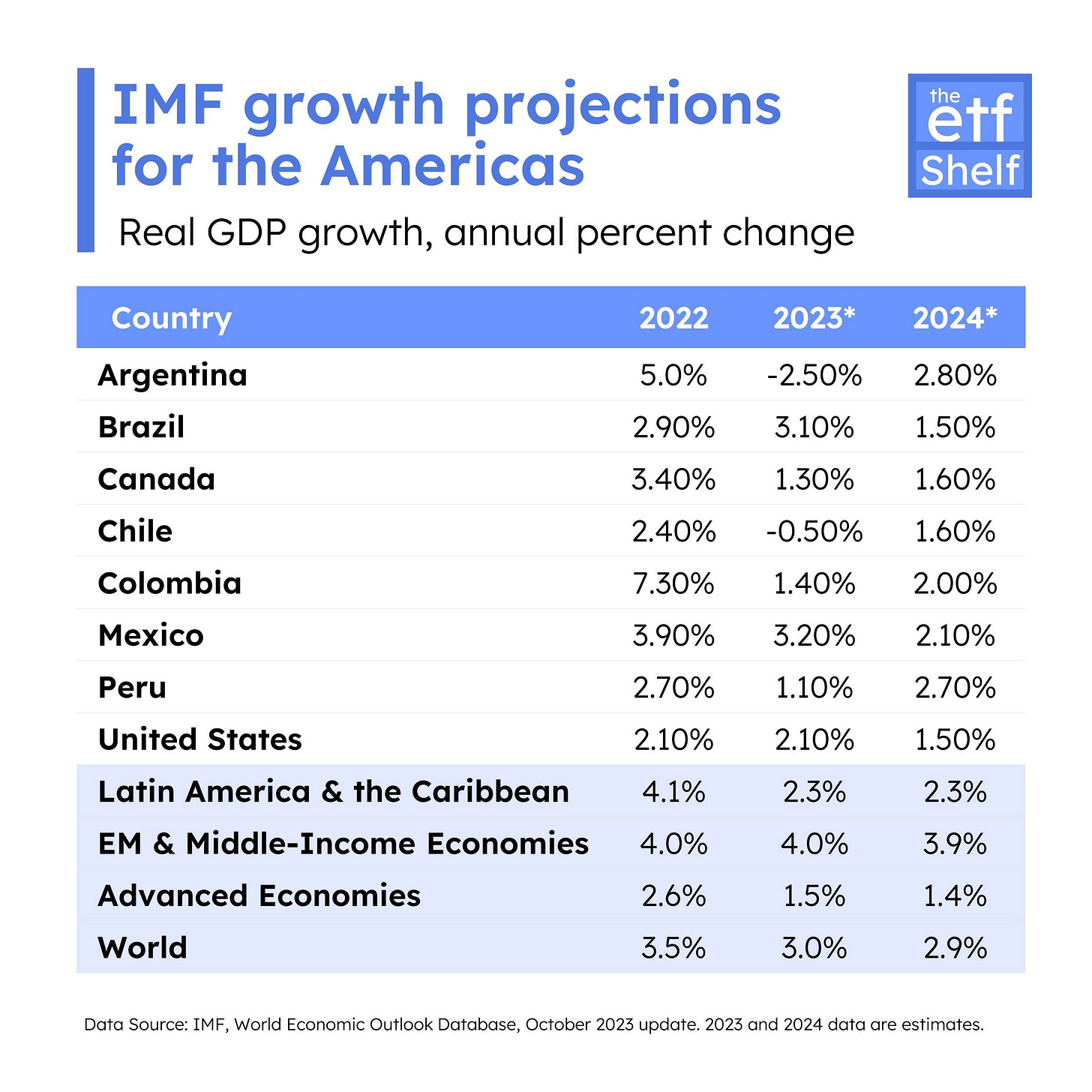

Emerging from the COVID-19 pandemic, Mexico's economy showcases resilience and adaptability amidst a landscape shaped by macroeconomic trends, monetary and fiscal policies, political dynamics, and nearshoring aspirations. As the country heads toward the 2024 elections, these elements collectively offer a nuanced perspective for investors.

Mexico's Economy Post-Pandemic

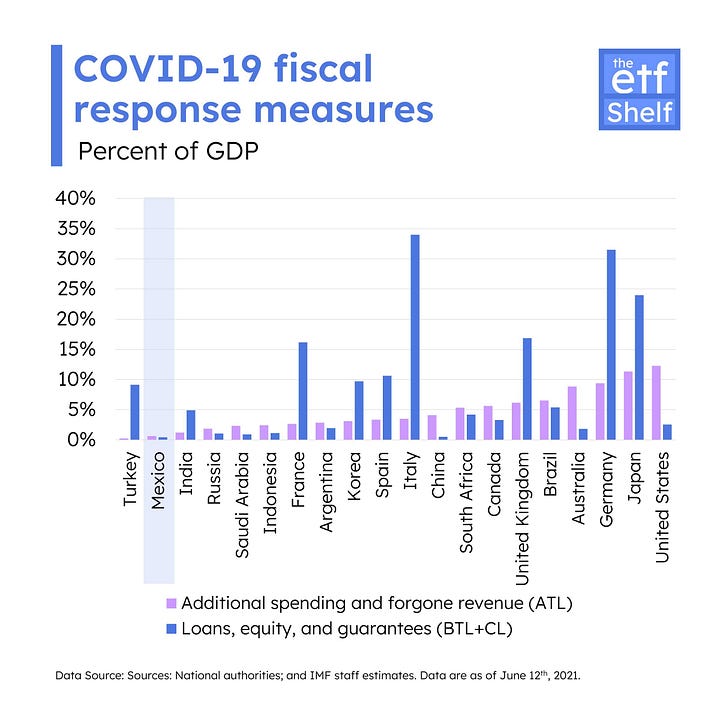

Fiscal Policy: Mexico adopted a unique, counter-consensus strategy during COVID-19, refraining from implementing any fiscal stimulus measures to bolster the economy. This approach contributed to maintaining economic stability in the post-pandemic period.

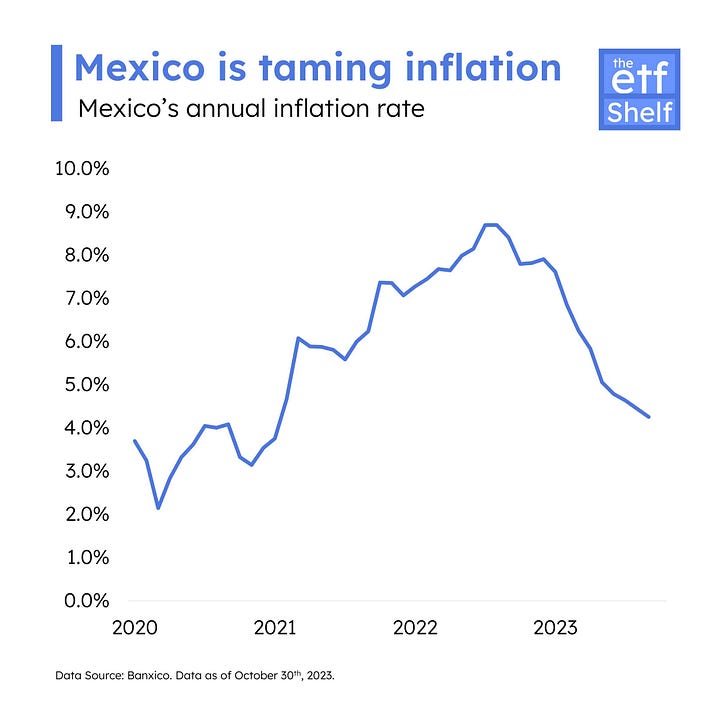

Monetary Policy: Monetarily, the Bank of Mexico (Banxico) took a distinct approach from the Federal Reserve, becoming the first to raise interest rates in response to inflation. This proactive management of post-COVID inflation by Banxico has been effective, creating a foundation for possible future rate cuts, with the current rates standing at 11.25%.

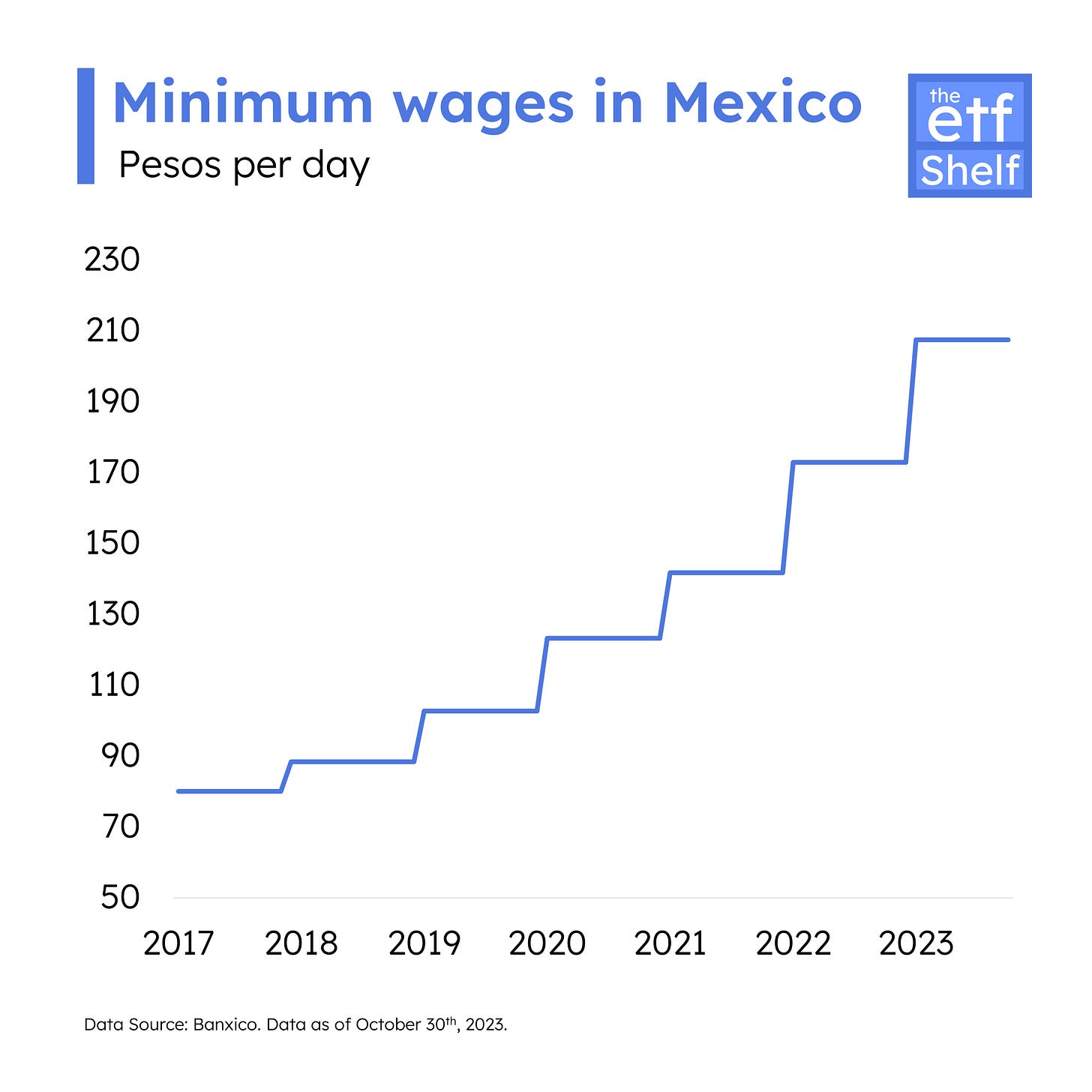

Strong Consumer Market: In the post-pandemic era, consumers have ramped up spending, encouraged by rising minimum wages and a tightening labor market that has led to higher wages overall. This surge in consumer spending is reflected in the strong performance of Oxxo.

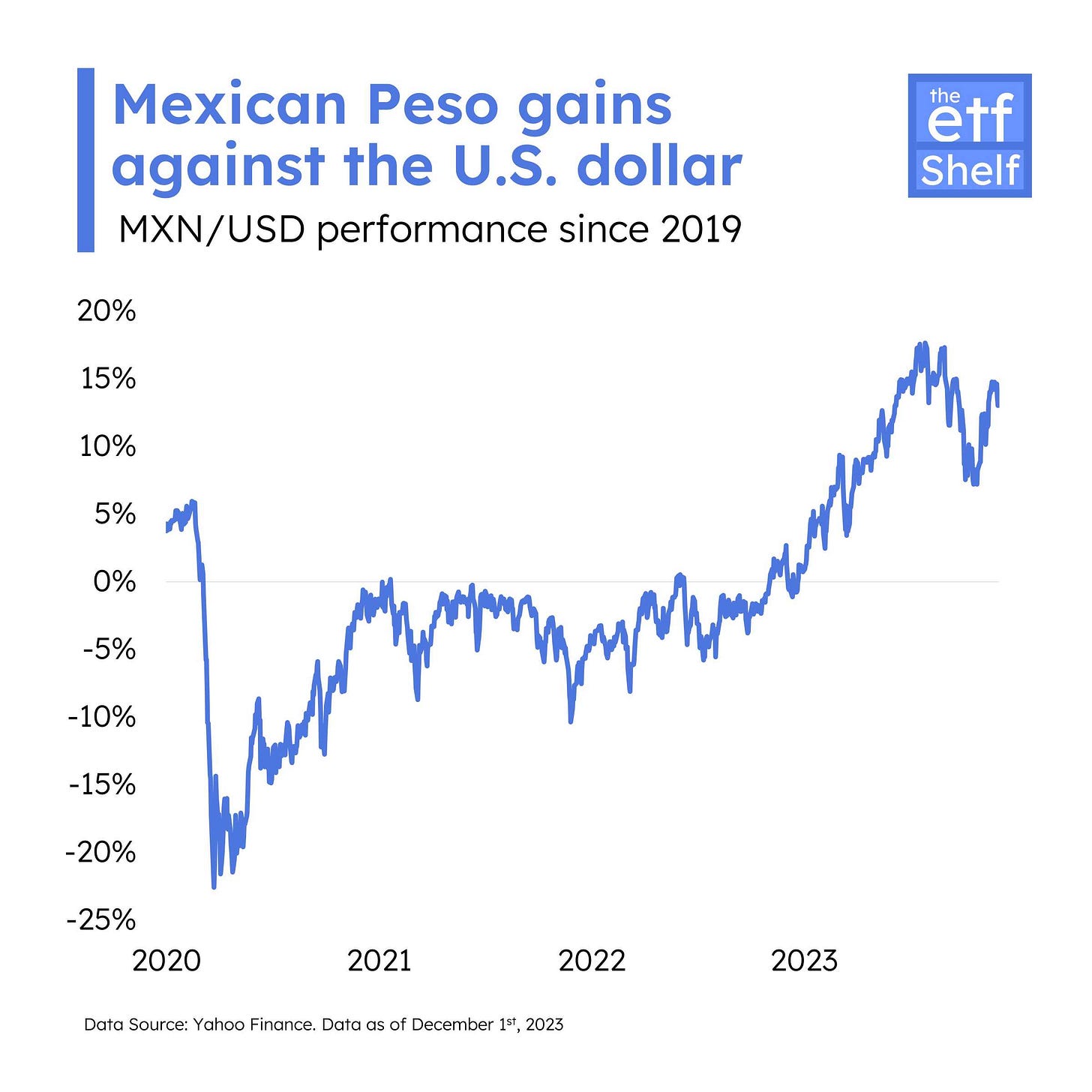

Strong Peso: The Mexican Peso maintains its robustness, currently trading at approximately 17.80/USD. This strength is underpinned by a strict monetary policy, a fluid foreign exchange market, and relatively lower geopolitical risks compared to other emerging markets. Additionally, the buoyant trend of nearshoring is further enhancing the Peso's stability.

Fiscal Spending Outlook: Although fiscal policy was restrained by COVID-19, the government typically spends heavily ahead of elections with a consensus fiscal deficit to climb to -4.9% in 2024e (BBG data).

Political Climate and 2024 Elections

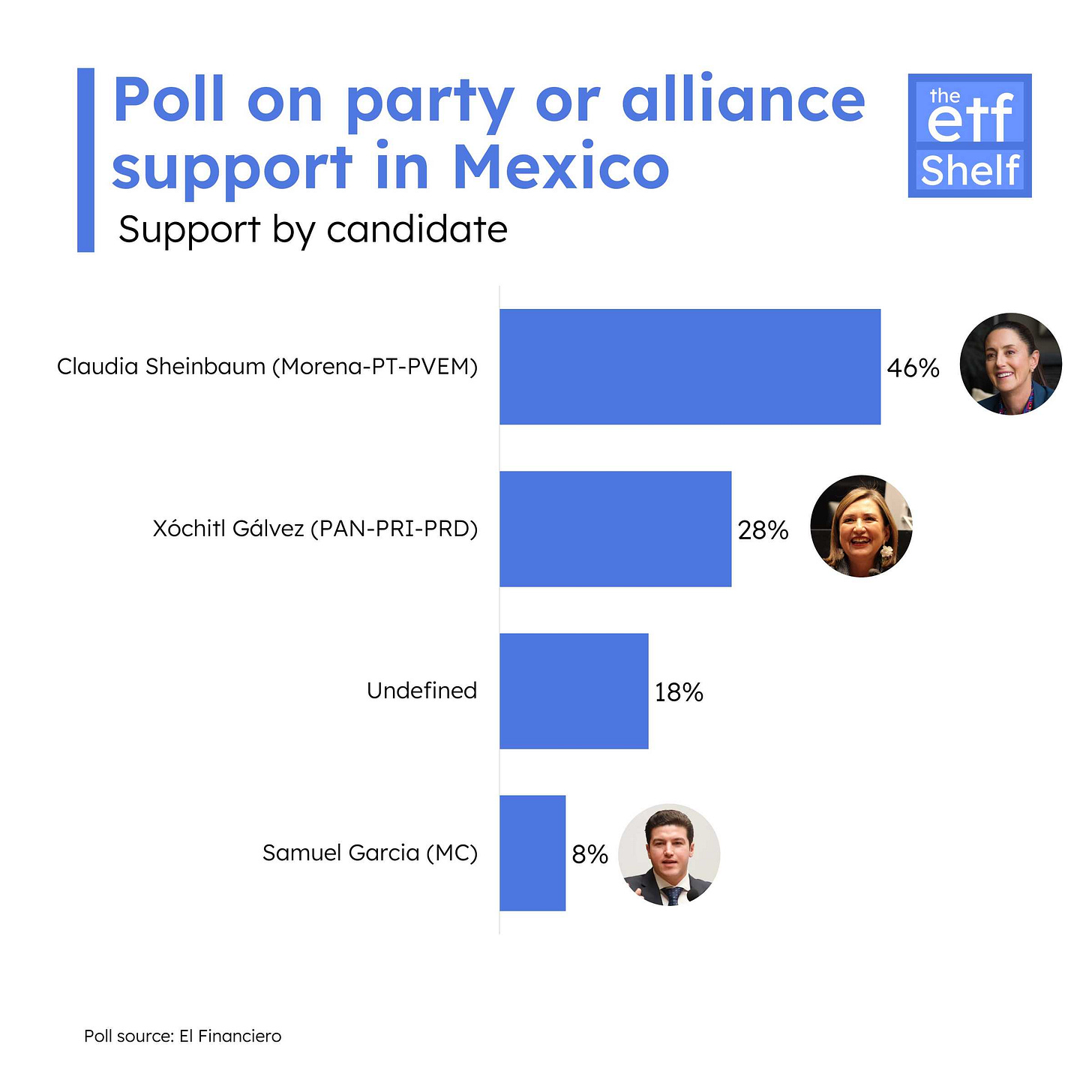

2024 Mexican Election Outlook: The Mexican political landscape is gearing up for the 2024 elections, with Claudia Sheinbaum (Morena) as a likely candidate against opposition figures like Xóchitl Gálvez or Samuel García. Incumbent AMLO aims to step away from politics but has recently found himself increasingly involved in policy and potential reforms.

View Full Poll Tracker: Contenders for Mexico's 2024 Presidential Vote

Implications of Sheinbaum's Presidency: In the event of a Sheinbaum presidency, characterized by weak internal support within her party (Morena), the prospect of legislative gridlock becomes more likely, especially in the face of a unified opposition. This scenario could significantly impede Morena's efforts to enact constitutional changes akin to those pursued by AMLO. Moreover, a Morena-led government might prioritize different policies, potentially slowing down the implementation of key reforms necessary for fostering nearshoring growth, particularly in energy and infrastructure sectors. However, considering the significant interests of the United States, it is highly likely that they would actively encourage and exert influence on Mexican leadership to advance the nearshoring initiatives.

The Nearshoring Trend: A Tailwind for Mexico

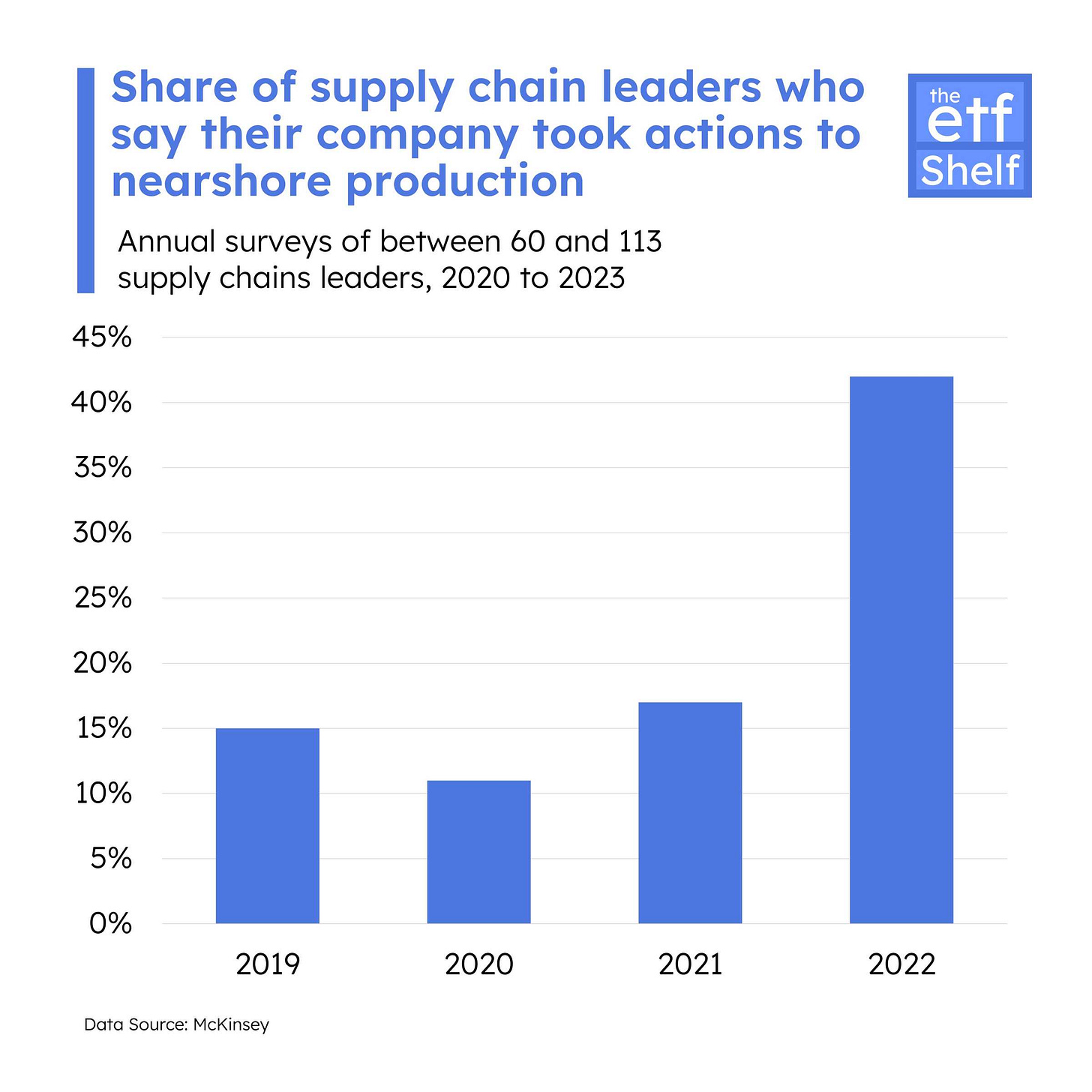

An Undeniable Trend: Nearshoring, the strategy of relocating business processes to nearby countries, is reshaping global trade dynamics. Mexico is at the forefront of this trend, well-positioned to benefit due to its proximity to the U.S., cultural alignment, and cost-effective labor market. Nearshoring is increasingly influencing Mexico's market dynamics and foreign direct investment (FDI) decisions. This trend is becoming more prominent as global economic policies shift toward "de-globalization."

US-China Economic Conflict: The ongoing economic arm wrestling between the US and China, particularly highlighted during the Trump administration, has led companies to reevaluate their supply-chain security. This reassessment is resulting in a strategic pivot away from China.

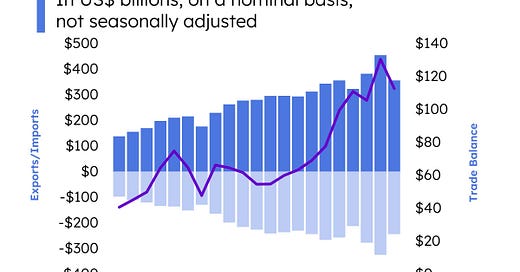

Mexico's Strategic Advantages: Mexico's advantageous geographical location and its well-established manufacturing sector are positioning it as a prime beneficiary of the nearshoring trend. The country is emerging as a crucial export partner for the US.

US Legislative Impact: U.S. policies such as the CHIPS Act and the Inflation Reduction Act, which focus on supply chain resilience, particularly in technology sectors, are reinforcing this shift towards nearshoring to Mexico.

Evolution to Nearshoring 2.0: Anticipated advancements in nearshoring practices are expected to lead to the development of specialized manufacturing clusters and the emergence of new industries in Mexico, expanding beyond traditional auto manufacturing to include high-value sectors like battery production.

Influence on FDI: FDI trends in Mexico are being molded by the increasing demand for nearshoring, along with growth in sectors such as consumer goods and financial inclusion. However, ongoing security concerns remain a factor impacting investor confidence and decision-making.

Potential Political Impact: The outcome of the 2024 US Presidential Election could significantly influence the trajectory of nearshoring, particularly a potential Trump victory. Given the history of relatively amicable US-Mexico relations during the USMCA negotiations under Trump's presidency, his victory could further enhance the nearshoring trend and strengthen bilateral trade relations.

Mexican Stock Market

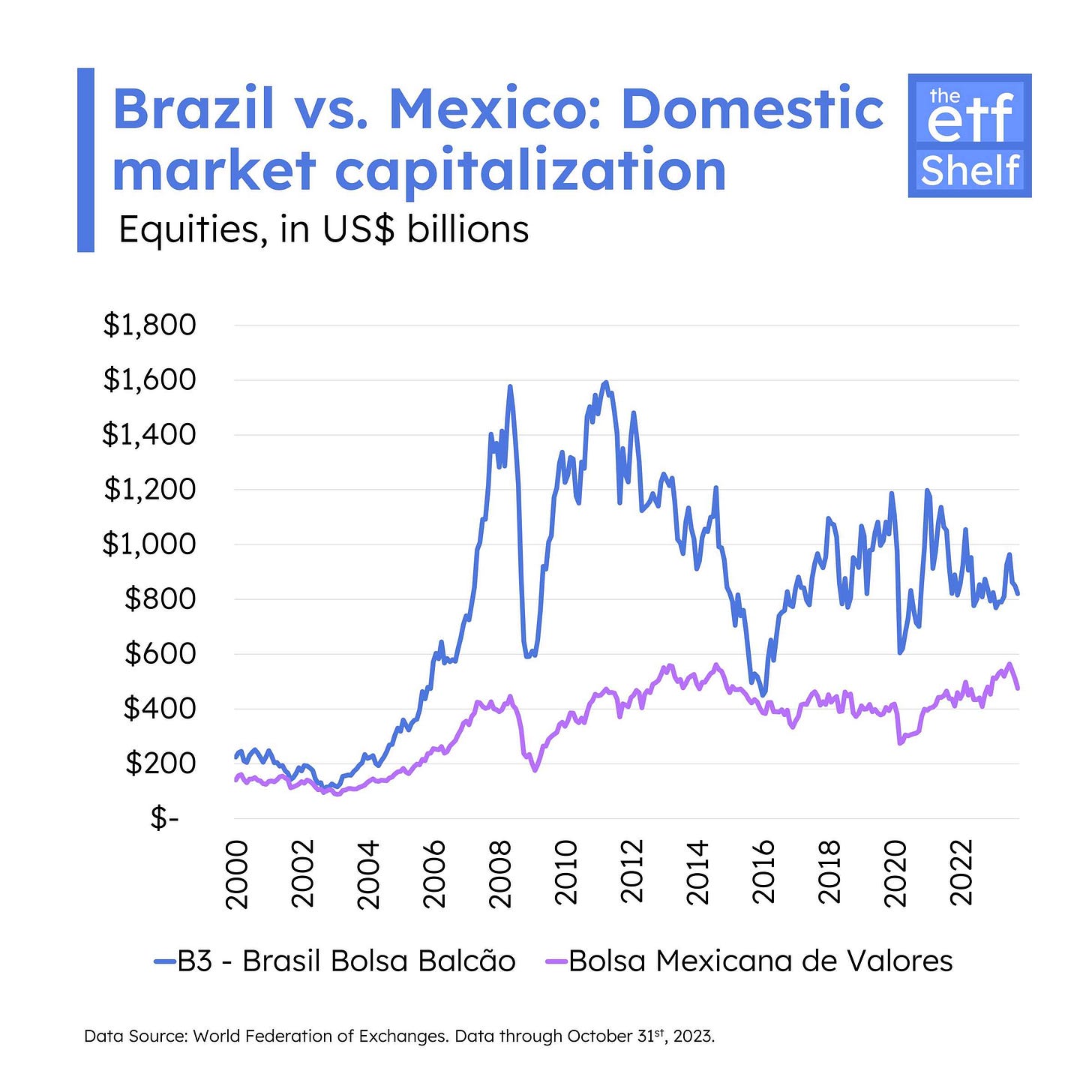

Size of the Mexican Stock Market: The Bolsa Mexicana de Valores, representing the Mexican stock market, ranks as the fifth largest in the Americas with a market capitalization of $476 billion as of October 31st, 2023. This positions it behind Brazil's stock market, which boasts a market capitalization of $821 billion.

Attractive Sectors: In the Mexican stock market, financials, consumer, and communication services sectors are exhibiting potential.

Market Valuation: The market's current valuation is near its 5-year P/E average of 12.7x, standing at about 12.1x, compared to MSCI EM at 11.5x.

Market Outlook

According to Portfolio Manager and Senior Analyst on Global X’s Emerging Market strategies, Paul Dmitriev1, the 2024 market outlook for Mexico is predominantly positive, driven by expected growth that may exceed current forecasts. This optimism stems from the rising trend of nearshoring and upcoming pension reforms, which are poised to bolster the equity market by increasing contributions and expanding retirement eligibility.

Other contributing factors include the strength of the Mexican Peso (MXN), a surge in remittances, a robust consumer market, and the buoyant impact of nearshoring. Moreover, anticipated increased fiscal spending ahead of the 2024 elections and growth in fixed capital formation further enhance this positive scenario, said Dmitriev.

Despite these encouraging signs, certain sectors, particularly those with concession exposure like airports, might face challenges under the current government. On the other hand, sectors such as consumer goods, Consumer Packaged Goods (CPG), financial inclusion, and those benefiting from nearshoring, are expected to prosper.

How to Invest in Mexican Equities

U.S. investors can access Mexican equities through various channels, including stocks with U.S. listings and funds with Mexico exposure.

Note the list below excludes Mutual Funds and is not financial advice.

Mexico ADRs

Mexico ADRs (American Depositary Receipts) are financial instruments that allow U.S. investors to invest in Mexican companies without having to deal with the complexities of buying stocks in foreign markets. ADRs are essentially shares of foreign companies that are held by a U.S. bank and traded on U.S. stock exchanges like the New York Stock Exchange (NYSE) or NASDAQ. Here’s a list of the top-listed Mexican ADRs.

View the full list here

Pure Mexican Equities ETFs

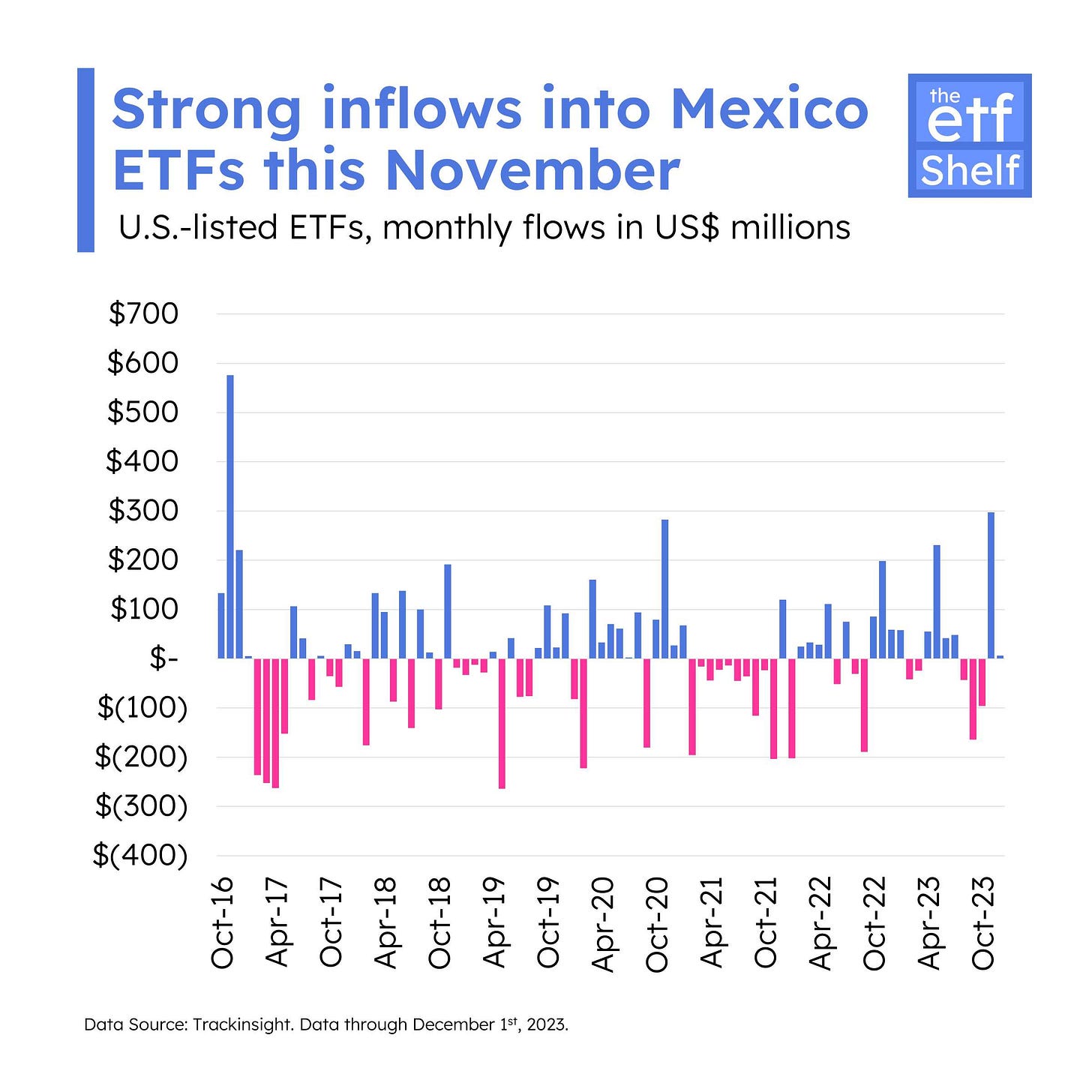

Investing in Mexican equity ETFs (Exchange-Traded Funds) presents a compelling opportunity, particularly for those aiming to diversify their investment portfolio. These ETFs offer broad exposure to the vibrant Mexican stock market, encompassing a diverse range of sectors and industries.

Using the Global Trackinsight ETF Screener, you can filter for ETFs that invest in Mexico (more or less pure exposure).

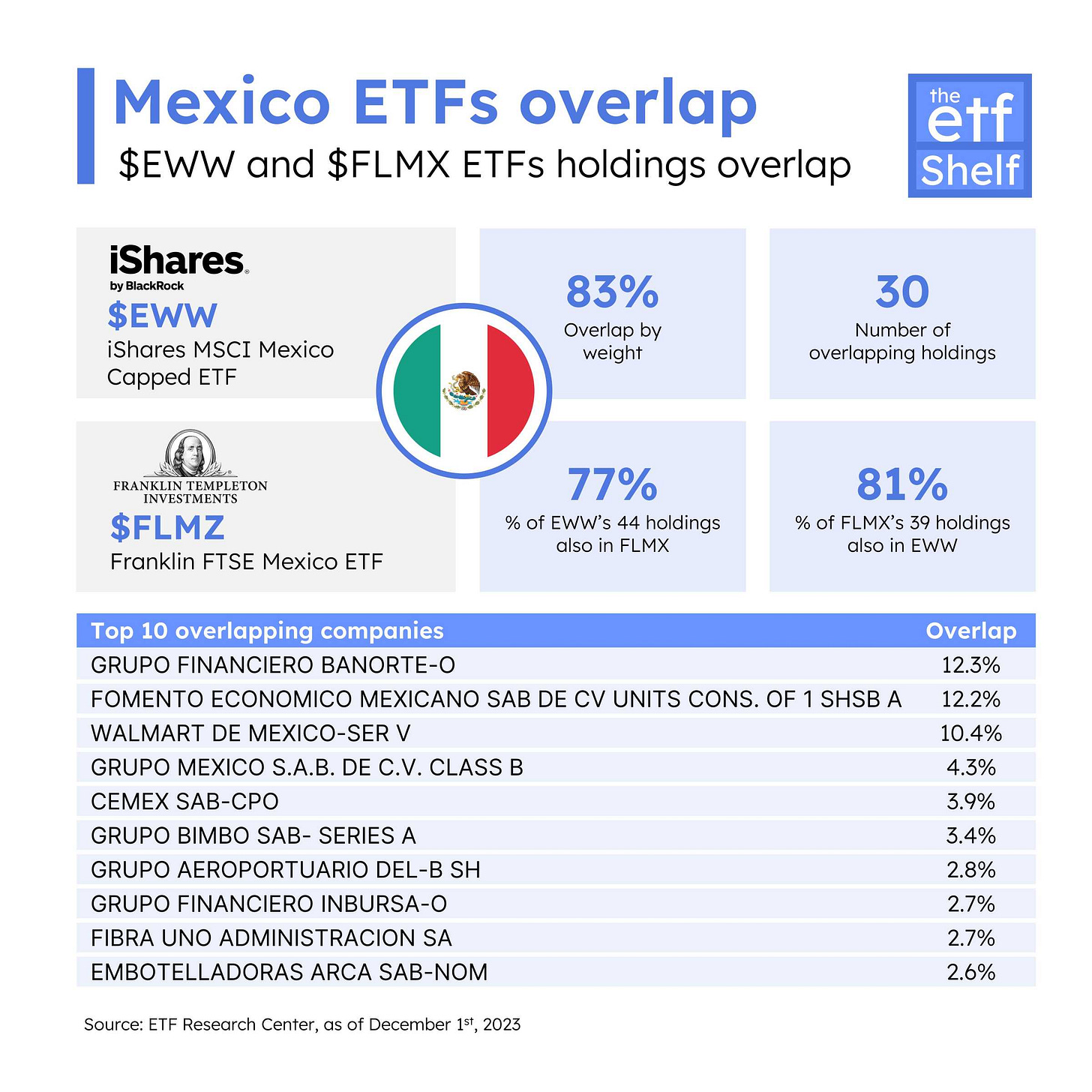

There are three U.S.-listed ETFs offering pure exposure to Mexican equities. The first is the iShares MSCI Mexico ETF ($EWW), with assets under management (AUM) of $1.62 billion and an expense ratio of 0.50%.

The second is the Franklin FTSE Mexico ETF ($FLMX), which has an AUM of $35.16 million and a lower expense ratio of 0.19%.

Here’s a comparison between the two funds done with the Trackinsight Fund Compare feature:

The third is the Direxion Daily MSCI Mexico Bull 3X Shares ($MEXX), a leveraged ETF that aims to provide three times (300%) the daily performance of the MSCI Mexico IMI 25/50 Index. It is the same underlying index of EWW and tracks the performance of a broad range of companies based in Mexico.

Latin America ETFs with Large Exposure to Mexican Equities

In addition to the ETFs with pure exposure to Mexican equities, there are Latin American ETFs that offer significant exposure to Mexico. These include the First Trust Latin America AlphaDEX Fund ($FLN), the Franklin FTSE Latin America ETF ($FLLA), and the iShares Latin America 40 ETF ($ILF).

Click here to see how they compare.

Emerging Markets ETFs with Strategic Exposure to Mexican Equities

Emerging Markets ETFs offer a diversified investment approach, providing exposure to Mexican stocks alongside a selection of equities from other countries sharing similar economic development characteristics.

This strategy allows for a well-rounded portfolio that leverages the collective growth potential of comparable emerging economies, while also spreading risk across a broader international spectrum. Here are some ETFs you can explore:

iShares Emerging Markets Infrastructure ETF ($EMIF, 16% Mexico Exposure)

Global X MSCI Next Emerging & Frontier ETF ($EMFM, 8% Mexico Exposure)

EMFM seeks to improve upon traditional emerging market (EM) funds by excluding the slower-growing, developed EMs of Brazil, Russia, India, China, South Korea, and Taiwan while including higher-growth potential frontier markets.

Global X Emerging Markets Great Consumer ETF ($EMC, 4% Mexico exposure) - Actively Managed.

EMC seeks to invest in companies that are economically tied to long-term trends in emerging markets created by the newfound purchasing power of a rising middle class.

Global X Emerging Markets ETF ($EMM, 3.2% Mexico exposure) - Actively Managed.

EMM seeks to invest in emerging market companies that the provider believes can achieve, or maintain, a dominant position within their respective market. As part of its investment strategy, EMM aims to identify early winners in growing industries, where entrepreneurship can produce long-term global competitiveness.

New Thematic ETF Capitalizing on the Nearshoring Trend

Aztlan is tapping into the nearshoring trend with its new fund, the Aztlan North America Nearshoring Stock Selection ETF ($NRSH), launched on the New York Stock Exchange. This ETF specifically targets North American companies poised to benefit from nearshoring. It aims to mirror the Aztlan North America Nearshoring Index's performance, before fees and expenses. The index comprises a minimum of 30 North American firms across key subindustries: industrial real estate, storage and warehousing logistics, and transportation logistics.

Bottom Line

As Mexico navigates its post-pandemic recovery and approaches the 2024 elections, the interplay of economic policies, political shifts, and nearshoring trends offers a complex but potentially rewarding landscape for investors. With careful consideration of the various factors at play, investors can strategically position themselves in this evolving market.

Thank you for reading! Stay tuned!

Stay tuned for our upcoming edition on Colombia, as we continue our journey through the American ETFs landscape.

Disclaimer

This newsletter is for informational purposes only and is not financial advice. We do not guarantee the accuracy of the information or calculations provided. It is essential to consult a qualified financial advisor before making any investment decisions. We are not responsible for any errors or omissions in the data. Investing in ETFs or any financial instrument involves risk, and you should conduct your own research. Past performance does not guarantee future results. By using this newsletter, you agree to these terms and conditions.

Paul Dmitriev is a co-Portfolio Manager on the Global X India and Global X Brazil strategies. Paul also serves as a Senior Analyst on Global X’s Emerging Market strategies. Prior to the Mirae/Global X transition, Paul worked as an investment analyst at Mirae Asset Global Investments from 2017-2023, where he covered the same Global Emerging Market strategies. Paul began his career at HSBC as a research analyst covering credit and equity across Industrials, Energy, and Utilities. Paul holds a Bachelor of Science from NYU Stern School of Business, where he focused on economics, finance, and political science.