Charted📊: The Globe On A Scope - Part I.2

Zooming In On Single-Country Equities ETFs Around The World. Next in Our Americas Series: Brazil and Peru.

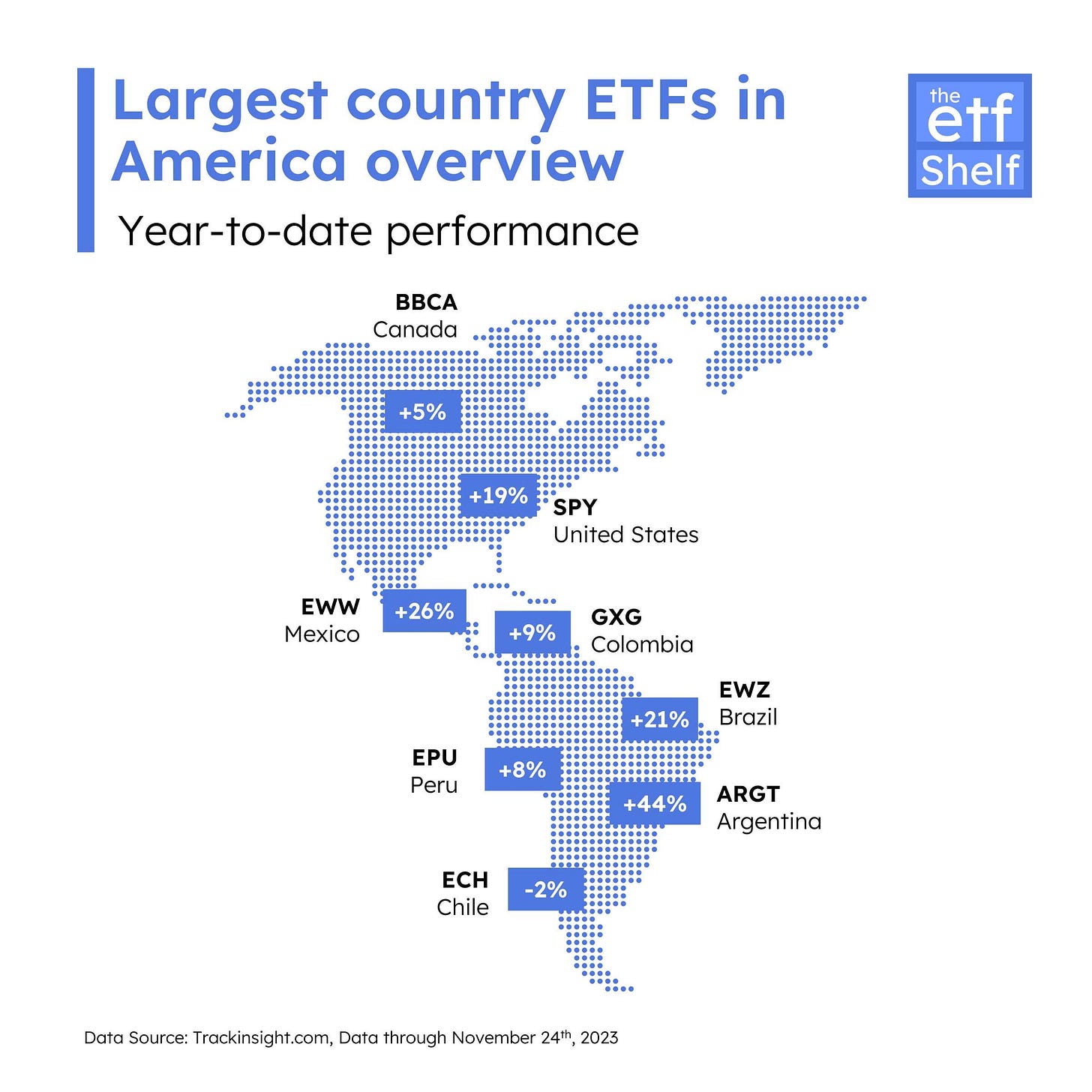

In our inaugural article of Globe On A Scope series, we provided an overview of some of the biggest U.S.-listed single-country ETFs in the American continent and we then dug a little deeper into the economies of Argentina and Chile. In this piece, we’ll move up north to talk about Brazil, the largest economy in Latin America, and one of its many neighbors, Peru.

Before that….An Update on Argentina

A new hip president

Argentina has chosen Javier Milei, a radical libertarian, as its new president in a decisive run-off election on November 19th. Milei, known for his pledge to radically overhaul the status quo, won with a commanding 56% of the vote, “chainsawing” his way to the Casa Rosada against Peronist Economy Minister Sergio Massa.

His victory, marking the beginning of his four-year term starting December 10, is largely attributed to public outrage over skyrocketing inflation, nearing 150%, and severe poverty.

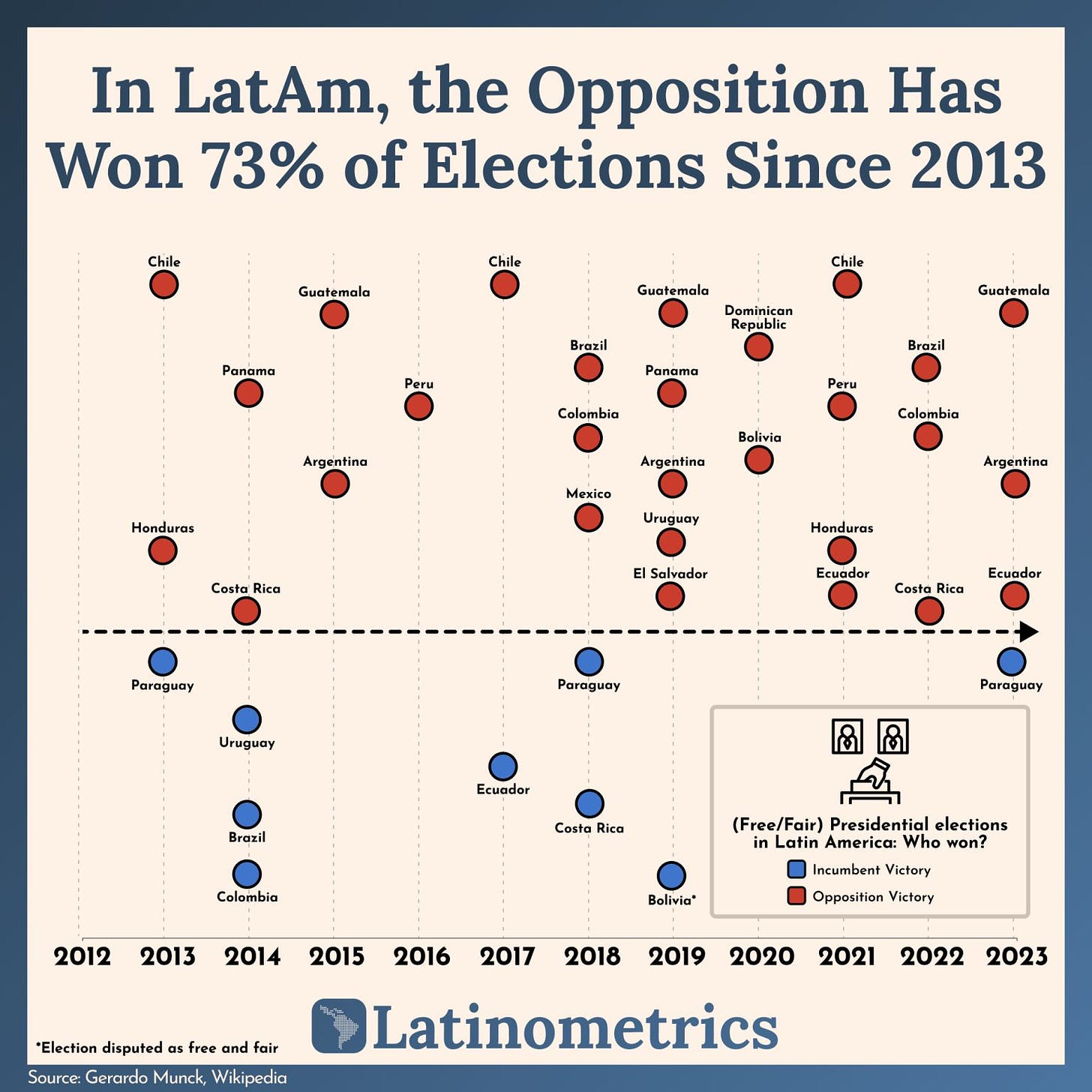

The LatAm Pendulum

As highlighted by

, the recent anti-incumbent wave in Latin America, exemplified by Javier Milei's victory in Argentina, reflects deep public dissatisfaction with incumbent governments. Driven by economic hardships like high inflation and debt, and declining living standards post-commodities boom, voters are increasingly favoring radical alternatives to the status quo, seeking meaningful change.Argentina ETF pops post-victory

Following Milei's victory, the ARGT ETF by Global X, the sole fund offering pure exposure to Argentine stocks, surged by +18% since election day and is now up by +48% this year.

Brazil Overview

Brazil today

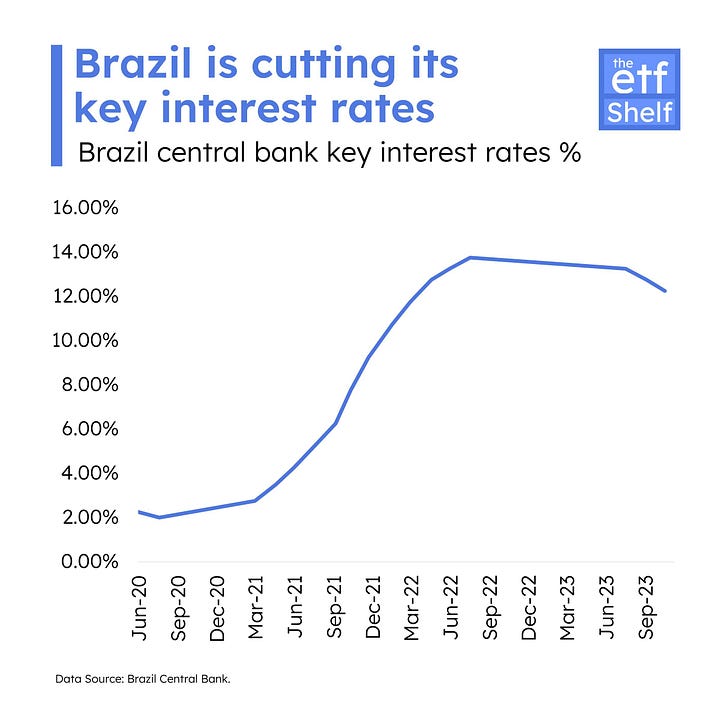

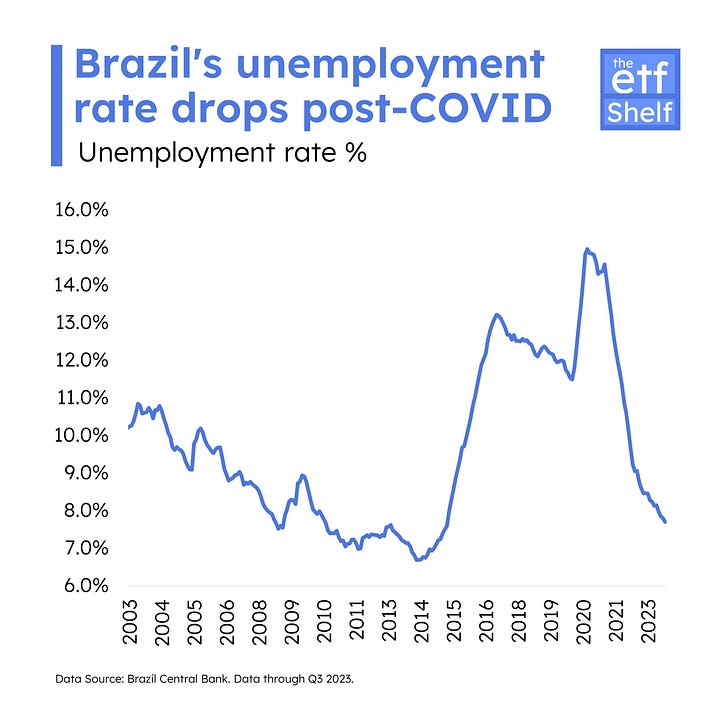

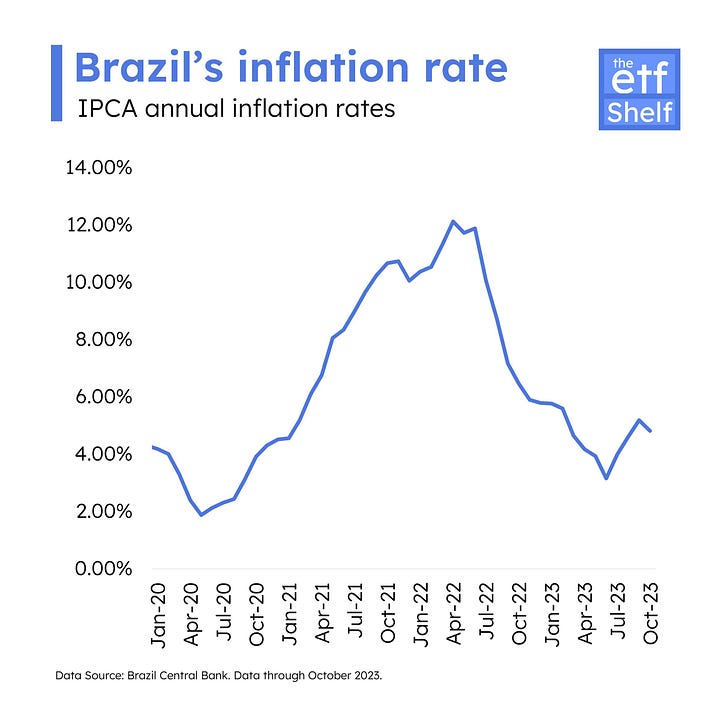

Brazil's economy has undergone significant transformations over the past few years, marked by a rise in interest rates from 2% to 13.75% to control post-COVID inflation to low/mid-single digits. This adjustment, coupled with GDP growth of 2-3% and a drop in unemployment to mid-single digits, led to three consecutive 50 basis point rate cuts. These changes have bolstered equities, particularly for companies with floating rate debts, by reducing net interest expenses and promoting a shift from fixed income to equities.

Stabilizing Political Climate

Initial Spook

Following the election of President Lula Inacio da Silva from the Worker’s Party last year, international allocators moved out of Brazil amid concerns about his spending and wealth redistribution rhetoric, reminiscent of his previous term and successor Dilma's policies.

Eased Fears

This raised fears of fiscal deficit challenges. However, the emergence of centered parties in the Senate and Lower House has established a system of checks and balances, enhancing prospects for fiscal orthodoxy. Finance Minister Haddad, advocating for a zero-deficit goal, has been a reassuring presence for markets.

Robust Central Bank Performance

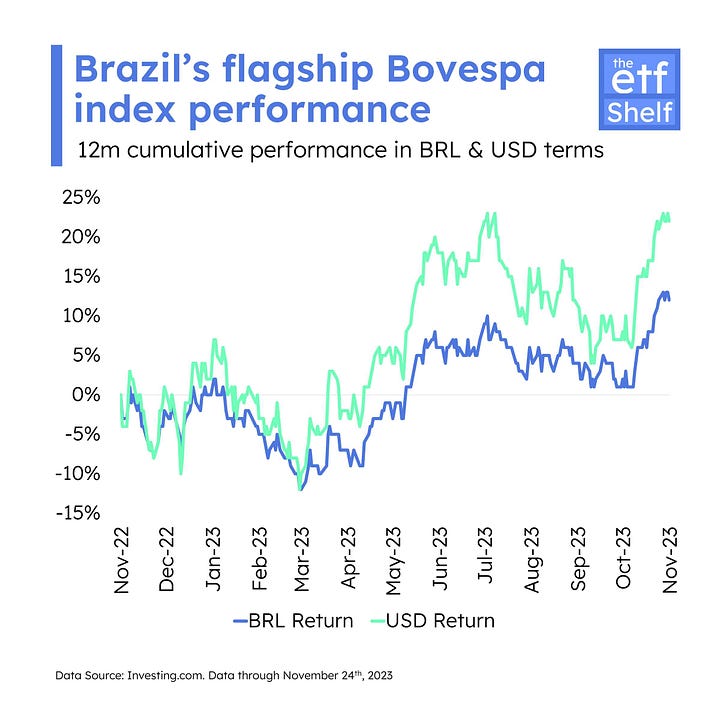

The Central Bank of Brazil, now independent, effectively managed inflation while supporting growth and reducing unemployment, fostering a strong positive real rate environment that bolstered the currency. This has benefitted U.S. dollar-based investors, with Brazil’s flagship Bovespaindex rising 15.71% in BRL terms and 26.58% in USD over the last year.

Strong Commodity Prices Boosted the Economy

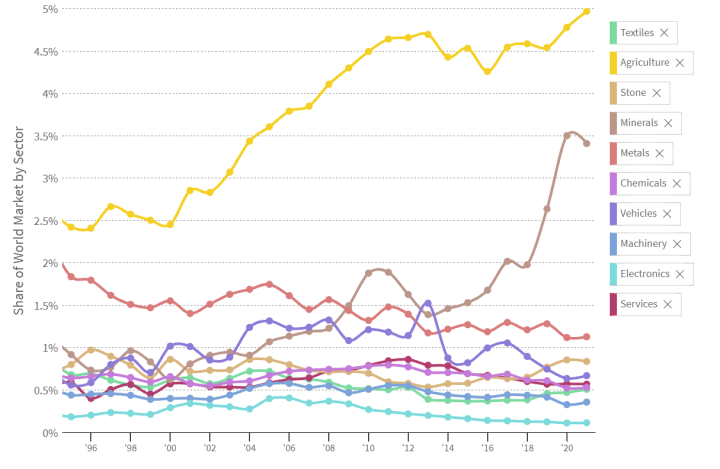

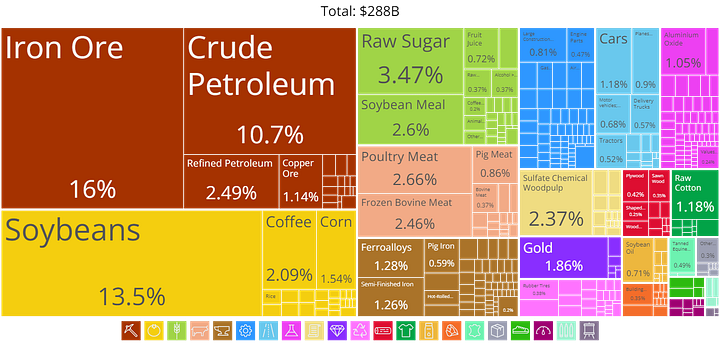

Brazil, recognized as a commodity powerhouse, benefits significantly from rising prices in key commodities like oil, iron ore, soybeans, and other agricultural products. Recent production cuts by OPEC+ and global supply constraints post-pandemic and the Russia-Ukraine war have positively influenced commodity prices, thereby supporting Brazil's economy.

Brazil's economic fortitude, though significant, is not without its vulnerabilities. The country's deep trade ties with China render its economy and equity markets susceptible to the ebbs and flows of China's economic health, which is currently challenged by a slowing property market. Furthermore, Brazil's reliance on strong prices for agricultural products and proteins ties its economic well-being to a range of external factors, including weather conditions, global market dynamics, and broader economic trends.

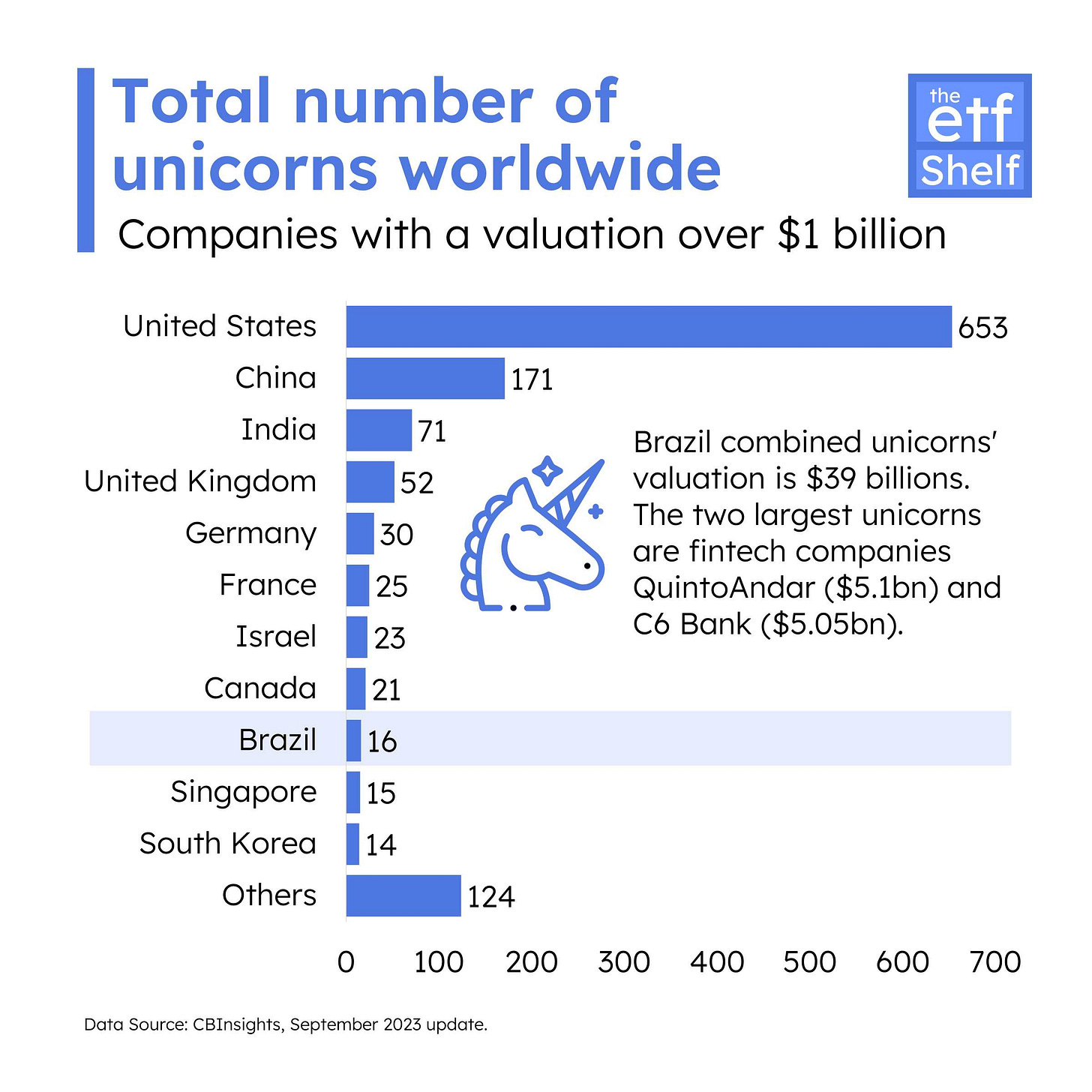

Investors are Back, Eying Flourishing Sectors

The resurgence of investor interest in Brazil is largely due to a confluence of favorable factors. A robust real rate environment and an unexpectedly prudent political climate are key drivers. Additionally, Brazil's wealth of natural resources, coupled with its burgeoning tech sector, particularly in fintech, is becoming increasingly compelling.

The Brazilian fintech sector in particular has seen exponential growth, with investment in fintech startups skyrocketing from $52 million in 2015 to nearly $4.5 billion in 20221, spread across 1,289 companies. This dynamic blend of economic stability, political foresight, natural wealth, and technological innovation makes Brazil an increasingly attractive destination for investors.

Low Valuations, Strong Prospects

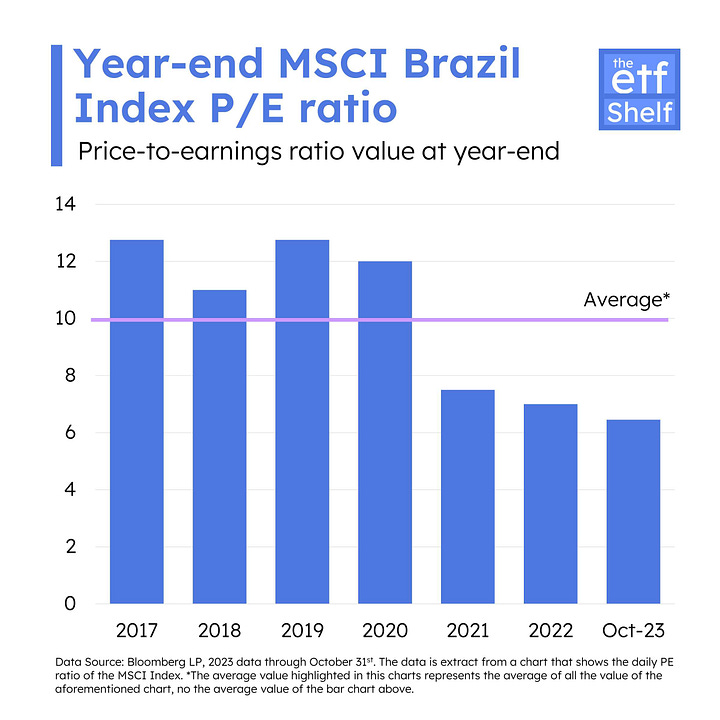

In comparison to other emerging markets, Brazil stands out with a 6.45x P/E ratio, 1.45x book value, and an 8.88% dividend yield2, offering substantial investment opportunities, especially in consumer and financial sectors due to lower interest rates and improved asset quality.

The short to medium-term prospects for Brazil are very strong, based on the country’s advanced monetary policy cycle and valuations trading more than 1 standard deviation below their 5-year historical averages3. In the long term, Brazil's prospects are bright, contingent on future elections and political governance.

How U.S. Investors Can Invest in Brazilian Equities

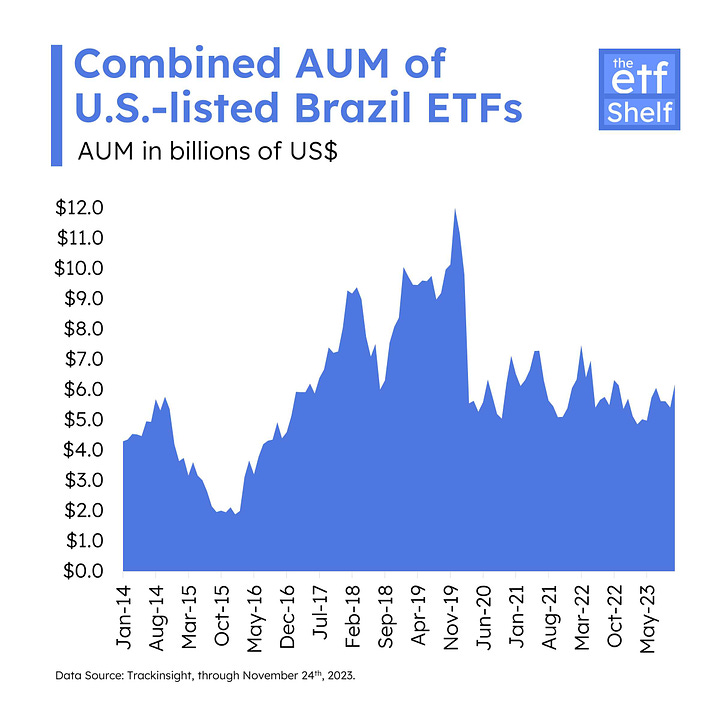

Options for Brazil exposure: Despite the strong demand, there are limited options for US investors to find active management with direct Brazil exposure. US vehicles are passive and most Brazilian vehicles charge 2% management fees and 20% on performance. However, there are still billions of dollars invested in public equities in Brazil via passive ETFs.

Inefficiencies of passive products: None of the top 5 passive Brazil strategies have been able to match their tracking benchmarks over the past 5 years. The largest underperformed by about 500bps. The MSCI Brazil benchmark is roughly 35% state-owned enterprises, 13.5% Vale, and 16.5% Petrobras4. This signals a significant amount of concentrated exposure to cyclical commodities and to state-run management teams that might not have a strong alignment of interest with minority shareholders.

An Active Approach With BRAZ 0.00%↑ETF: The Global X Brazil Active ETF (BRAZ) is the only active ETF or mutual fund dedicated to investing in Brazil for US clients. The fund holds 20-30 best-idea names and will consistently be underweight Vale and Petrobras, instead focusing on asset-light, high-return business models that can compound earnings above their cost of capital.

The fund also boasts various off-benchmark names such as Nubank, Mercado Libre, Arcos Dorados, Vivara, Vamos, 3R Petroleum, and Bradespar. It is run by Malcolm Dorson, who is the head of Emerging Markets Strategy at Global X and has been running bottom-up EM and Brazil funds for parent company, Mirae, since 2015.

Peru Overview

Fiscal Health and Trade Balances

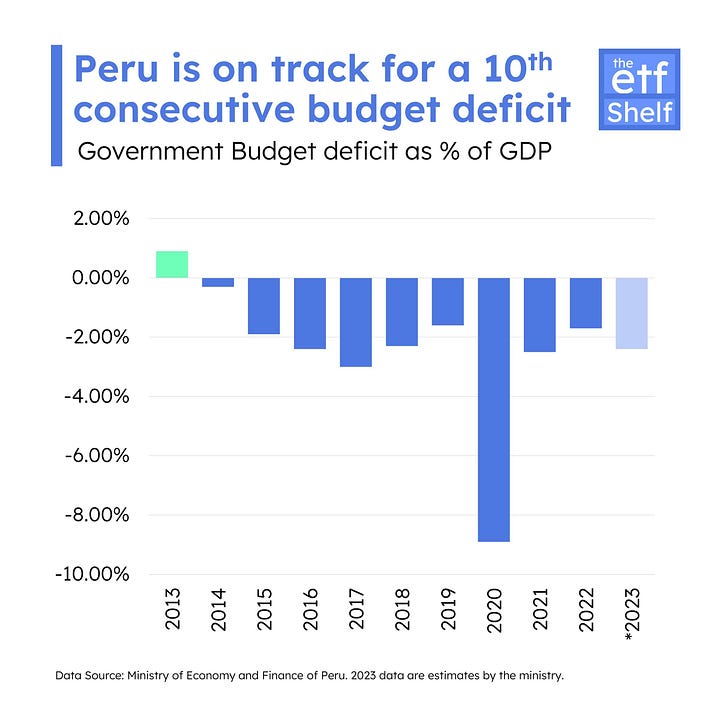

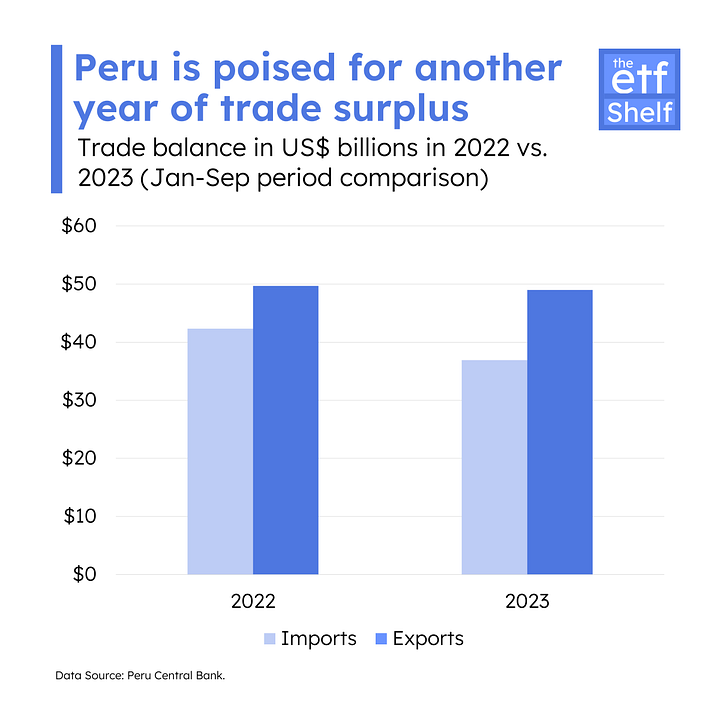

Peru's fiscal and trade balances appear relatively healthy.

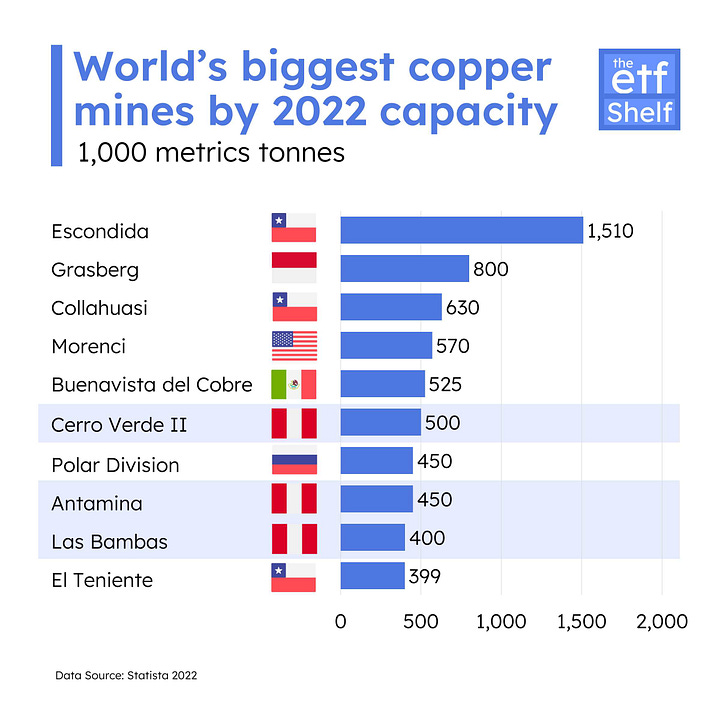

The government's constant flux has prevented significant spending, and the increase in copper production is positively influencing trade.

The nation is currently embarking on a phase of relaxed monetary policies, anticipated to significantly boost the economy. Additionally, the Peruvian Sol has shown a slight but noteworthy strengthening this year, offering a favorable advantage to investors dealing in US dollars.

Political Instability and Governance

Peru has experienced notable political instability, with six presidents since March 2018. Each term has been marked by social unrest and corruption allegations.

However, the political climate has shown signs of stabilizing recently, and it's believed that President Boluarte might complete her term through 2026. Political change and gridlock have hindered progress and growth prospects, so any signs of stability should act as a tailwind for the market.

Central Bank and Inflation Management

With a backdrop of falling inflation and weak economic data, Peru's central bank began easing rates in September. Inflation appears under control, and the Central Bank has acted responsibly, which is a positive indicator for the economy.

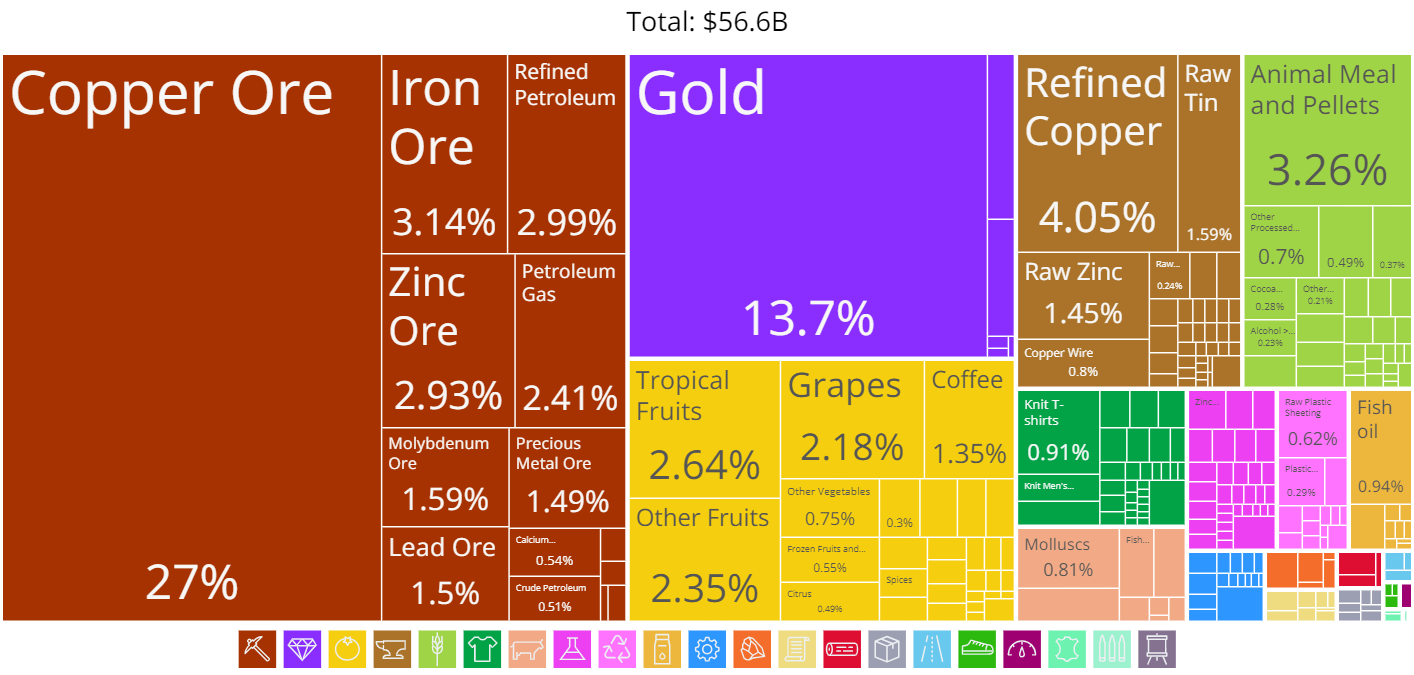

Commodities and Global Economic Trends

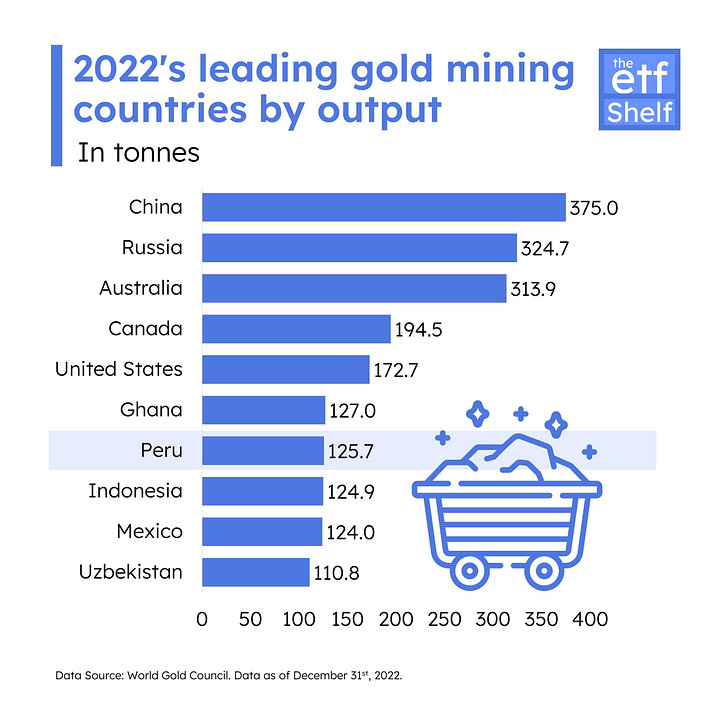

Peru, a key gold-producing nation, is likely to benefit as gold prices are expected to rise with the easing of U.S. monetary policy and ongoing geopolitical tensions. Additionally, copper production in Peru has been rebounding and should have bright short and long-term outlooks. In the near term, copper will benefit from rebounding activity out of China, while in the long term, it is a key beneficiary of the movement toward electric vehicles.

Overall Economic Outlook

On the positive side, Peru should benefit from easing monetary policy and a backdrop of strong commodity prices. Valuations are also undemanding and trade below historical averages. However, the political landscape remains a roller coaster. Though the current administration is gaining stability, strong popular pressure for early elections persists. Robust macro fundamentals have mitigated recent political turmoil, but the market's attractiveness is tempered without stability in governance.

How U.S. Investors Can Invest in Peruvian Equities

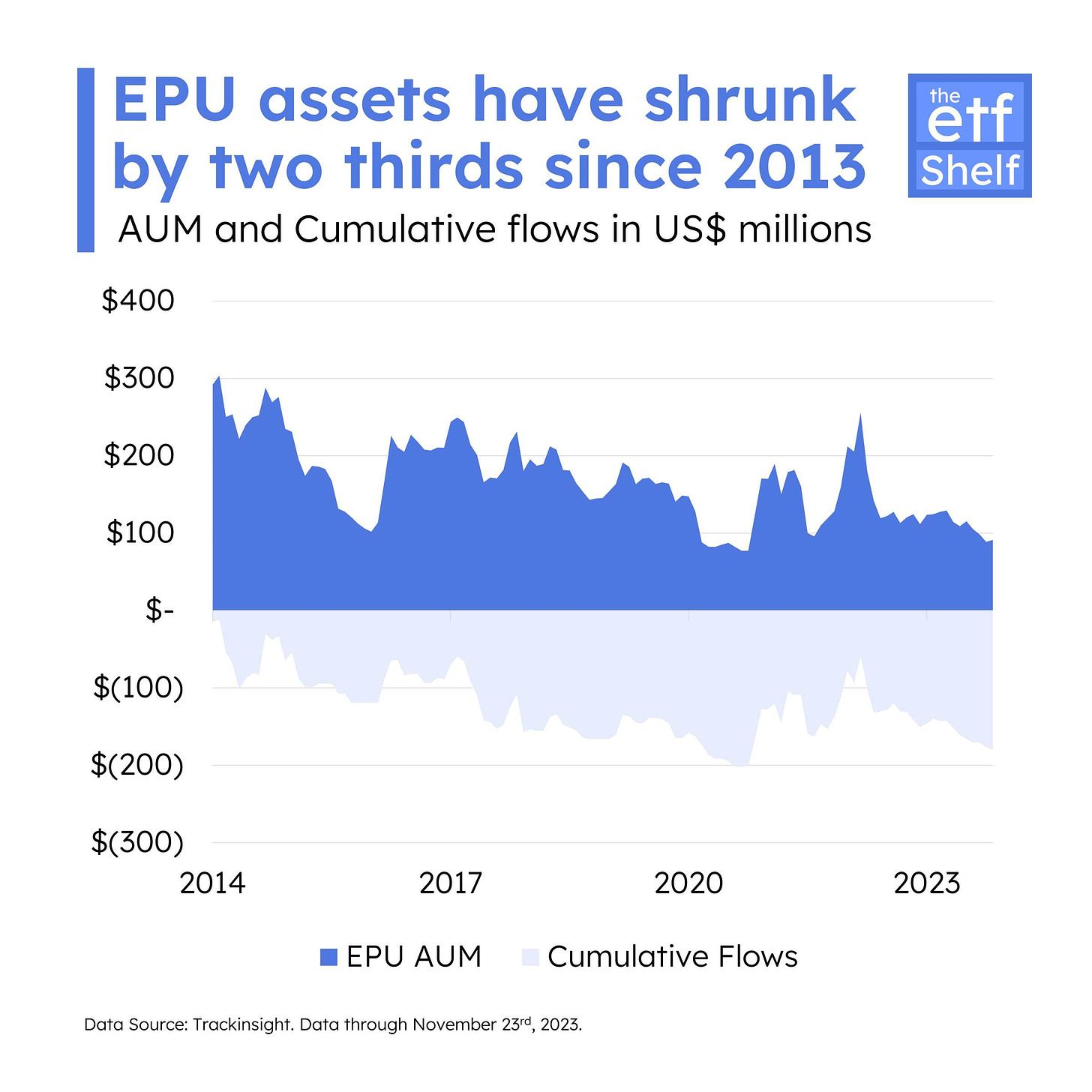

U.S. investors can access Peruvian equities through the iShares MSCI Peru and Global Exposure ETF ($EPU). The fund seeks to track the MSCI All Peru Capped Index and provide exposure to a broad range of companies in or with economic exposure to Peru (e.g. Some domiciled in Canada, U.S., U.K., Chile, China, and Colombia).

Unlike Brazil or other emerging markets, Peru's market is shallow and concentrated. Consequently, the index includes 25 companies with only three notable names: Southern Copper (22%), Creditcorp (21.5%), and Cia de Minas Buenaventura5. Year-to-date the fund has returned +11% but has seen around $30 million in outflows (Fund total AUM is at $91 million).

Thank you for reading! Stay tuned!

Stay tuned for our upcoming edition on Colombia and Mexico, as we continue our journey through the American ETFs landscape.

Disclaimer

This newsletter is for informational purposes only and is not financial advice. We do not guarantee the accuracy of the information or calculations provided. It is essential to consult a qualified financial advisor before making any investment decisions. We are not responsible for any errors or omissions in the data. Investing in ETFs or any financial instrument involves risk, and you should conduct your own research. Past performance does not guarantee future results. By using this newsletter, you agree to these terms and conditions.