Charted📊: The Globe On A Scope - Part I.I

Zooming In On Single-Country Equities ETFs Around The World: Our First Stop - The Americas

Before we start….

The Global ETF Survey 2024

➡️ Join J.P.Morgan, State Street, and Investing.com in completing the Fifth Annual Trackinsight Global ETF Survey 2024 to gain insights on what influences professional investors investment decisions and what they think of major market trends in the ETF space, including ESG, thematic investing, Active management, Cryptocurrencies and more.

💝A completed survey means an automatic $10 donated to the International Federation of Red Cross and Red Crescent Societies.

😲15,000 professional investors have read the 2023 Global ETF Survey.

The Globe on a Scope - Part I.I

Welcome to the opening segment of our series on single-country-focused Equity ETFs globally.

This first edition kicks off with a focus on the Americas, beginning with two key players in the south: Argentina and Chile. I will explore the key factors influencing ETFs with exposure to these nations. In future editions, I’ll dive into the ETFs with targeted exposure to Brazil, Canada, Colombia, Mexico, Peru, and the United States.

Stay tuned for these chart-infested insights!

America’s Overview in Numbers

The ETFs

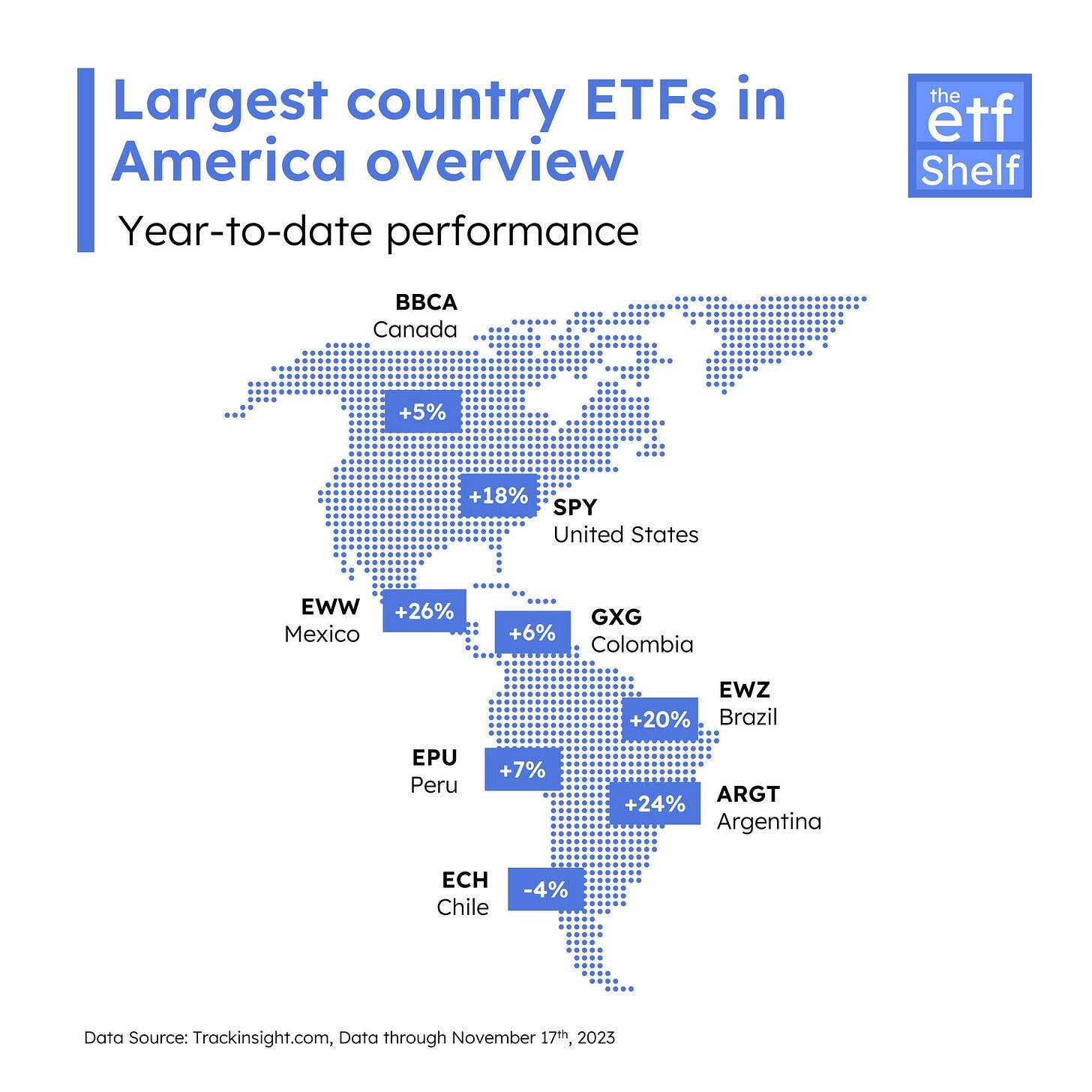

Here's a map displaying the performance of the largest U.S.-listed equity ETFs that specifically target individual countries on the American continent, including those that are the sole options available for their respective countries.

According to Trackinsight data, ETFs tied to these nations have largely yielded positive returns, with the sole exception being the ETF associated with Chile (ECH ETF), with a -4% return year-to-date.

After a challenging 2022 with an -18%1 downturn, the world’s largest ETF SPY 0.00%↑ , which tracks the flagship U.S. benchmark S&P500, has made a significant turnaround, now back in the green for this year.

ETFs that tap into the three largest economies in Latin America (Brazil, Mexico, Argentina) have each had a solid YTD performance and have outperformed $SPY.

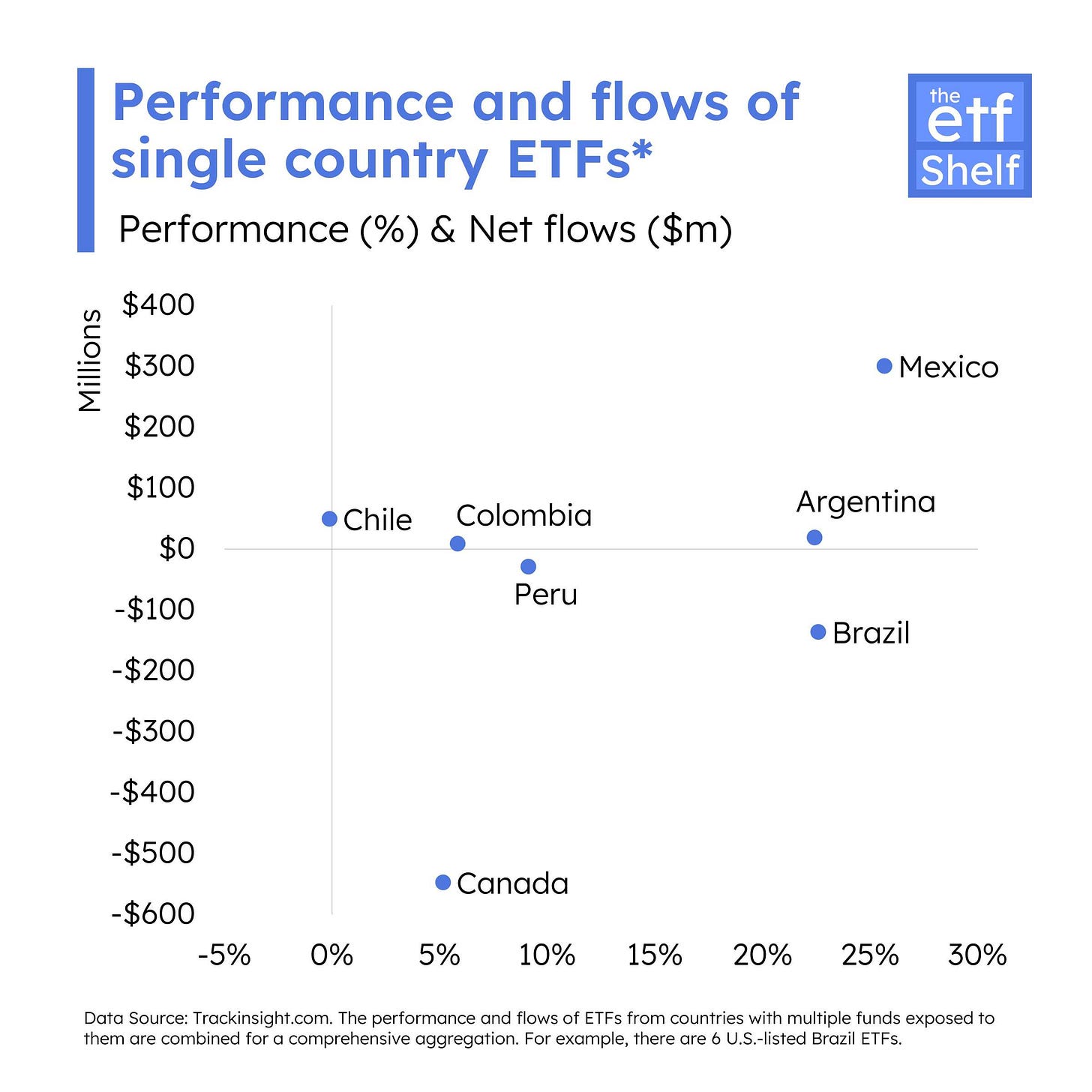

The EWW ETF, focused on Mexican equities, has attracted over $280 million in net inflows this year, with $114 million in just the past 30 days. This is a notable achievement for a fund with $1.55 billion in assets under management (AUM).

On the other hand, Canadian equity ETFs, represented by three funds, have experienced significant combined outflows. Most of these are due to the iShares EWC ETF, which recorded over $900 million in net outflows this year. In contrast, the largest Canada ETF by JPMorgan (BBCA ETF) has seen $250 million in net inflows.

The Economies

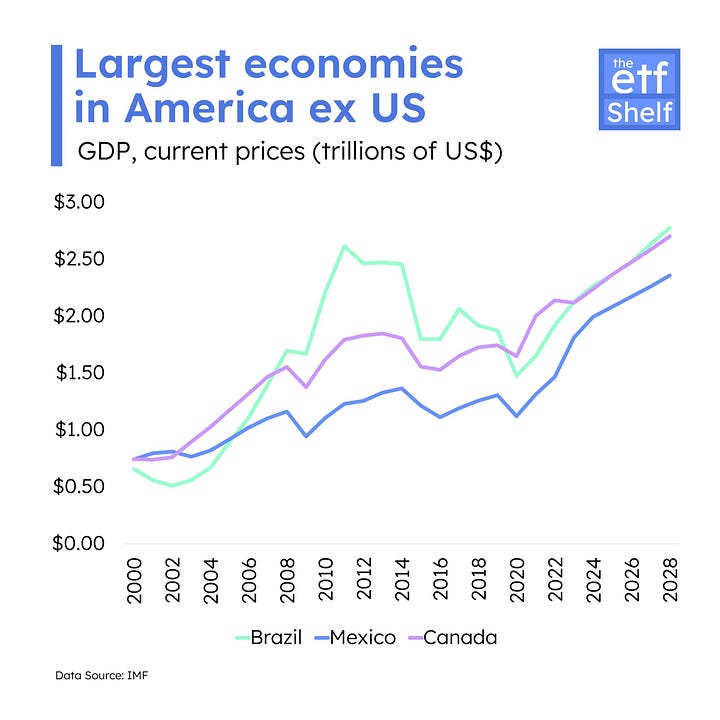

The American continent is home to 4 of the 20 largest economies in the world (the US, Brazil, Canada, and Mexico) with a combined GDP of $33 trillion (31% of the World’s combined GDP).

The Economics

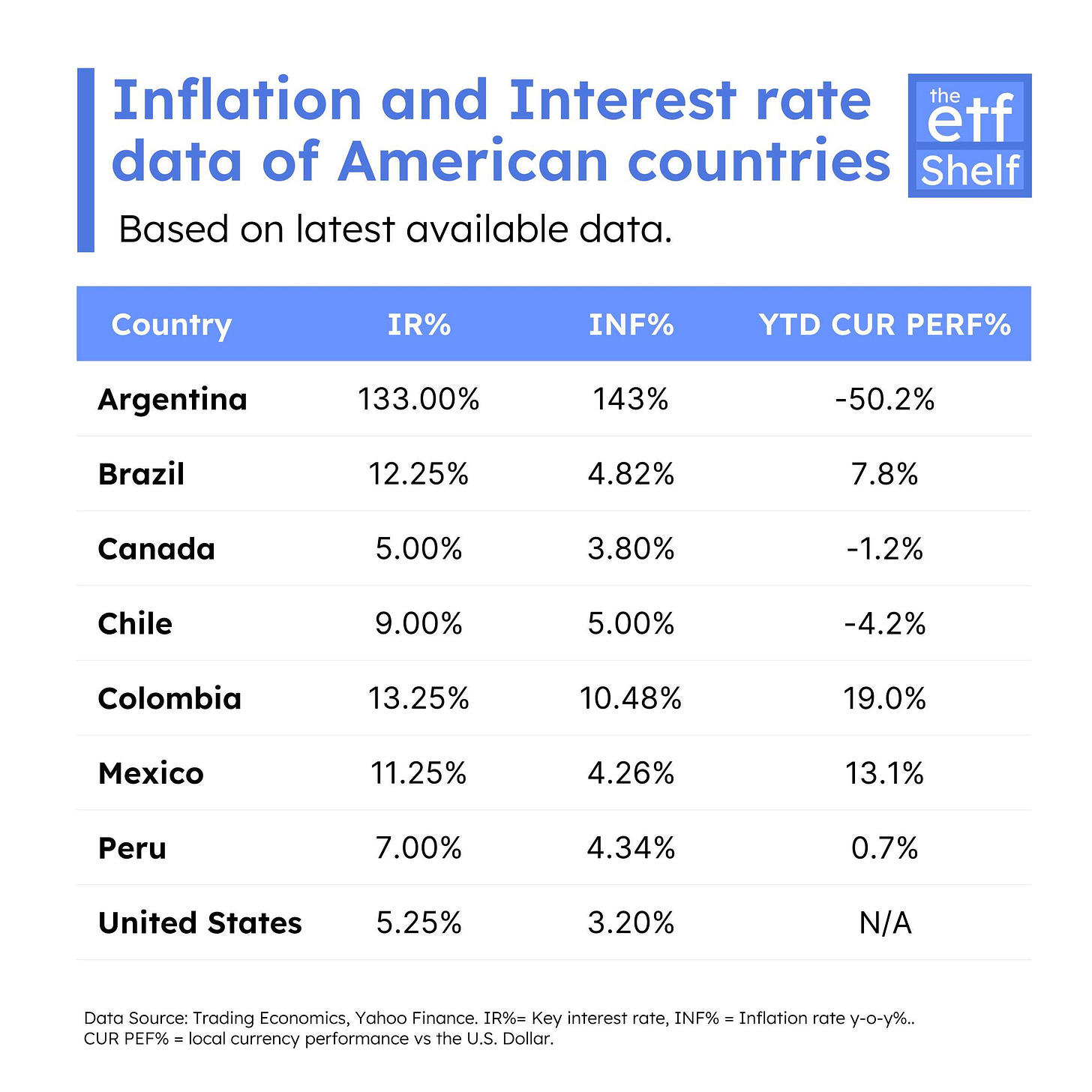

After the COVID-19 pandemic, no country was spared from the impact of inflation. Central banks around the world took action to combat this surge in inflation, employing various measures including interest rate hikes.

Latin American countries are particularly sensitive to global challenges due to several factors. First, many of these nations rely heavily on agriculture, making them vulnerable to weather extremes and climate change. This dependence on a sector susceptible to environmental fluctuations can significantly impact their economies. Add frequent political swings and instability to the mix, Latin American countries often exhibit wild fiscal and monetary policies that can turn the economy upside down.

The table below presents the most recent data on inflation and key interest rates across major economies in the Americas. It also includes information on the changes in the value of local currencies compared to the U.S. Dollar.

The Outlook

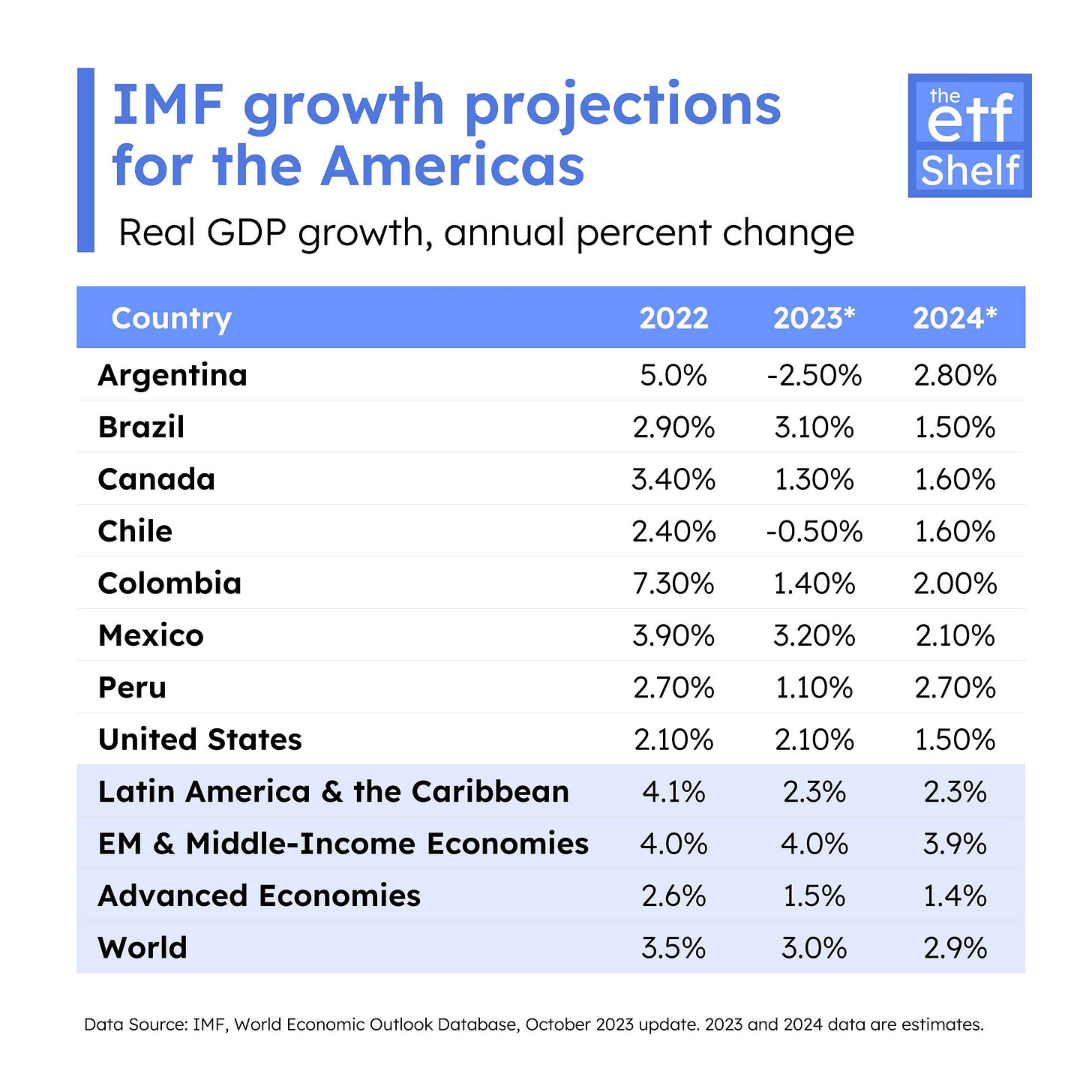

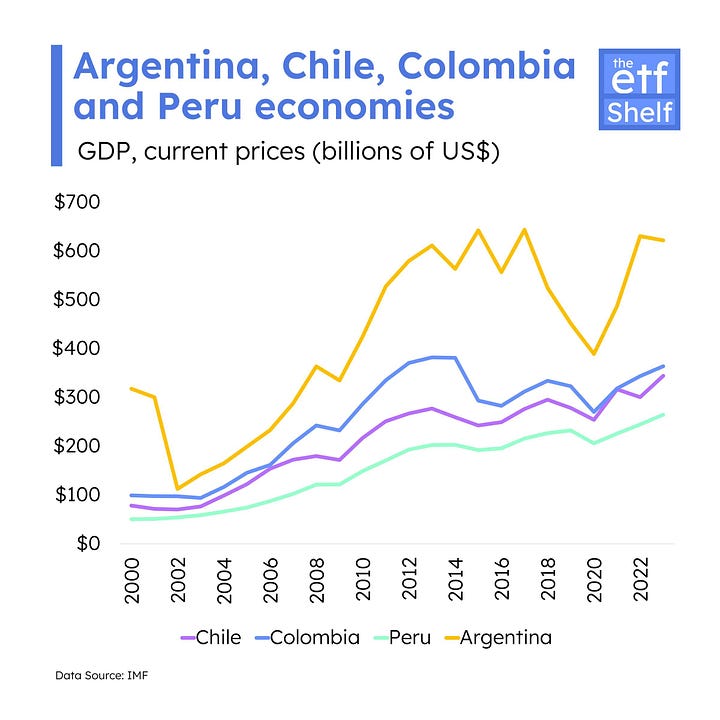

The IMF Economic Outlook's October 2023 update indicates a mixed bag: while all countries except Chile and Argentina are slated for a dip in growth this year, Brazil and Mexico are ahead, each with a projected growth surpassing 3%.

Come 2024, the forecast is more upbeat, envisioning growth across these economies, albeit with a slight deceleration in pace for Brazil and Mexico.

Country Drilldown: Argentina & Chile

Now let’s dive into the first duo in the South, Argentina, and Chile, and see what’s driving the performance needle of their respective U.S.-listed ETFs.

Argentina

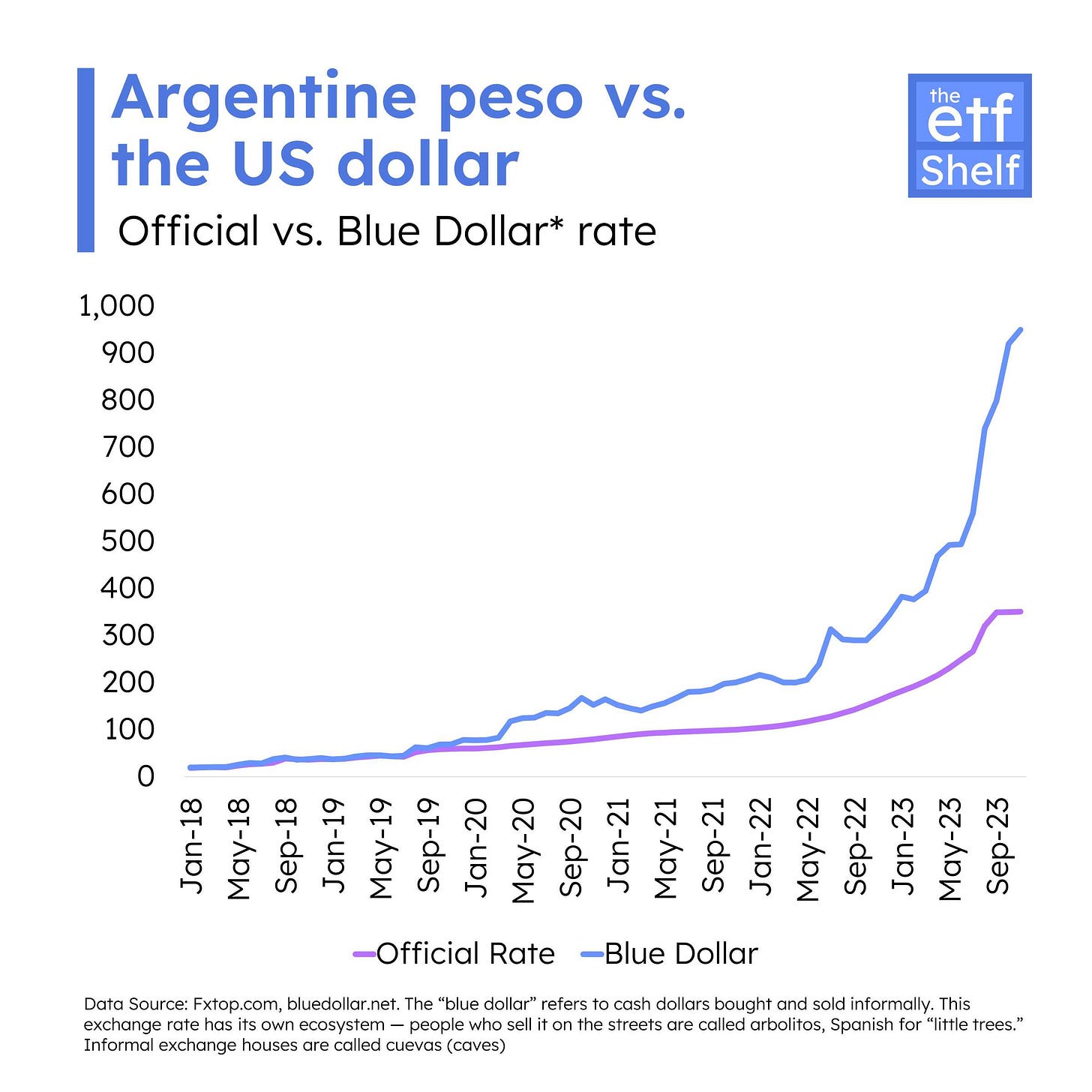

How It’s Going: Argentina faces severe economic distress with y-o-y inflation exceeding 142.7%2 (Oct. 2023), a response to which has been a steep interest rate hike to 133%3. The peso's devaluation and an agricultural downturn due to drought have exacerbated a recession, propelling poverty levels beyond 40%4.

How it Started: Argentina's financial troubles began in the 1980s with market collapse, currency depreciation, and capital flight, leading to government reliance on central bank funds, and sparking inflation. Subsequent challenges, including the COVID pandemic and international pressures, exacerbated the situation, with government programs like subsidized healthcare and public transport further straining finances through increased currency printing.

Presidential Showdown: Argentina is voting today (Nov. 19) in a crucial presidential election. The race is headlined by the unconventional frontrunner Javier Milei, who’s pushing for the bold strategy of complete dollarization. He faces off against Sergio Massa, who proposes more conventional economic stabilization approaches. This election unfolds against a backdrop of widespread disillusionment with the country's long-established political groups. Track the Argentina Election Live Results here

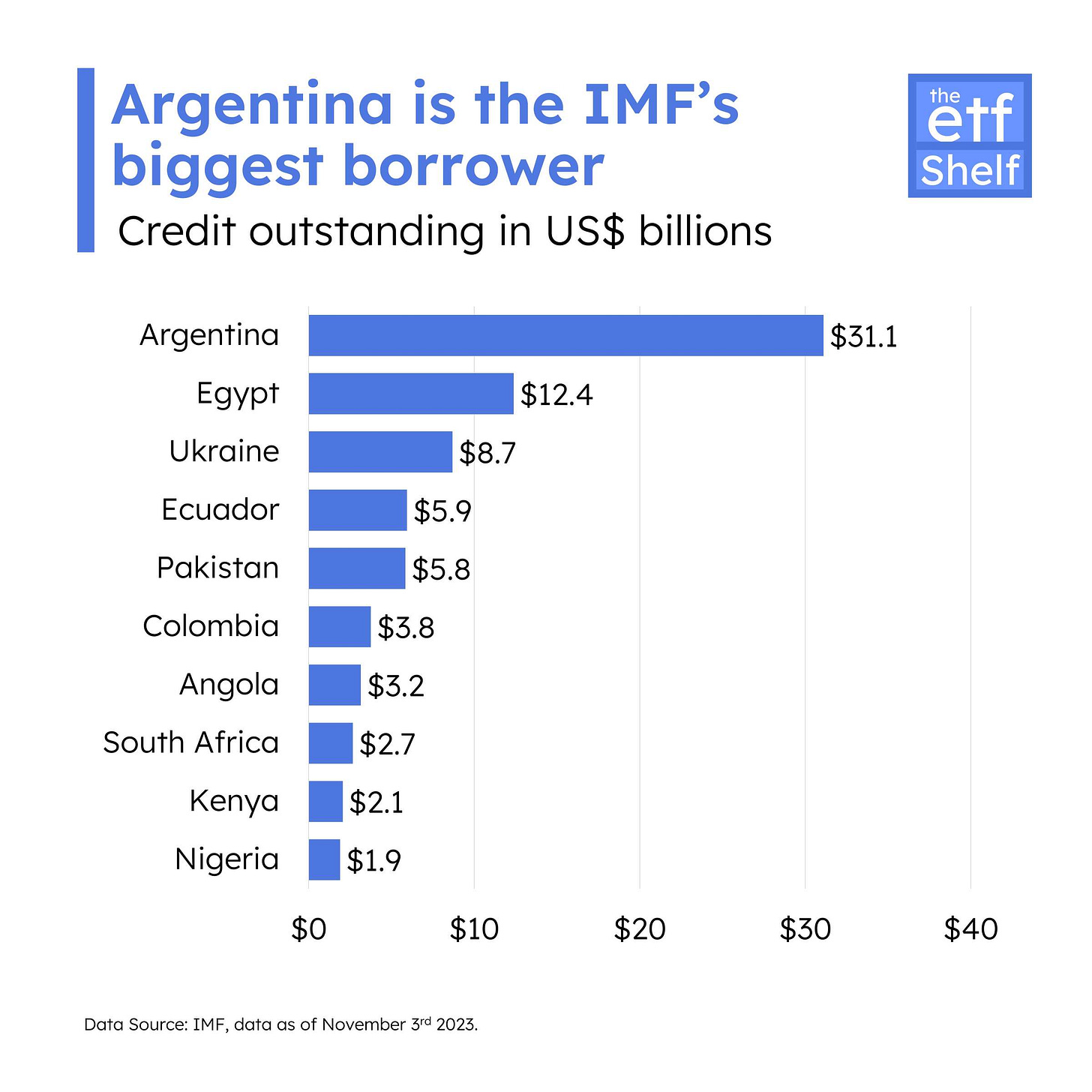

Solving Argentina’s Debt Dilemma: With Argentina as the IMF's largest debtor, election outcomes will heavily influence debt management strategies. Candidates propose varying fiscal policies from cutting public expenditures to overhauling tax systems, aiming to service the IMF loan without fueling further economic instability.

Exploring ARGT ETF Strong Performance

What is ARGT ETF? The Global X MSCI Argentina ETF (ARGT) is the sole ETF available in the U.S. that specifically invests in Argentina. It focuses on some of the largest and most liquid securities with exposure to the Argentinian market, offering a unique investment opportunity for those looking to tap into this specific regional economy. As of November 17, 2023, it manages assets of approximately $56 million and includes 25 holdings with a semi-annual dividend distribution.

Why ARGT ETF is Going Up? Argentinians are increasingly investing in stocks and bonds as hedges against the declining peso, with daily stock trading up 33%5 this year and brokerages seeing more retail investors turning to equities and dollar-linked assets for protection. The surge has lifted the local stock index, the S&P Merval Index by +220% this year6 (Peso terms). Despite the devaluation of the Peso, the ARGT ETF (USD-denominated), which tracks a different index, managed to pull off a decent performance so far.

Chile

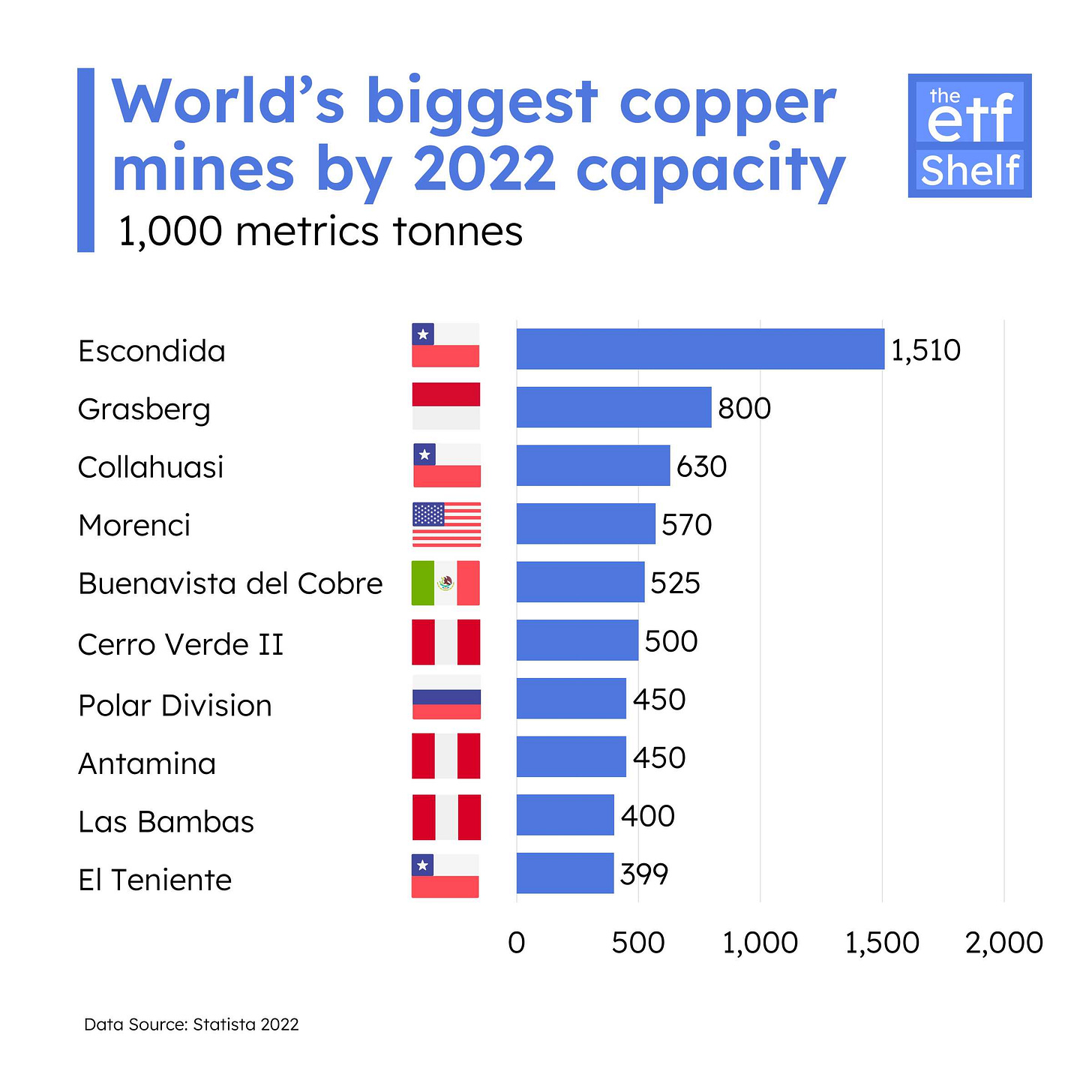

About the Chilean Economy: The Chilean economy is characterized by its strong dependence on the mining sector, particularly copper, which is a major global export and a key driver of economic growth. This industry has positioned Chile as the world's top copper producer, significantly influencing international copper prices and markets.

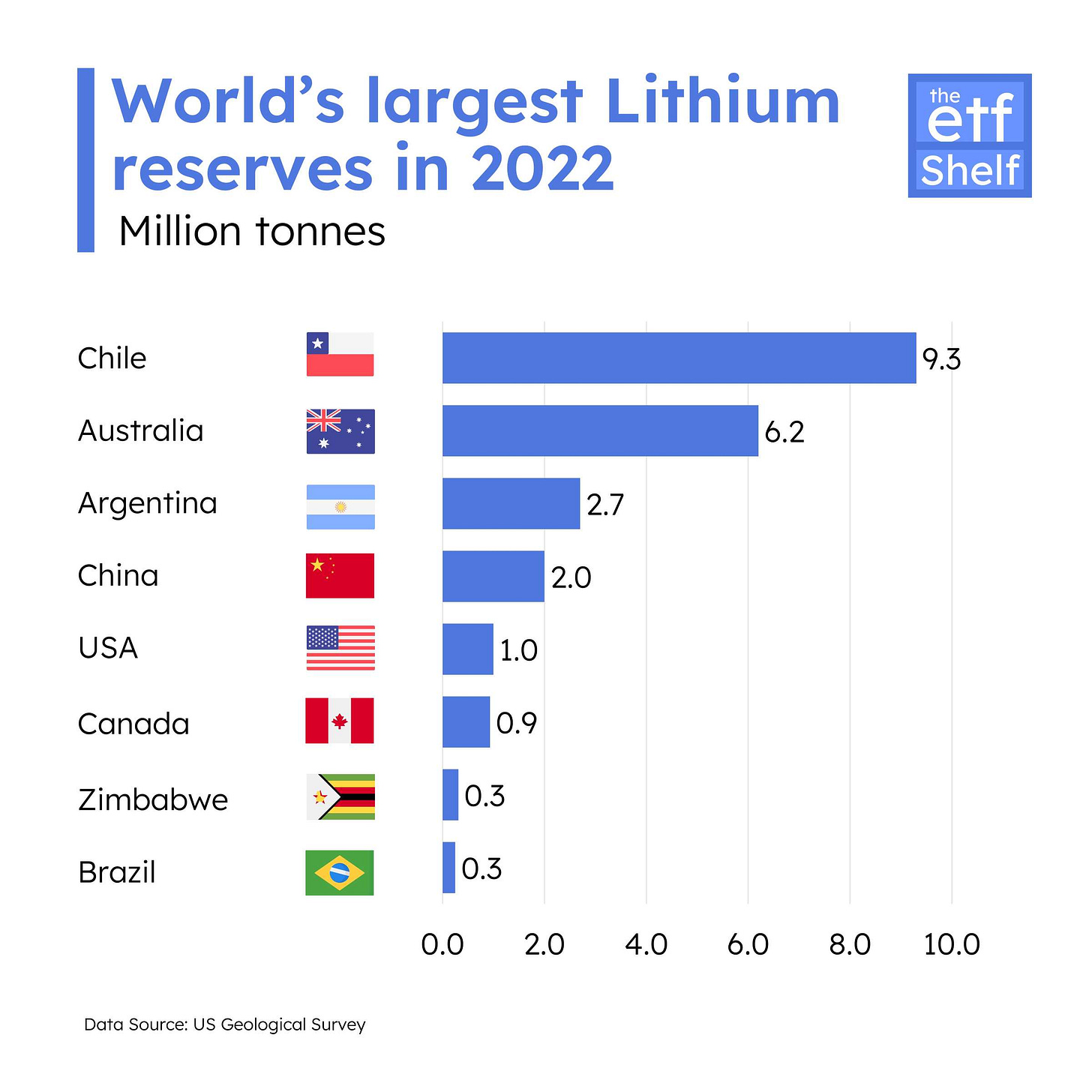

Powering the Future: Additionally, Chile's economy benefits from a diverse range of other minerals, including lithium, a critical component in the burgeoning electric vehicle and renewable energy sectors.

Mining Overdependence: Despite its rich mineral resources, Chile grapples with challenges in diversifying its economy (mining contributes 10-15% of GDP, 50-60% of exports7) and mitigating inequalities, issues intensified by the variable global demand for these minerals.

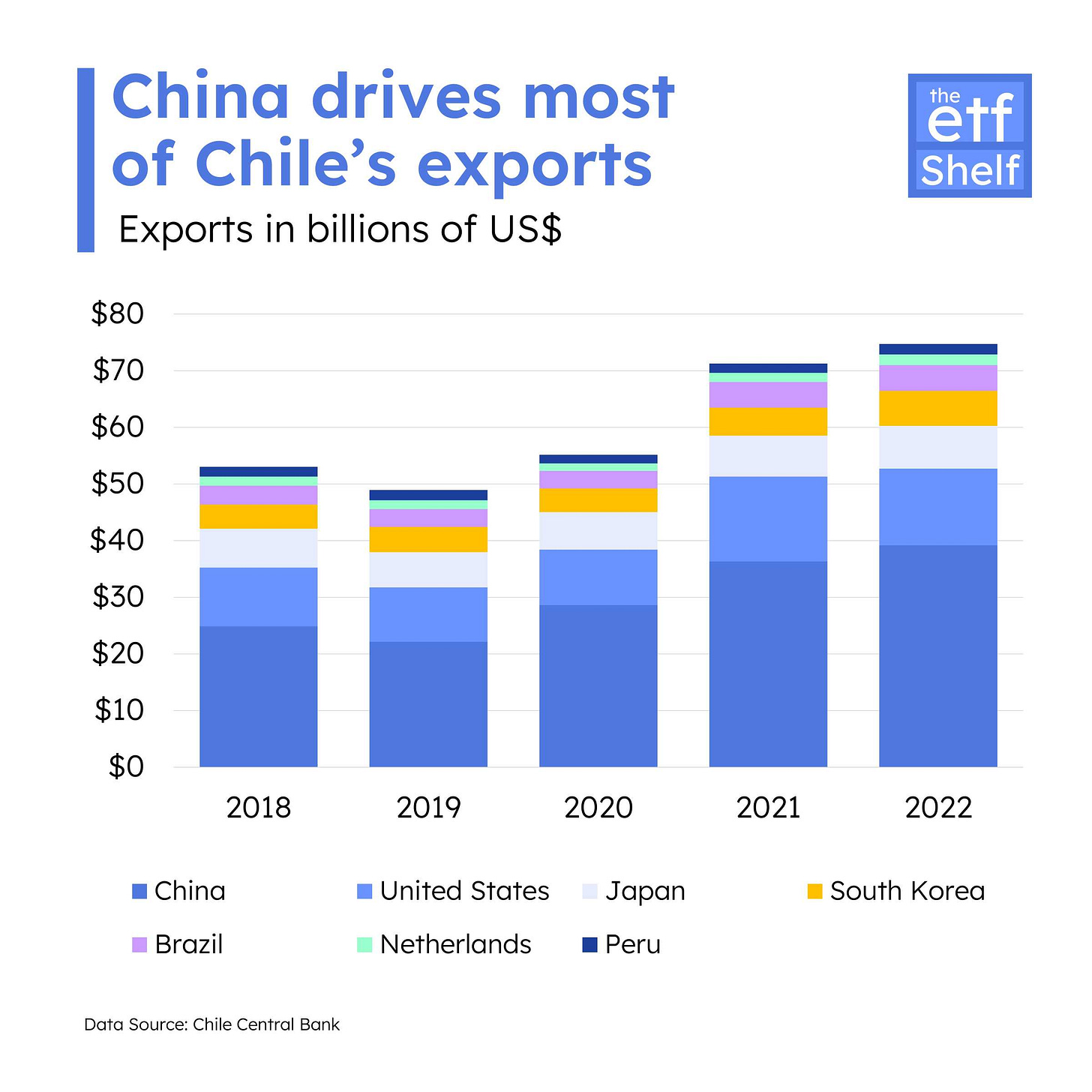

Partners Overdependence: Moreover, the concern extends beyond just broadening the economic sectors; it also involves diversifying economic partnerships. A significant aspect of this challenge is Chile's high dependency on China as a trading partner, to the extent that its exports to China surpass the combined value of exports to its top five other key trading partners.

Exploring ECH ETF Performance

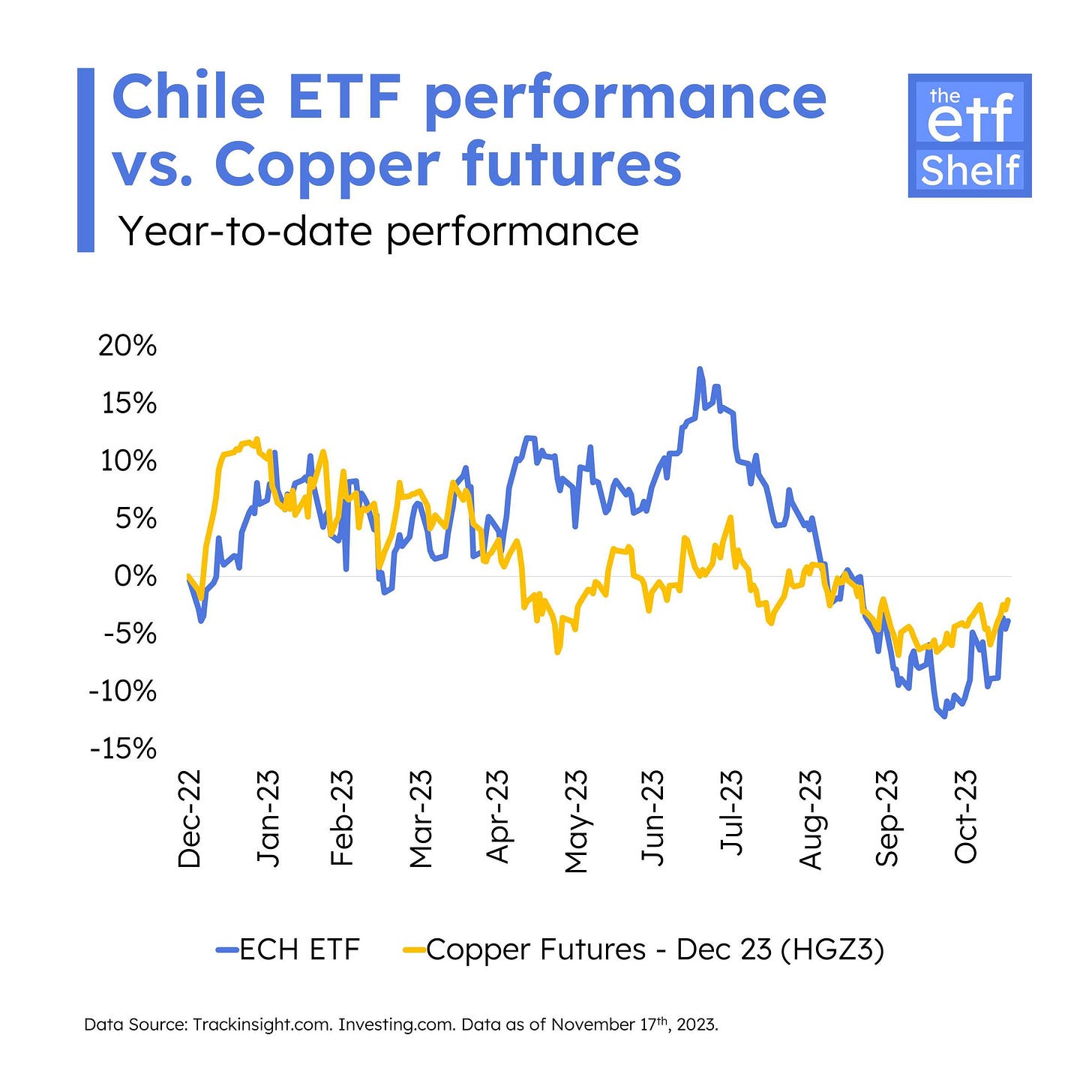

What is ECH ETF? The iShares MSCI Chile ETF (ECH) focuses on Chilean equities, tracking the MSCI Chile IMI 25/50 Index. As of November 17, 2023, it manages assets of approximately $528 million and includes 26 holdings with a semi-annual dividend distribution.

Why ECH ETF is down this year? In the first half of 2023, Chile's market saw growth, driven by China’s ending of its COVID policy and the rate cuts by the Chilean Central Bank in July. These moves were positive for Chile because of its strong trade ties with China. However, the upward trend hit a snag due to issues in China's property market and fears of its economic slowdown. In May, Chile's political landscape underwent a significant shift as right-wing parties gained a majority in the Constitutional Council, diverging from the previously progressive majority that could not pass an earlier constitutional rewrite. This change has heightened market uncertainties and showcased the country's deep ideological splits. The right wing recently introduced a conservative draft for the new constitution. The forthcoming referendum on December 17, although not anticipated to greatly alter Chile's socio-economic fabric, underscores the nation's persistent political and economic instability. Facing criticism for its pro-business stance and controversial views on abortion and immigration, this new constitution is set for a public vote, marking Chile's second constitutional referendum in two years.

A “Copper” Lining: On a positive note, Beijing is committed to investing CNY 1 trillion in manufacturing and infrastructure boosting copper's prospects. Furthermore, the People's Bank of China considered a CNY 1 trillion injection into struggling property developers, providing some stability.

A “Lithium” Lining: A key development occurred when Chile announced plans to expand lithium mining, aiming to reclaim its status as the top lithium producer globally. This was followed by the U.S. Senate progressing a tax treaty with Chile, a strategic step to ensure American companies access to lithium, vital for electric vehicle batteries.

📊 Weekly Poll

Share your investment insights and tactics with our readers!

Thank you for reading! Stay tuned for the next one, focusing on Brazil and Peru!

Disclaimer

This newsletter is for informational purposes only and is not financial advice. We do not guarantee the accuracy of the information or calculations provided. It is essential to consult a qualified financial advisor before making any investment decisions. We are not responsible for any errors or omissions in the data. Investing in ETFs or any financial instrument involves risk, and you should conduct your own research. Past performance does not guarantee future results. By using this newsletter, you agree to these terms and conditions.

Yahoo Finance

Argentina Central Bank

Argentina Central Bank

Argentinian Government INDEC statistics agency

BNN Bloomberg

S&P Dow Jones Indices

International Trade Administration