10 ETF Charts I Thought You’d Like This Week

Options-based strategies, CLOs, High-income single stocks, Latam majors and more.....

The rise and proliferation of options-based ETFs

Investors in the US are flocking to options-based ETFs that either leverage option strategies to potentially boost returns (e.g., covered calls) or shield portfolios from downturns (e.g., buffer ETFs), among other strategies.

This innovative approach is particularly appealing in today's volatile market environment, where traditional investments like stocks and bonds are offering lackluster returns and yields or heightened risk.

One of the most popular ETF segments

This segment of the ETF market in the U.S. has now close to 450 ETFs with a combined AUM of $136 billion. Over the past year, investors added $47 billion to these ETFs.

Retail investors love these ETFs

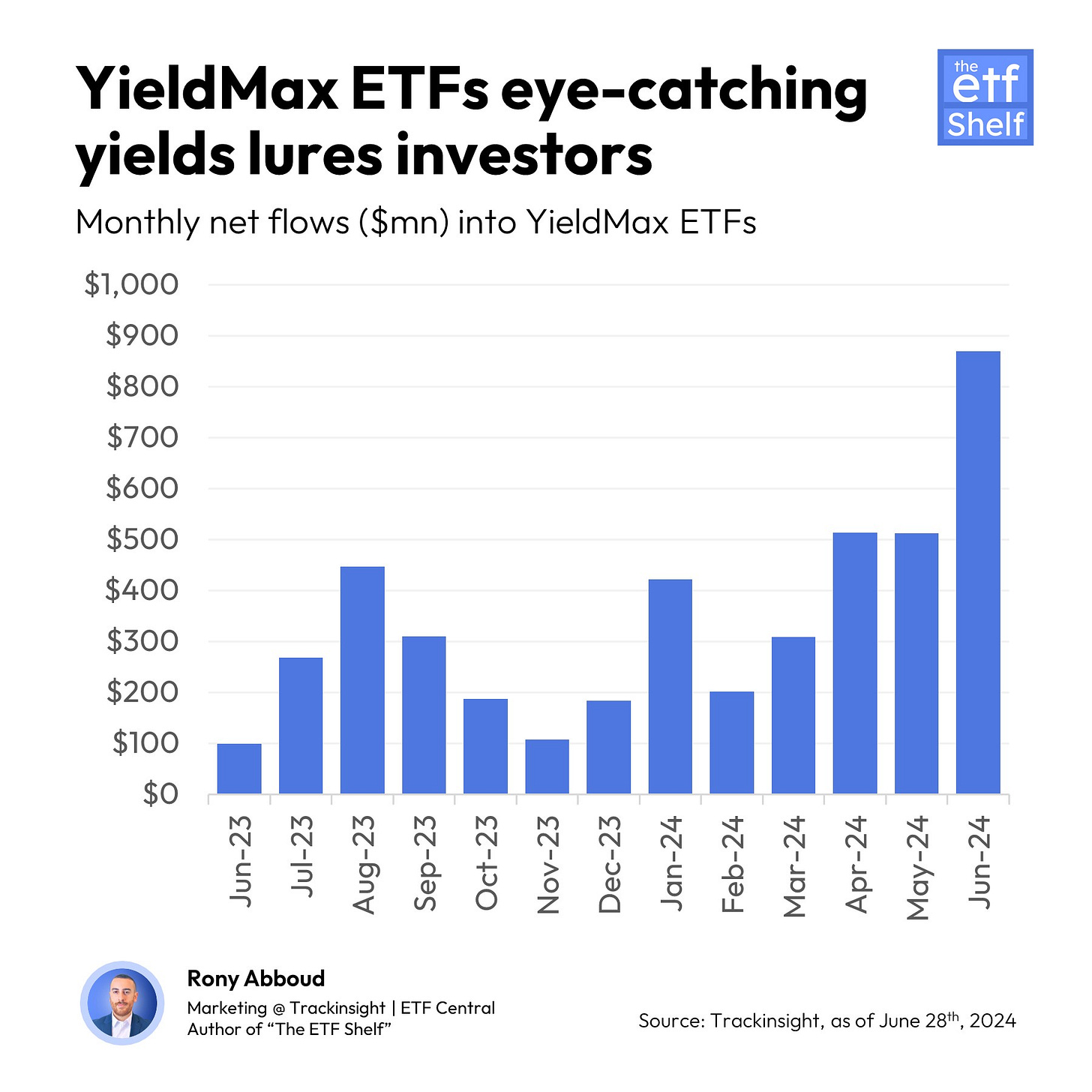

Rising in popularity, YieldMax ETFs is renowned in the options-based ETF niche for its unique single-stock approach and consistent double-digit yields.

Here's how they work:

Quoting Tony Dong, lead ETF analyst on ETF Central

Instead of purchasing the stock, YieldMax combines a short put and a long call to create what's known as a synthetic stock position. This method is not only capital efficient but also mirrors owning the actual stock.

The real twist comes with the addition of selling a short call to generate income, which forms the core of the covered call strategy. However, since the ETF doesn't hold the underlying shares, there's nothing to get called away if it does expire in-the-money and gets assigned.

To back these positions and add a layer of security, YieldMax uses Treasuries as collateral. In today's environment of higher interest rates, this also contributes to earning a competitive yield.

The result? YieldMax ETFs provide above-average monthly income and exposure to the returns of the underlying reference asset without physically holding it. However, like all covered call ETFs, the upside is capped, and there is still exposure to downside risk.

Strong inflows into these funds

Their ETF lineup has raked in over $4.4 billion in the past year, with June shattering records for the highest monthly inflow ever.

Investors are increasingly drawn to CLO ETFs

More investors are catching on to CLO ETFs, which offer a compelling mix of high yields, built-in protection, and diversification. These ETFs hold the senior slices of CLOs, which are essentially bundles of loans to companies.

The high credit rating on these senior tranches and the floating rate nature of the loans make CLO ETFs attractive in today's environment of rising interest rates and investor wariness of traditional fixed income.

📃Read more: Tony's ETF Buyers Guide: Collateralized Loan Obligation (CLO) ETFs

Strong inflows into these funds

This segment has exploded in popularity, boasting over $13 billion in total assets under management. Investors have poured nearly $10 billion into these funds over the past year, with a whopping $4.2 billion coming in just the last three months.

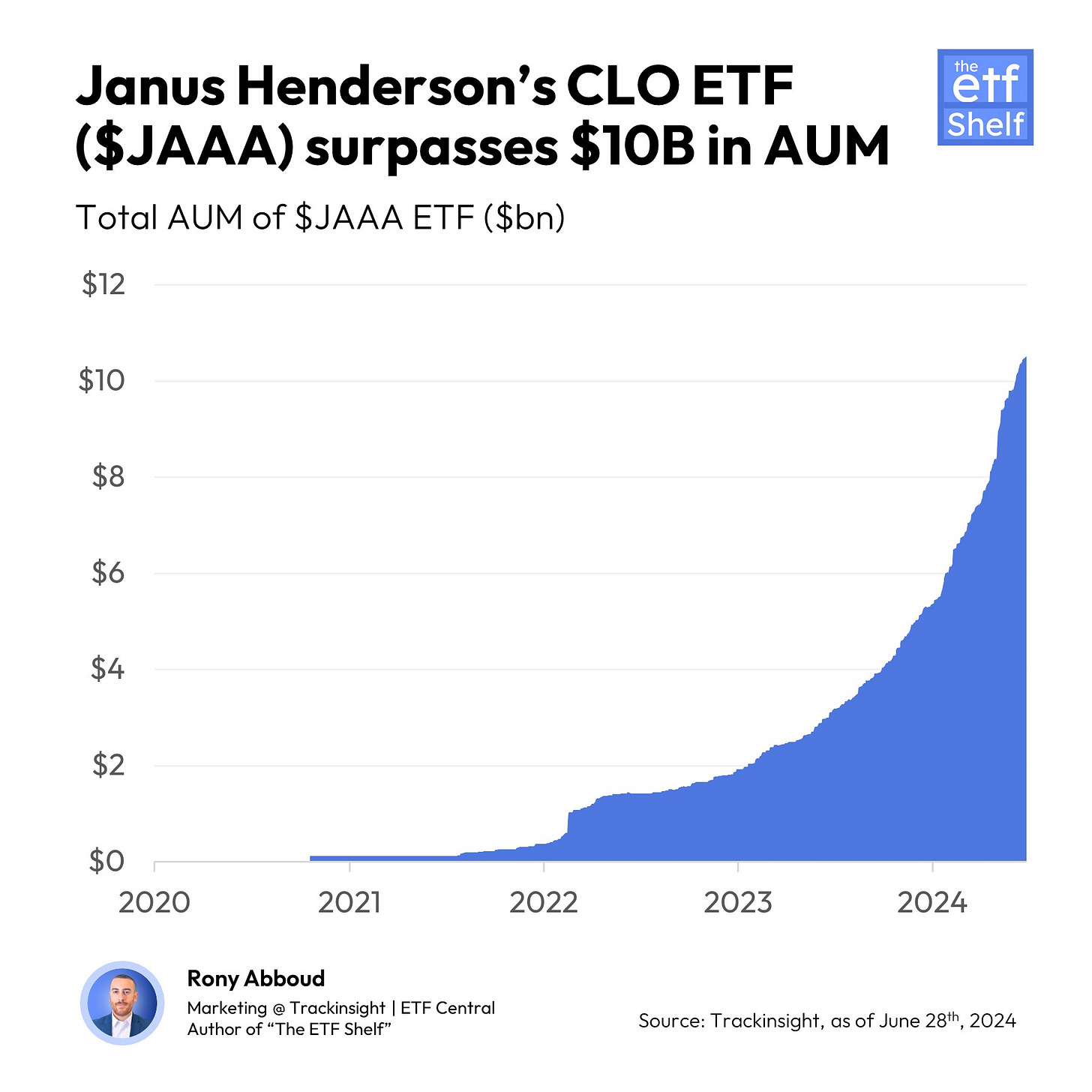

The largest CLO ETF hits new milestone

Janus Henderson’s largest ETF, AAA CLO ETF ($JAAA), and the largest CLO ETF in the U.S. market recently crossed $10 billion in assets.

This ETF offers access to the institutional AAA CLO market with the benefits of an ETF, including transparency, liquidity, and ease of trade. Retail investors can now buy and sell CLOs just like stocks.

It provides an attractive monthly income with a 6.67% 30-day SEC yield. Additionally, the low 0.21-year effective duration translates to minimal interest rate risk. The fund holds a diversified portfolio of 369 CLOs, each backed by a pool of leveraged loans.

😲Free cool feature for ETF investors

Visit Trackinsight.com and build custom watchlists to track your favorite ETFs. See key metrics like flows, performance, expense ratio, and more, all on one screen.

You can also export the free data to Excel!

Here’s how to create a list of India ETFs:

Turks seek refuge in equities

With the Turkish lira in freefall against the US dollar, Turkish investors are scrambling for safe havens. The stock market has emerged as the top choice, fueled by a desperate need to preserve wealth against inflation and currency depreciation. This flight to safety has ignited a remarkable rally – the main national index, the BIST 100, has skyrocketed an impressive 40% so far this year.

The sole pure-play Turkey ETF

U.S. investors looking to capitalize on this Turkish surge can consider the iShares MSCI Turkey ETF ($TUR). As the top-performing country ETF globally in 2024 (YTD), it offers easy access to the Turkish market, delivering over 30% returns year-to-date.

What’s happening in Latam’s biggest markets?

Investors in Mexico’s and Brazil’s US-listed ETFs have felt the pain this year. What’s going on?

Mexico

Mexican financial markets have been rattled since the June election. The peso has shed a hefty 7% against the US dollar in just a month, while the country's main stock index has fallen for the third consecutive month, dropping 5% since the new president took office in early June.

This slump is largely driven by investor unease. The strong showing of the Morena Party has sparked fears of significant policy changes, potentially even constitutional reforms. This uncertainty has rattled investors, prompting them to withdraw from Mexican assets, triggering a sell-off in stocks and weakening of the peso.

Brazil

Investor anxiety is rising due to President Lula's spending plans, which aim to both raise taxes by an unproven amount and increase expenditure. This raises concerns about the government's ability to achieve a planned budget surplus, especially considering the already high public debt hovering around 76% of GDP.

Adding fuel to the fire, the government has watered down its own targets for achieving a surplus, instead committing to increasing expenditure in real terms annually. Some investors fear the government will fail to eliminate the significant deficit this year as planned. The economic outlook isn't much brighter, with GDP growth predicted to slow to 2% this year from 2.9% last year.

Inflation concerns are also rising, with full-year forecasts reaching 4%, above the official target of 3%. To combat inflation, the central bank's base rate sits at a high 10.5%, seen as harmful to economic growth.

However, the government's fiscal looseness limits the bank's ability to lower rates. These factors have led investors to demand higher yields for holding Brazilian debt, pushing up borrowing costs and contributing to market volatility.

These factors, along with fears of political interference in central bank decisions, have led to a significant sell-off, making the Brazilian real one of the worst-performing emerging market currencies with a near-13% decline this year and causing an 8.6% drop in the Bovespa equity index.

Data by Trackinsight shows that U.S. ETF investors have pulled out over $560 million from Brazil ETFs this year. This outflow, coupled with the underperformance of major companies like Vale, has dragged the stock market down.

Beyond the States: Where are U.S. investors putting their money to work?

U.S. investors have poured a whopping $200 billion into pure U.S. equities ETFs this year. But where did the remaining $57 billion flow?

ARK Invest's ETFs continue to stumble

ARK Invest's ETFs, once soaring high on pandemic-fueled enthusiasm, have hit a rough patch. After reaching a peak of $50 billion in assets, their lineup has experienced significant outflows due to lagging performance and missed opportunities (e.g.like selling Nvidia shares too early). Year-to-date, the firm saw $3.17 billion in net outflows for their equity ETFs.

But their Bitcoin ETF is a success...

However, a glimmer of hope shines in the form of their new spot bitcoin ETF ARK 21Shares Bitcoin ETF ($ARKB). Launched in January, it has managed to attract $2.79 billion and is now the fourth-largest Bitcoin ETF in the U.S. market.

Note: ARKB saw over $200 million in net outflows over the past month.

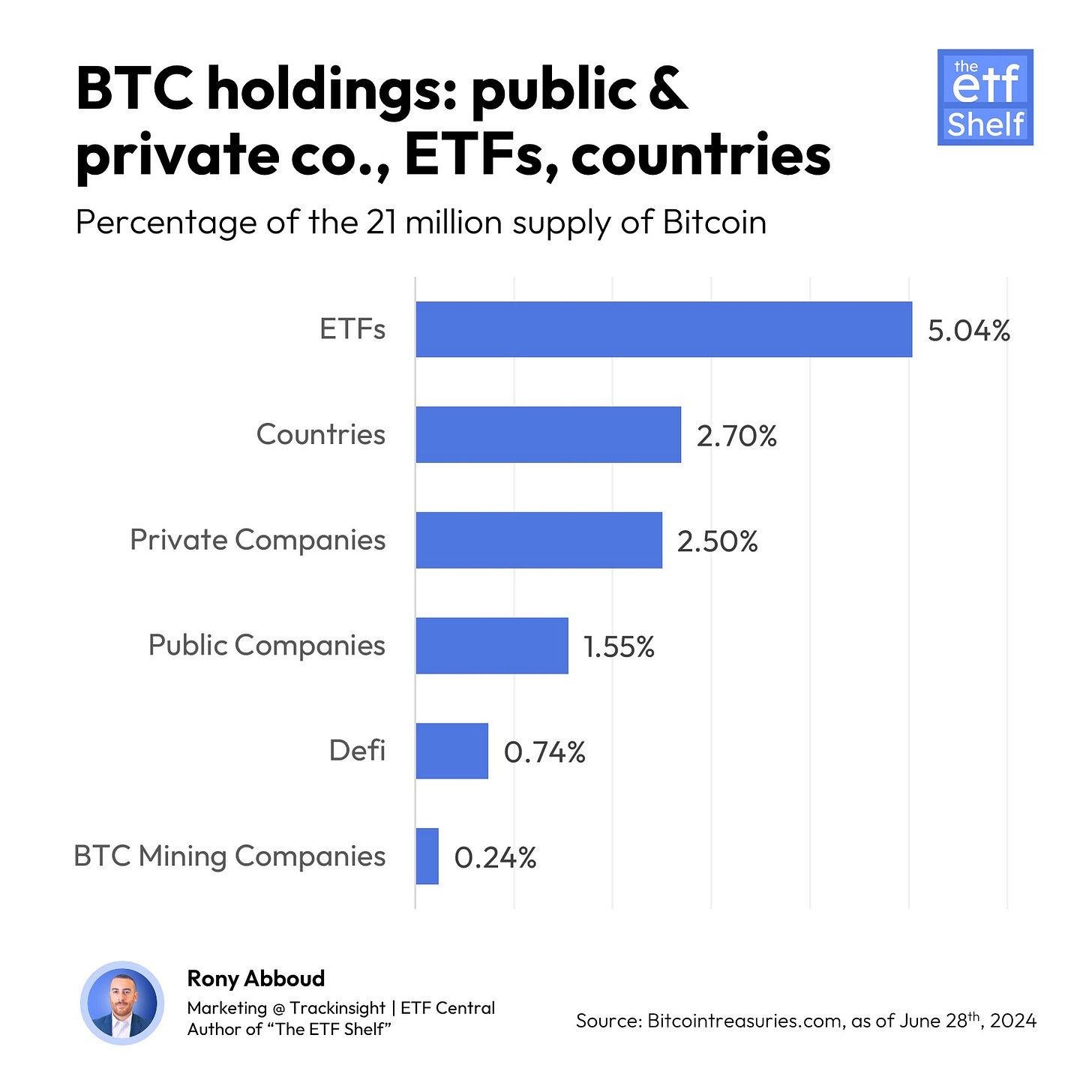

Bonus Chart: Speaking of Bitcoin

Spot Bitcoin ETFs have justified the hype, attracting strong inflows since their launch this year. As a result, these ETFs, combined with other Bitcoin-holding ETPs globally, now control a significant chunk of the market – 5% of the total Bitcoin supply.

Disclaimer

This newsletter is for informational purposes only and is not financial advice. We do not guarantee the accuracy of the information or calculations provided. It is essential to consult a qualified financial advisor before making any investment decisions. We are not responsible for any errors or omissions in the data. Investing in ETFs or any financial instrument involves risk, and you should conduct your own research. Past performance does not guarantee future results. By using this newsletter, you agree to these terms and conditions.