The ETF Shelf - Week #28 Updates

Week #28 ETF highlights: Top-performing ETFs, worst-performing ETFs, emerging trends, new filings, and more! Follow @etfshelf on twitter for daily insights. Kindly read the disclaimer in the footer.

This week's newsletter begins with a chart showcasing the growing dominance of ETF interests in Google search trends compared to traditional mutual funds.

In this segment, we review the best and worst-performing ETFs from July 10th to July 14th (excluding ETNs, Single Stocks, and Leveraged ETFs).

Top ETFs of the Week

This week's list is dominated by crypto-linked ETFs, which concluded week 28 with impressive double-digit gains. The top four performers saw a remarkable surge of over 15%.

Despite the absence of significant upward movement in the prices of top cryptocurrencies this week, stocks related to the crypto industry such as exchanges and miners surged on positive updates.

Coinbase's stock ( COIN 0.00%↑ , common holding in these ETFs) surged by around 35% to an 11-month high in the week ending July 14, following Ripple's legal win against the SEC. The SEC had accused Ripple of selling illegal securities, but a judge ruled that XRP sales on public crypto exchanges did not violate securities laws.

After Ripple's success, traders gained confidence that other tokens could overcome SEC regulations. This positive sentiment contributed to Coinbase's victory and a 150% rebound in its shares since the SEC lawsuit. Traders are increasingly hopeful that Coinbase will succeed against the regulator in court. Read more here: Coinbase, Robinhood, Bitcoin miners surge as Ripple ruling bodes well for crypto plays: ‘This is a positive read-through.

In other news, there have been positive operational updates from several crypto miners. Find out more here:

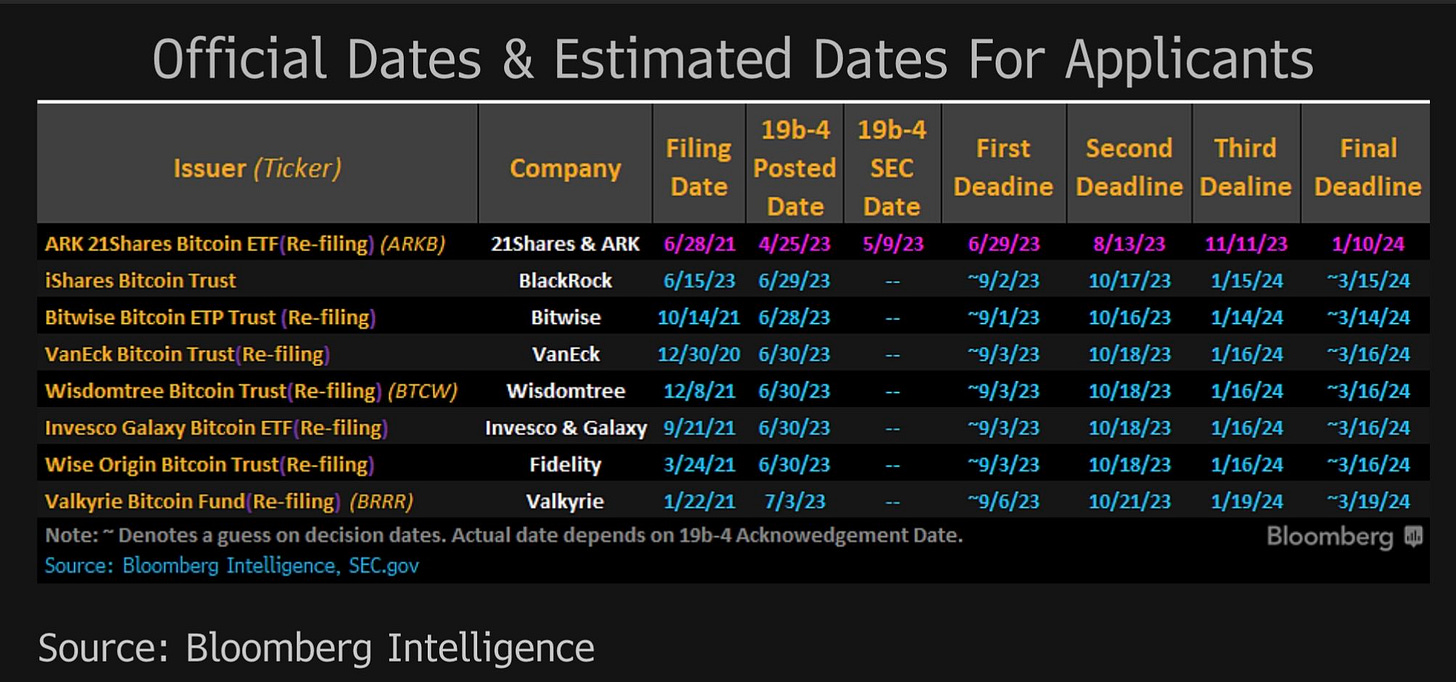

In addition, the competition for the first US spot Bitcoin ETF has also played a significant role, as institutional validation is seen as a crucial catalyst for the digital asset industry.

Worst 3 ETFs of the Week

Cannabis and Telecom ETFs experienced a challenging week as two ETFs from each category found themselves on the loser’s leaderboard.

Telecom ETFs

Shares of AT&T Inc. ( T 0.00%↑ ). and other telecom companies fell this week after concerns arose about the high costs they may incur to clean up lead-contaminated wiring in their networks. A Wall Street Journal report highlighted the presence of lead-clad cables from early landline networks. Investors reacted to the potential financial impact, leading to a decline in stock prices. Telecom ETF subsequently fell.

Cannabis ETFs

Cannabis ETFs keep plunging as the industry remains devoid of any positive developments, such as the enactment of the Safe Banking Act. Read more: Schumer’s weed plan hits bipartisan resistance.

Utilizing Google Trends, we monitor the ETFs that have gained significant attention and popularity over the course of the week. Here are some of the hottest ETFs for this week.

1- MUSQ Global Music Industry ETF ($MUSQ)

MUSQ launched its first-ever ETF named The MUSQ Global Music Industry ETF ($MUSQ) early this week. The fund offers a unique “pure play” exposure to the $26.6 billion global music industry.

MUSQ 0.00%↑ will closely follow the performance of the MUSQ Global Music Industry Index and will be invested in a portfolio of 48 companies.

These companies operate in various sectors of the music industry, including streaming services (34.2%), content and distribution (35.3%), live events and ticketing (9.47%), satellite and broadcast radio (7%), and music equipment and technology (13.17%).

MUSQ 0.00%↑ top names include Amazon.com Inc. (7.93%), Alphabet Inc.(7.55%), Apple Inc. (7.38%), Sony Group Corp (3.63%), and Stream Media Corp (2.77%). The fund trades on NYSE and has an expense ratio of 0.78%.

Why it’s trending:

The music industry theme has gained significant traction this quarter with the introduction of two new ETFs, namely MUSQ and TUNE. These ETFs provide investors with fresh opportunities to invest in the music sector, offering innovative ways to participate in the industry's growth.

Facts

The global music industry experienced record revenues of $26.2 billion in 2022, marking a 9% growth compared to the previous year.

Forecasts indicated that the music market will continue to expand at a compound annual growth rate of 11.8% from 2022 to 2026.

Paid streaming penetration is expected to double by 2030, with revenues projected to grow at a 10% compound annual growth rate until then.

Music publishing revenues are also anticipated to rise, reaching $11.7 billion by 2030 with a 6% compound annual growth rate.

Goldman Sachs predicts that the global music industry will increase at a compound annual growth rate of 12% to reach $53.2 billion by 2030.

2- Global X Artificial Intelligence & Technology ETF ($AIQ)

The ETF invests in AI-focused companies that can benefit from AI technology and hardware for data analysis. It trades on NASDAQ and has accumulated $432 million in assets since May 11, 2018.

AIQ tracks the Indxx Artificial Intelligence & Big Data Index and has an expense ratio of 0.68%

The fund comprises 85 holdings, including NVIDIA Corp. (5.51%), Meta Platforms Inc (5.02%), Tesla Inc (4.56%), Salesforce Inc (3.42%), and Microsoft Corp (3.32%).

Why it’s trending:

The introduction of OpenAI's ChatGPT has sparked a competitive race in the AI industry, resulting in a significant increase in share prices for companies leading the innovation and those leveraging the benefits of this technology (e.g. chipmaker Nvidia gained +217.63% YTD). This includes ETFs that are invested in those companies, such as AIQ.

AIQ 0.00%↑ has generated a total return of +45% year-to-date. Other AI-themed ETFs surged during the same period such as IRBO (+34.28%), BOTZ (+42.42%), LRNZ (+48.13%), THNQ (+40.54%), and ROBT ETF (+29.37%).

3- VanEck Digital Transformation ETF ($DAPP)

DAPP aims to closely track the performance of the MVIS Global Digital Assets Equity Index.

The fund provides diversified exposure to digital asset exchanges, miners, and other infrastructure companies. It also offers access to companies that have the potential to generate 50% of their revenue from digital assets.

DAPP trades on the NASDAQ and has a net expense ratio of 0.50%.

The fund has 23 holdings, including Coinbase Global Inc (8.87%), Riot Platforms Inc (6.98%), Terawulf Inc (6.76%), Marathon Digital Holdings Inc (6.69%), and Hut 8 Mining Corp (6.26%).

Why it’s trending:

DAPP is one of the top-performing ETFs this week and is the second-best performing ETF this year (+259%), behind its competition - Valkyrie Bitcoin Miners ETF ($WGMI, +326%). Read the previous analysis above on why DAPP and other crypto-linked ETFs are shining

In this week’s meet the fund segment, we introduce you to VanEck Morningstar Wide Moat ETF ($MOAT) The fund focuses on companies with solid competitive advantages, aiming to mirror the performance of the Morningstar Wide Moat Focus Index.

Click here or on the image below to view the full infographic thread on Twitter

Would you like a daily dose of ETF industry charts and infographics?

Follow me on Twitter for a visual feast of valuable insights. Check out these bonus charts below!

This newsletter is for informational purposes only and is not financial advice. We do not guarantee the accuracy of the information or calculations provided. It is essential to consult a qualified financial advisor before making any investment decisions. We are not responsible for any errors or omissions in the data. Investing in ETFs or any financial instrument involves risk, and you should conduct your own research. Past performance does not guarantee future results. By using this newsletter, you agree to these terms and conditions.