A Zeus-Strong Start Turns Merely Herculean

GREK ETF Performance Review 2023

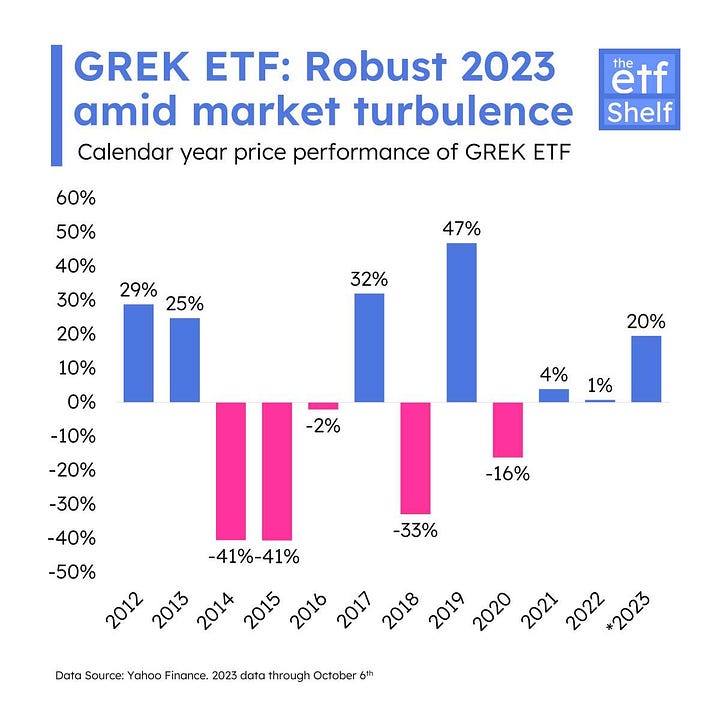

The Global X MSCI Greece ETF (GREK) navigated a turbulent 2023, peaking with a 50% surge by late July, only to retract to a 20% YTD gain by October. Once basking in the spotlight among the year's top performers, the fund experienced a significant reversal, finding itself overshadowed in a year largely dominated by AI and crypto-linked funds.

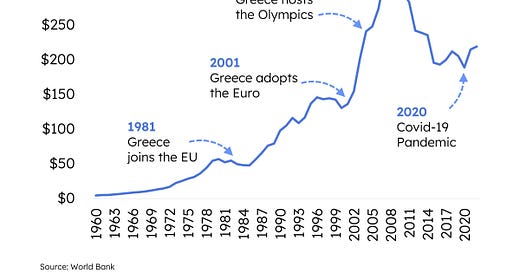

The Greek Economy in a Nutshell

Early 2000s: Boom and EU Adoption

The Greek economy experienced a period of growth and prosperity in the early 2000s, particularly after adopting the Euro in 2001. This facilitated increased investment and lending, propelling the nation into an economic boom and allowing it to host the 2004 Olympics.

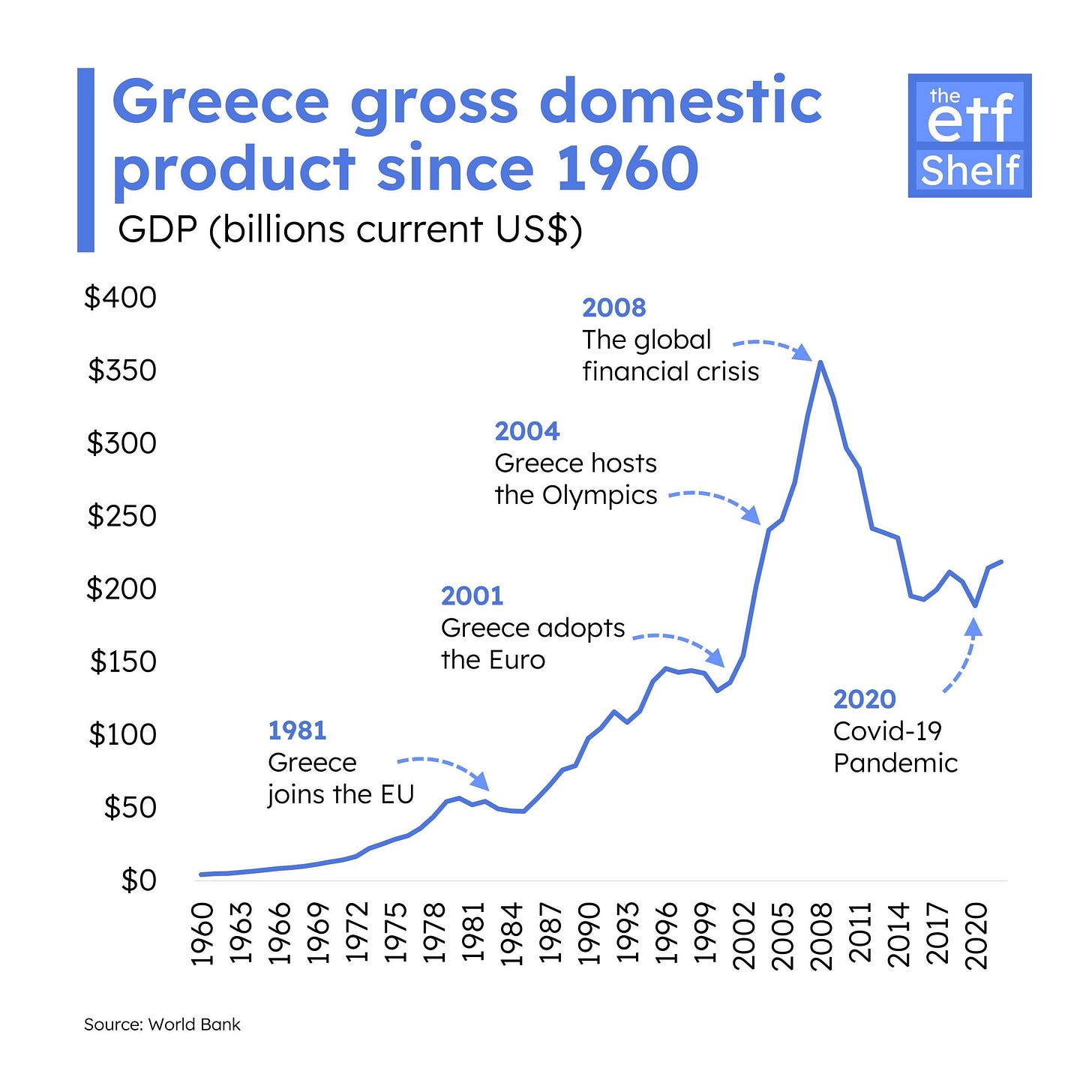

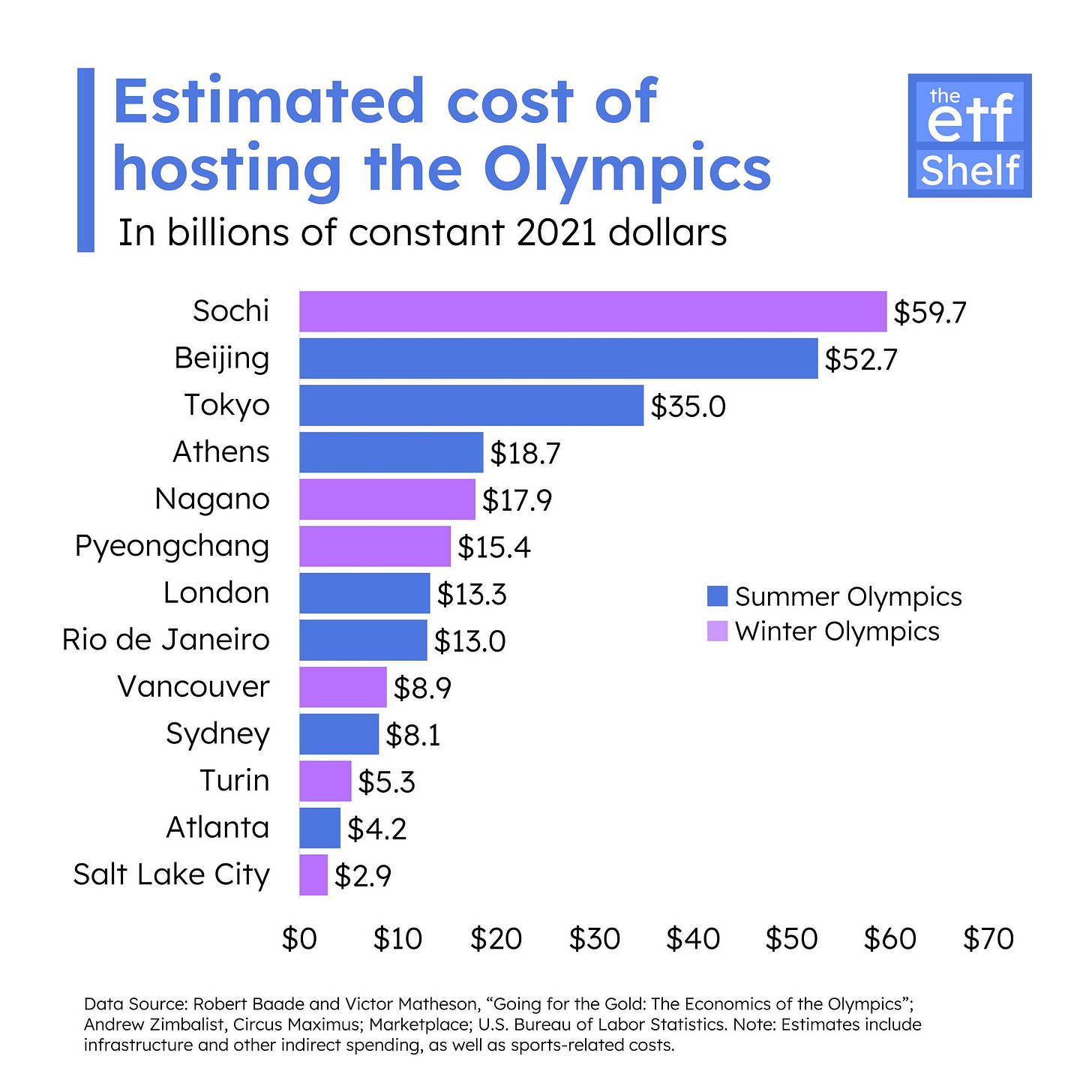

Mid-2000s: Post-Olympic Hangover and Mounting Debts

The 2004 Athens Olympics, though symbolically important, saw staggering financial overspending, totaling approximately $19 billion. Oxford University researchers assert that the Athens 2004 cost exceeded its budget by a whopping 97%, setting the stage for Greece's subsequent financial crises and challenges.

Late 2000s: Recession and Debt Crisis

The 2008 global financial crisis took a heavy toll on Greece, unveiling its unsustainable fiscal policies and culminating in a severe debt crisis. This period was marked by economic contraction, rising unemployment, and social unrest.

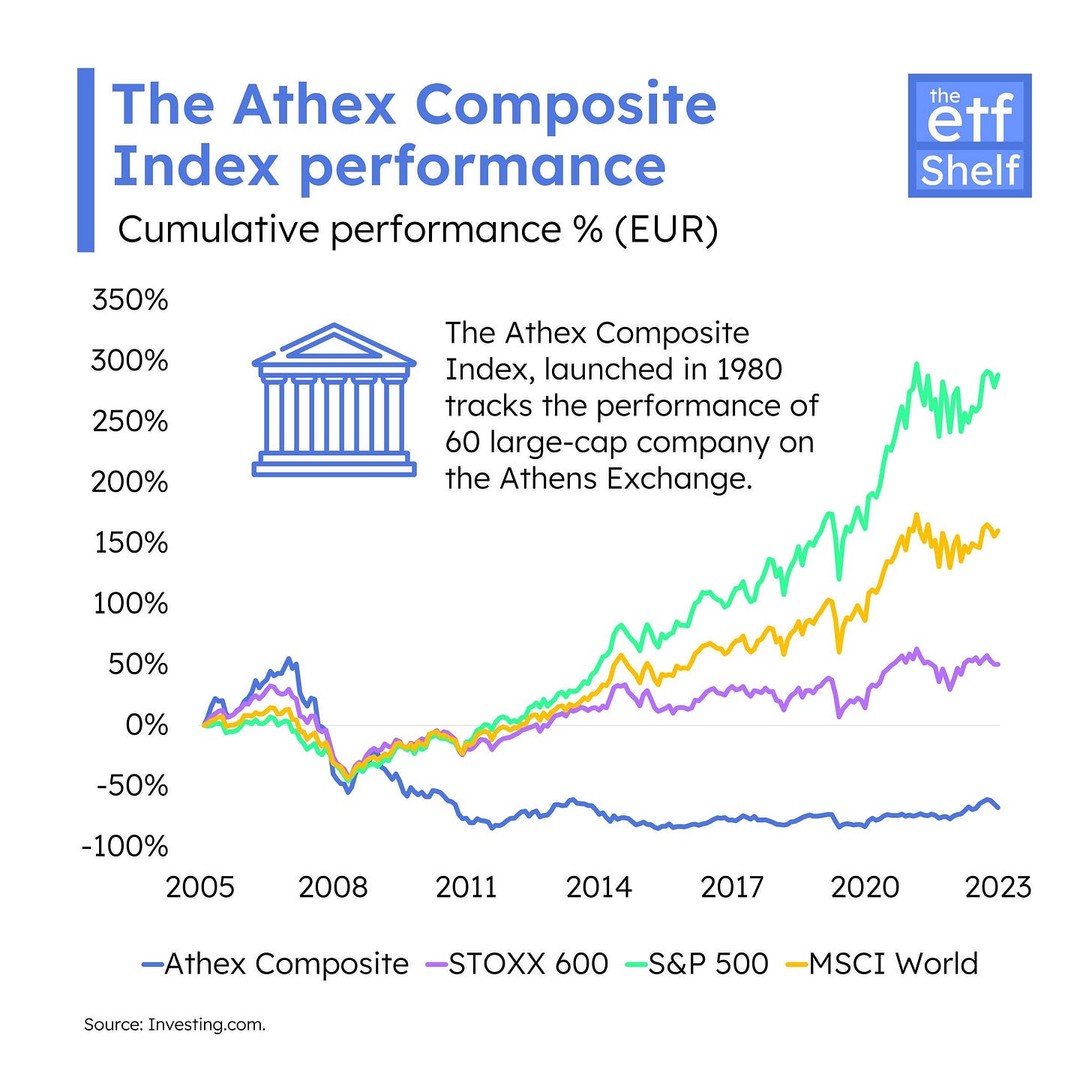

While many global stock markets recovered from the financial crisis and entered positive territory, Greek stocks remained in the deep red.

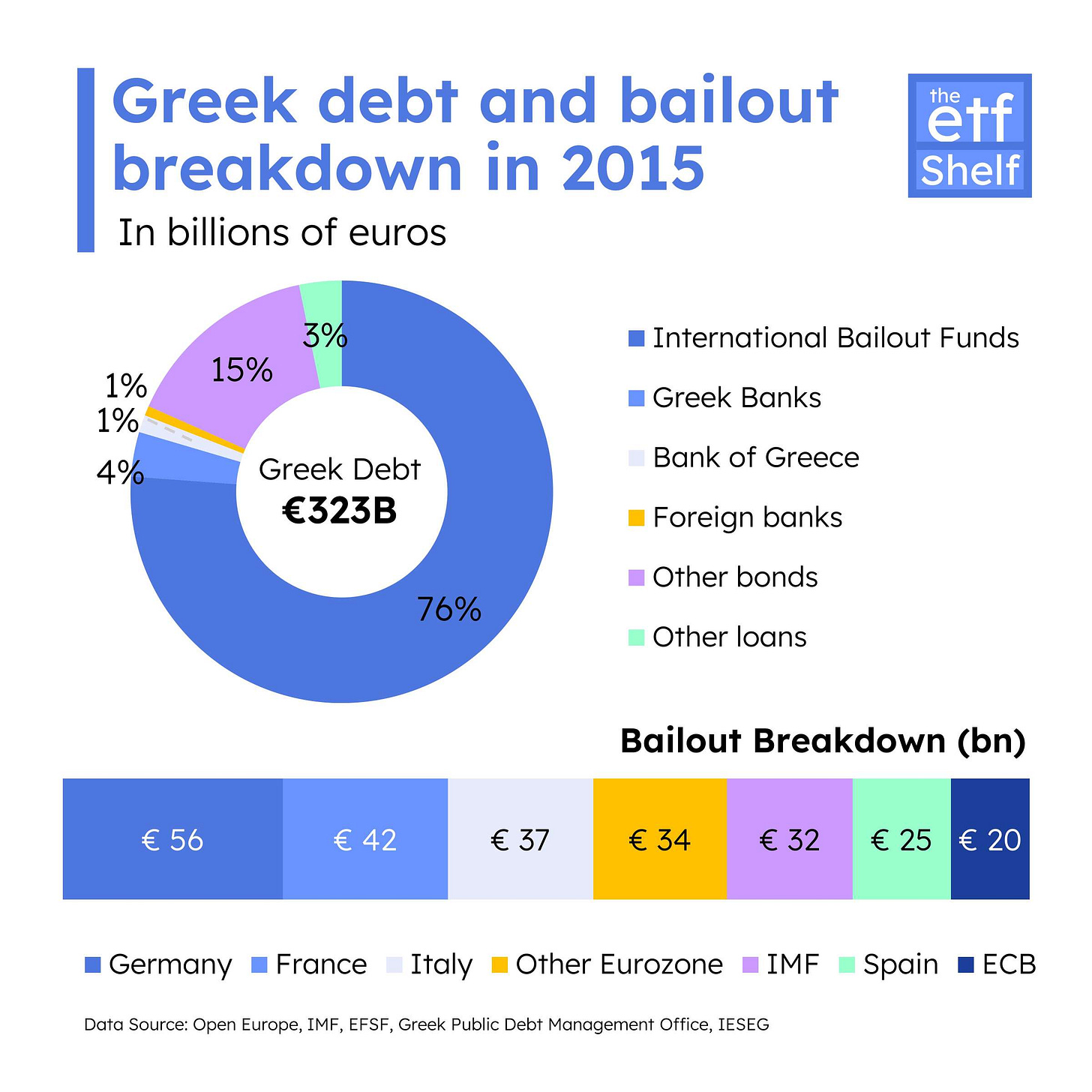

2010s: Bailouts and Austerity

The 2010s saw Greece stabilizing its economy through IMF and EU bailouts, imposing impactful austerity measures in return. While the latter years witnessed an exit from the bailout program and economic recovery indicators, like enhanced tourism and investor confidence, issues like unemployment and public debt persisted.

2020s: COVID-19 Setback

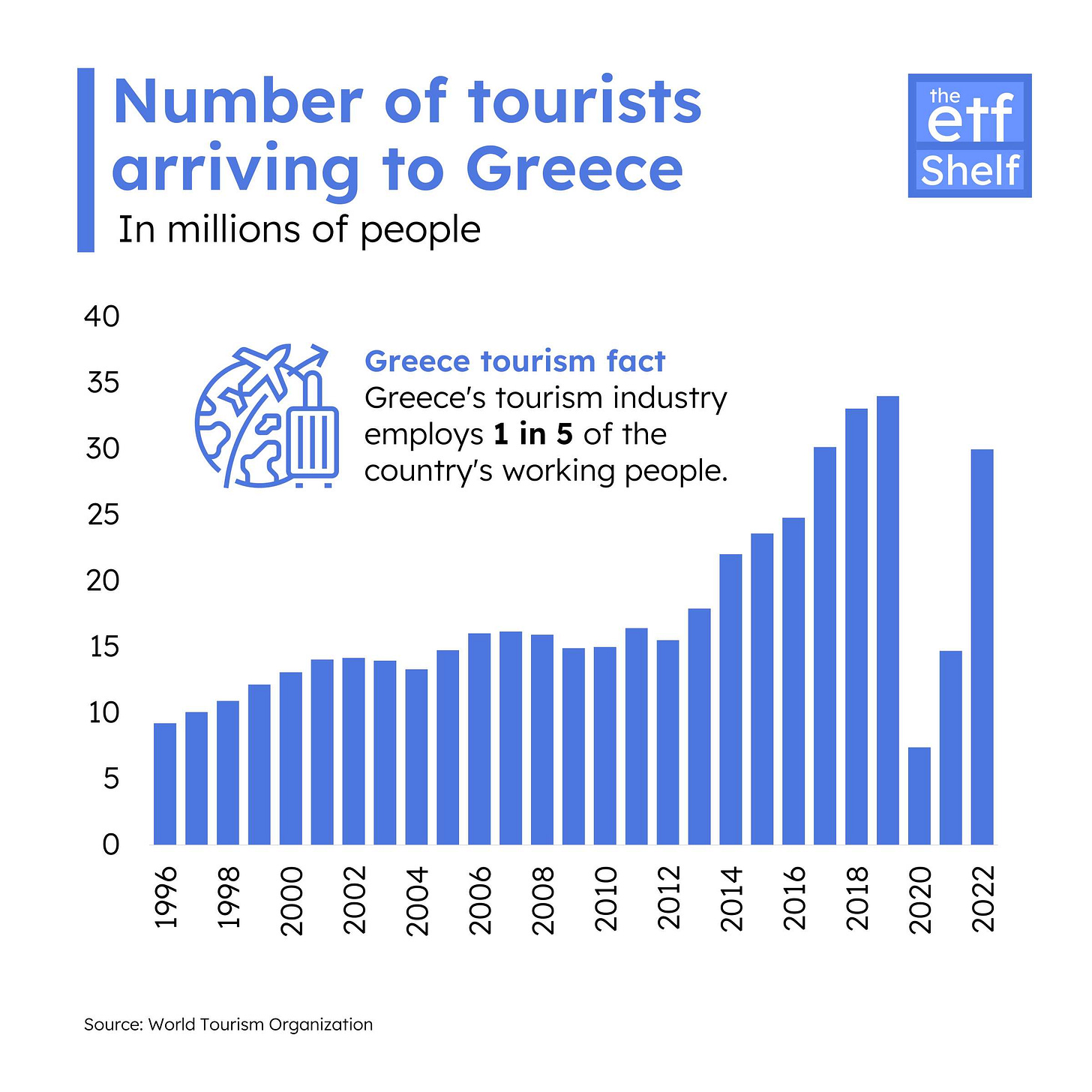

While the Greek economy slightly rebounded in the late 2010s, the COVID-19 pandemic in 2020 introduced new challenges, disrupting global economies and significantly impacting Greek tourism—a vital sector for the country.

What Happened to Greek Stocks Post-Covid?

Tourism Recovery

In 2022, Greece experienced a boost in its tourism sector, generating estimated revenues of 18 billion euros. Projections for 2023 anticipate tourism receipts will likely match 2022 figures.

Recovery and Resilience Package

The "Greece 2.0" National Recovery and Resilience Plan, approved by ECOFIN on 13 July 2021, comprises 106 investments and 68 reforms, with funds of 31.16 billion euros. Expected outcomes by 2026 include 180,000-200,000 quality jobs and a 6.9% GDP increase. The plan focuses on four pillars: Green, Digital, Employment and skills, and Private investment and economic transformation.

Capital Market Strategy

In February 2023, a strategy, supported by the EBRD and EU, was launched to rejuvenate the Greek capital market, targeting enhanced investor confidence and stock performance. Introduced in Athens, it emphasizes improving regulatory frameworks, expanding investment opportunities, and boosting investor demand, anchored in six pillars, with the EBRD investing over €6.4 billion in Greece since 2015.

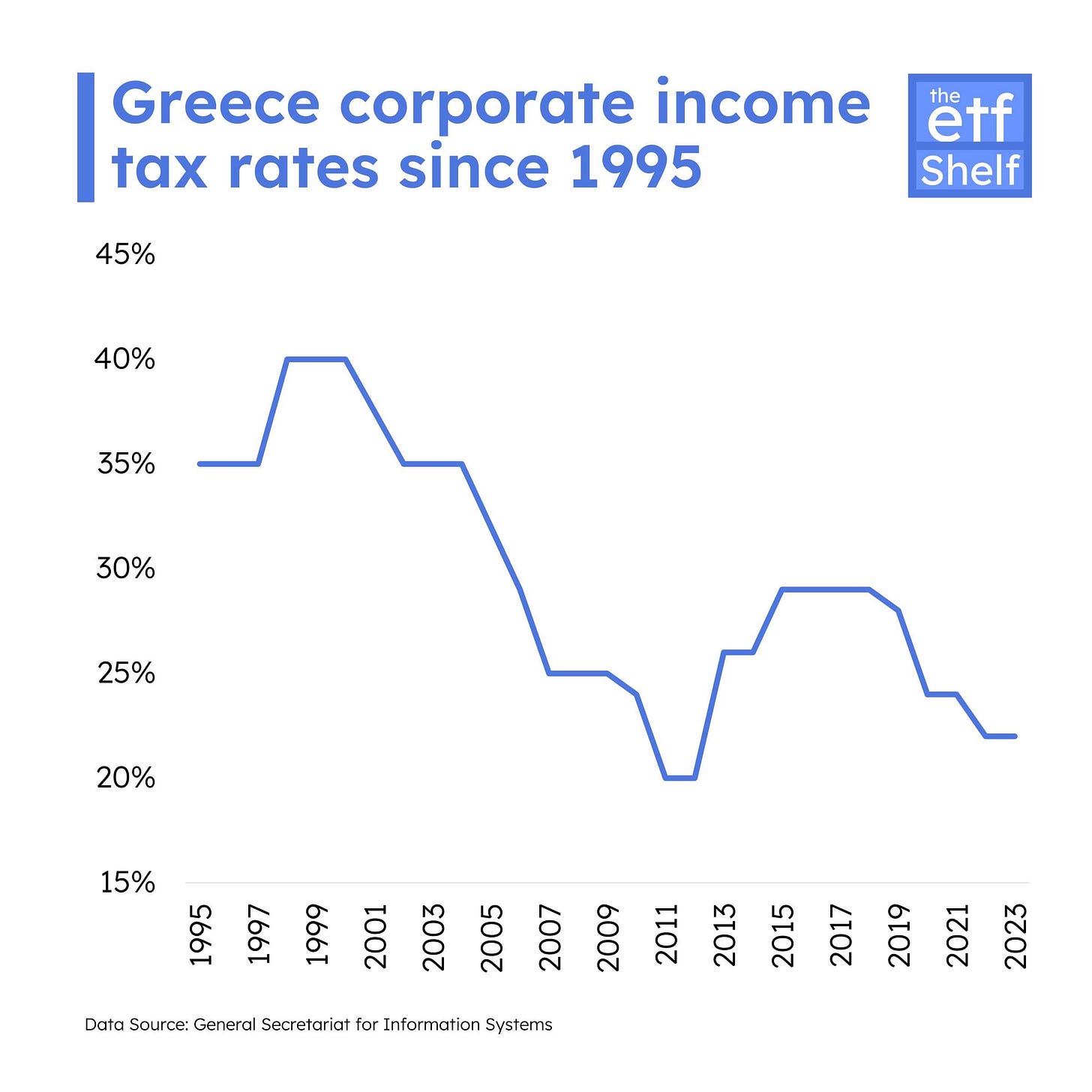

Pro-Business Economic Reforms

Under Prime Minister Kyriakos Mitsotakis, the government has enacted business-friendly policies, such as tax cuts and debt reductions, and approved reforms aiming for a 4% growth rate and €100 billion investment inflows by 2023.

Why the Greek stock market dipped in H2 2023?

This summer, Greek stocks experienced a downturn due to a myriad of crises, notably a surge in illegal immigration and devastating natural disasters. The government's urgent pleas for EU help to manage migrant deportations amid soaring arrivals has potentially shaken investor confidence. Concurrently, Greece grappled with its worst wildfires in 16 years, resulting in €1.66 billion in damages and claiming numerous lives, along with a massive flood after Storm Daniel, which caused substantial damage to crops and livestock. The combined socio-economic impacts of these calamities have likely contributed to the bleak performance of Greek stocks during the summer.

Yet…it’s still an improvement

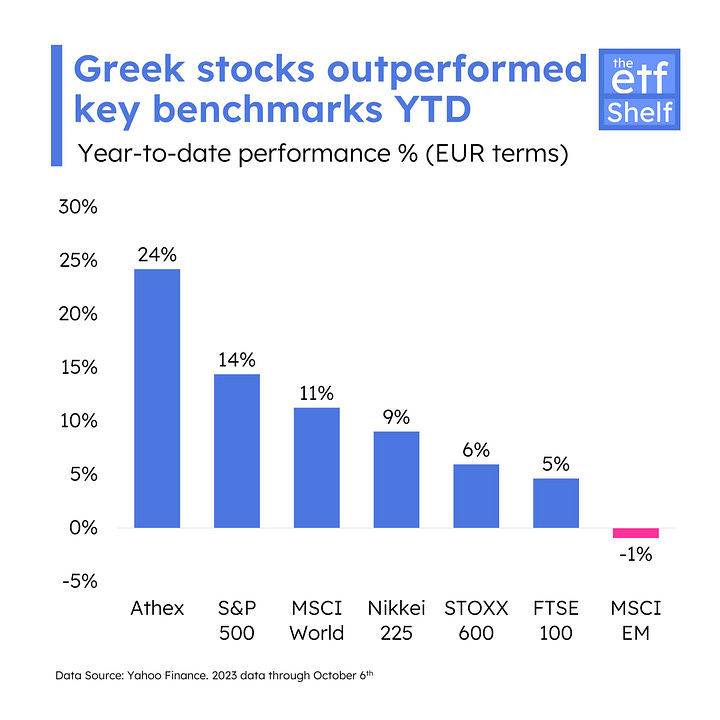

Despite its rollercoaster trajectory, the GREK ETF (tracks MSCI All Greece Select 25/50 Index) has secured a +20% return so far this year, eclipsing the SPY ETF and marking a notable ascent from prior years, with modest returns of 4% and 1% in 2021 and 2022 respectively (based on market price change). Greece’s benchmark index (Athex Composite) has also outperformed major indices in Euro terms.

Positive Q2 GDP Figure and Short-term Outlook

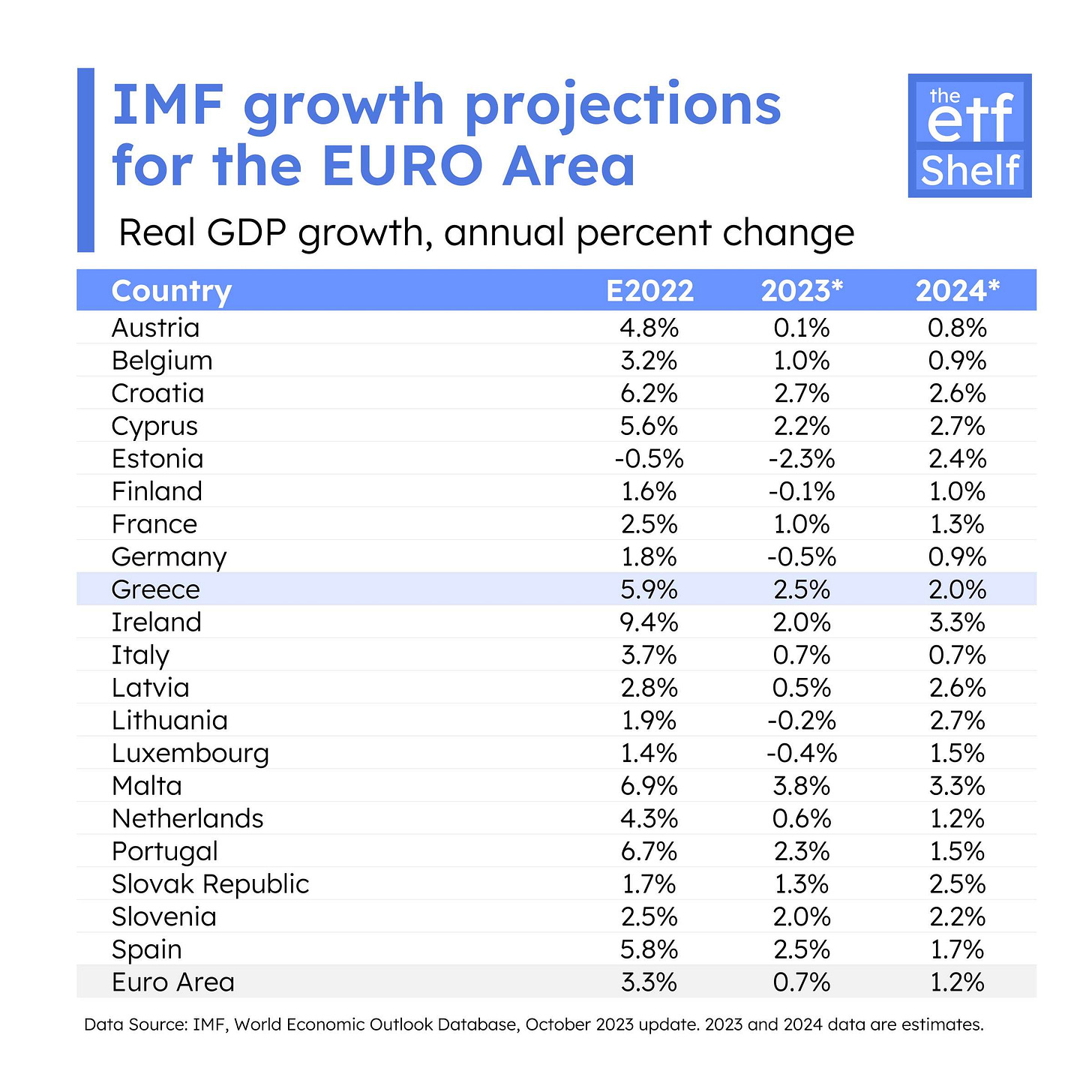

In Q2 2023, Greece witnessed a 1.3% economic upsurge, its most robust since Q1 2022, driven by elevated household consumption and fixed investment amidst declining government spending and unfavorable net external demand. The IMF forecasts a 2.5% GDP growth rate for Greece in 2023 and 2% for 2024, well above the Euro Area average.

About GREK ETF

The Global X MSCI Greece ETF (GREK), launched in December 2011, provides U.S. investors with distinct access to Greek stocks. The top 10 holdings which include EUROBANK ERGASIA and MYTILINEOS S.A., sum up to 63% of the fund's total weight. GREK trades on the NYSE and has a total expense ratio of 0.57%.

Note: This is not a sponsorship or an endorsement of GREK ETF.

This newsletter is for informational purposes only and is not financial advice. We do not guarantee the accuracy of the information or calculations provided. It is essential to consult a qualified financial advisor before making any investment decisions. We are not responsible for any errors or omissions in the data. Investing in ETFs or any financial instrument involves risk, and you should conduct your own research. Past performance does not guarantee future results. By using this newsletter, you agree to these terms and conditions.