10 ETF Charts I Thought You’d Like This Week

Active Giants, Europe Titans, Thematic Trends, ESG Disparities and a lot More!

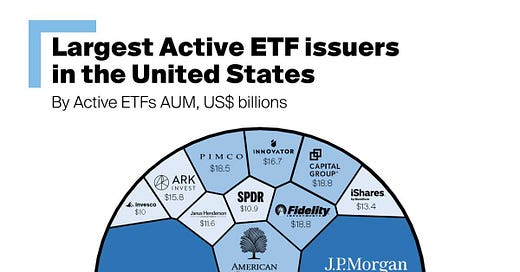

The Active Giants

According to the 2024 Global ETF Survey by Trackinsight, 73% of respondents are either already investing in Active ETFs or are interested in doing so, showing a willingness to increase their allocation. Moreover, they are more likely to invest in a strategy if it transitions from a mutual fund to an ETF format.

While active ETFs account for only 6% of the overall market share in the U.S., they captured around 23% of the total net flows as of year-end 2023.

In case you wondered, here are the biggest active issuers in the U.S.

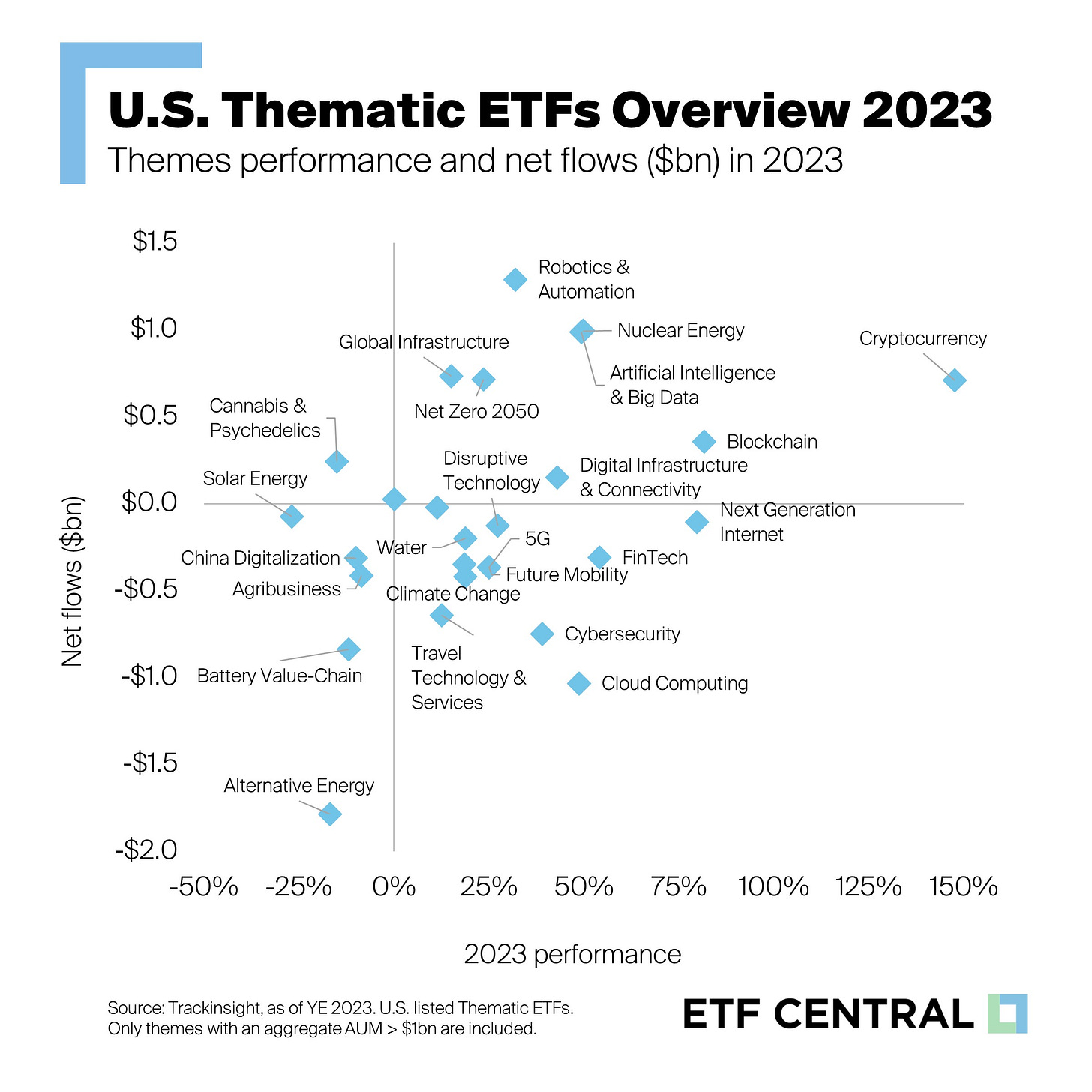

Most Popular ETF Themes in the U.S. in 2023

Thematic ETFs have lost some of their allure since the onset of the pandemic due to the shifting economic landscape characterized by increasing inflation and interest rate hikes. However, a handful of themes have managed to shine in both performance and popularity.

Keep track of the biggest ETF themes here

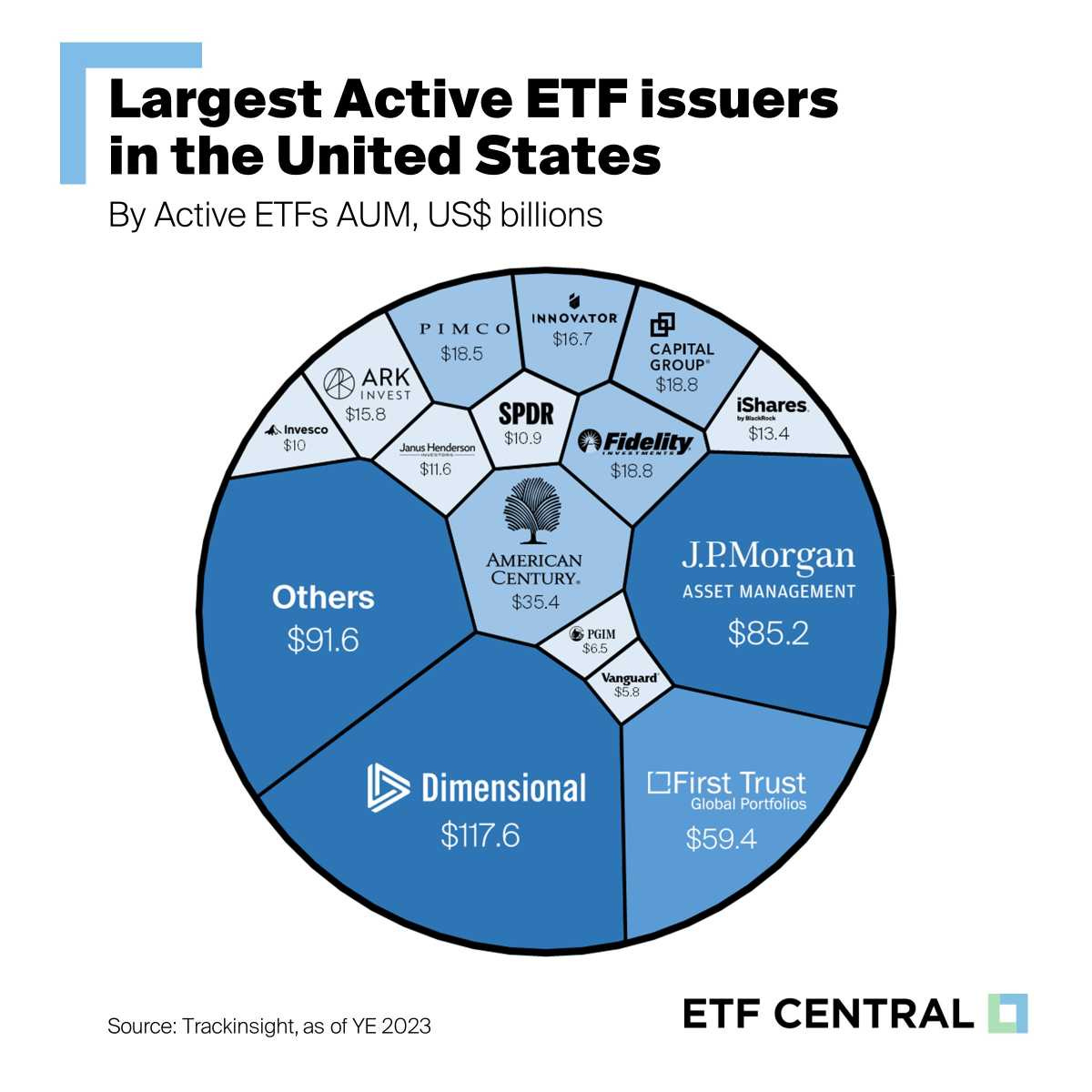

Comeback for Thematic ETFs?

As central banks are expected to lower rates in the next 2-3 years, investors are reconsidering their thematic exposure.

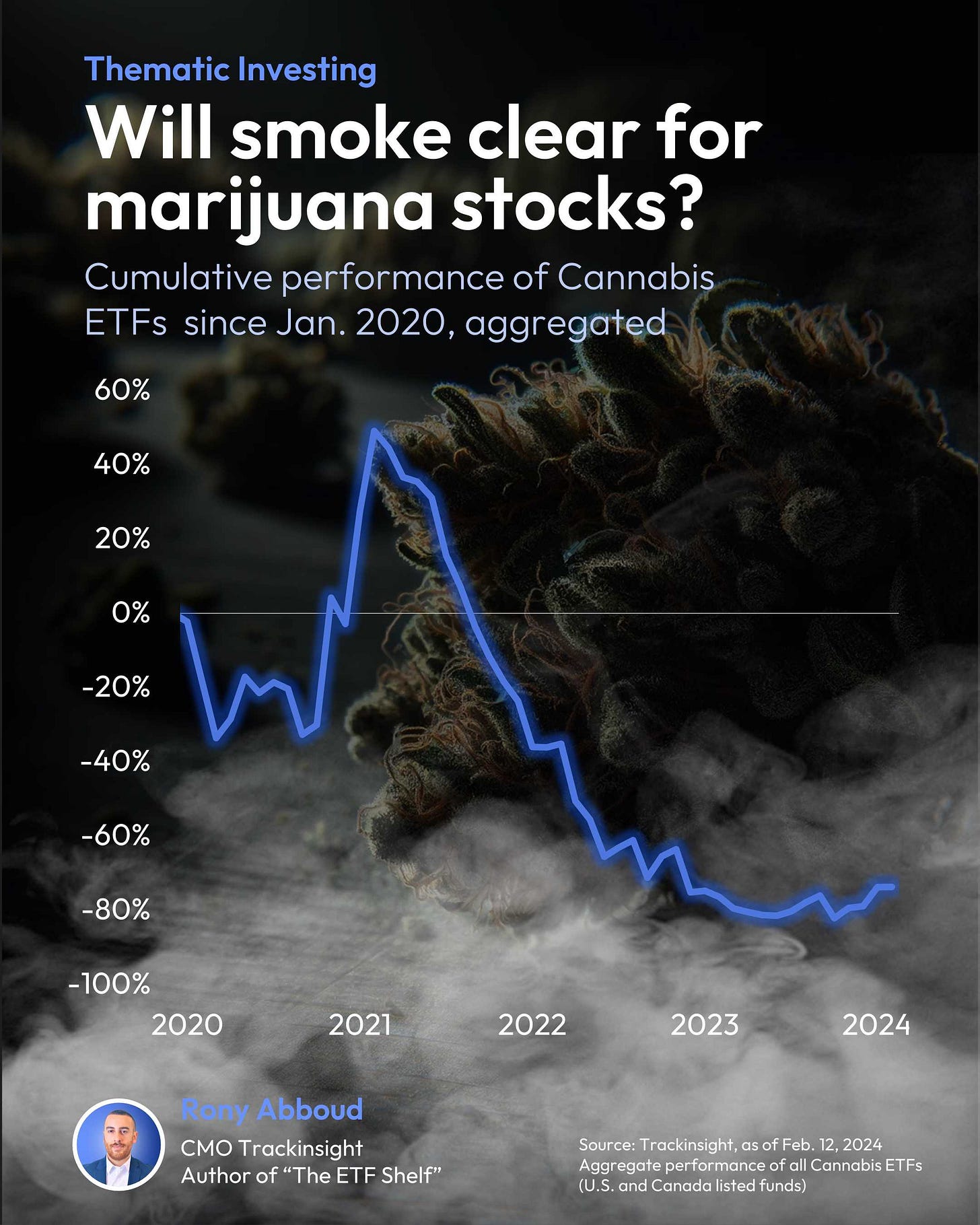

Cannabis ETF Investors Still Have “High” Hopes

Despite the poor performance, investors have put more than $3 billion into Cannabis ETFs in the last three years. They're hopeful that things will turn around with efforts for federal legalization in the U.S.

However, there's concern that the forthcoming U.S. election might impede progress, particularly if it results in a Republican presidency.

Let's see if investors decide to stick around or finally"weed out" their investments.

Democrats vs Republicans Battle it Out with ETFs

Democrats and Republicans face off in the market with meme-ish ETFs tracking their trades. $NANC, following Democratic members, outperforms $SPY by 7%, leaving $KRUZ trailing by 15% since its debut on February 7, 2023. Unusual Whales notes that many politicians outperform the market, with Democrats earning 33% and Republicans 18% on average in 2023. Of 100 trading members, 33% beat SPY with their portfolios. (Source: Unusual Whales)

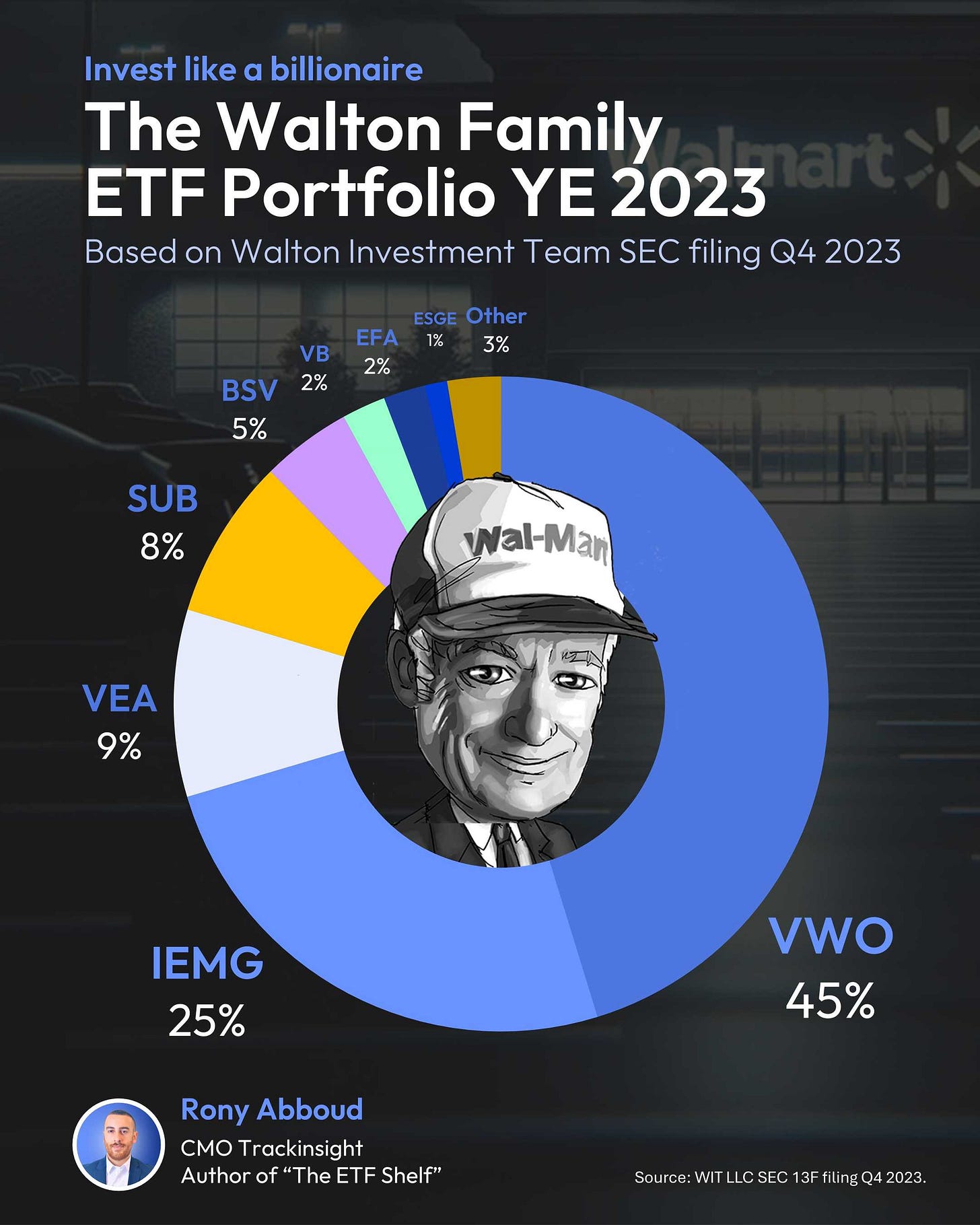

The Walton Family ETF Portfolio

The ETF portfolio of the world's wealthiest family, the Waltons, has been unveiled in the latest SEC filings.

Consisting of 14 ETFs, the portfolio's total worth is $2.6 billion, down from $3.45 billion in the previous quarter. This decline is primarily attributed to the investment team's decision to reduce their allocation in the Vanguard Short-Term Treasury ETF ($VGSH) by $910 million.

Notable buys in Q4 include $VWO (Emerging markets, +$137 million) and $VEA (Developed market, +$31.4 million).

Among the top sells besides $VGSH, are $IEMG (Emerging markets, -$143 million), $VB (Small Cap, -$80 million), and $SUB (National Municipal Bonds, -$31 million).

Leading the Show in Europe

Europe's ETF ecosystem continues to flourish as assets under management reached another record in 2023, hitting $1.8 trillion in total assets after an improved performance across different asset classes and net inflows of over $150 billion.

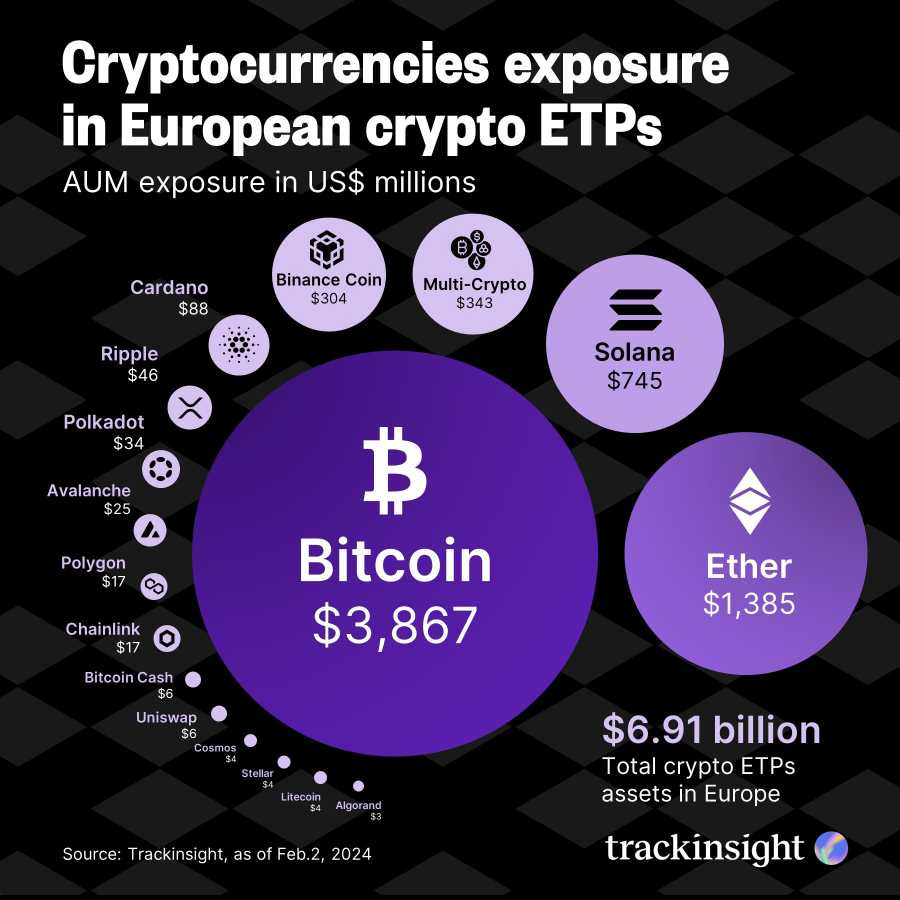

The Diverse Crypto ETP Space in Europe

While it’s Bitcoin this and Bitcoin that in the States, there's a whole array of ETPs in Europe that let you invest in different cryptocurrencies beyond just Bitcoin.

ESG Polarity Across the Atlantic

Following its peak in 2021, global demand for ESG ETFs has declined. In the United States, political divisions have acted as a barrier to widespread ESG adoption. However, Europe continues to lead in this sector, albeit with somewhat reduced demand compared to previous years.

Active ETFs with ESG Twist in Europe are in Demand

In Europe, active ETF issuers blending active management with ESG principles have garnered a larger share of new ESG investments, boosting the adoption of active strategies. By YE 2023, Europe's active AUM totals $33 billion, with $24 billion allocated to ESG-labeled funds. Additionally, 13% of total ESG ETF flows in 2023 went into actively managed funds, marking a significant increase from 3% in 2020.

Download Free Report on Worldwide ETF Trends

Disclaimer

This newsletter is for informational purposes only and is not financial advice. We do not guarantee the accuracy of the information or calculations provided. It is essential to consult a qualified financial advisor before making any investment decisions. We are not responsible for any errors or omissions in the data. Investing in ETFs or any financial instrument involves risk, and you should conduct your own research. Past performance does not guarantee future results. By using this newsletter, you agree to these terms and conditions.